Real estate experts have taken to the media, predicting that 2024 will be a great year for the housing market overall. The Midwest, including Minnesota, is expected to be a top performer, considering past trends and expert opinions.

In this article, we will take a closer look at the Minnesota housing market and go through the underlying reasons for the promising outlook for the sector.

Minnesota Housing Market Trends

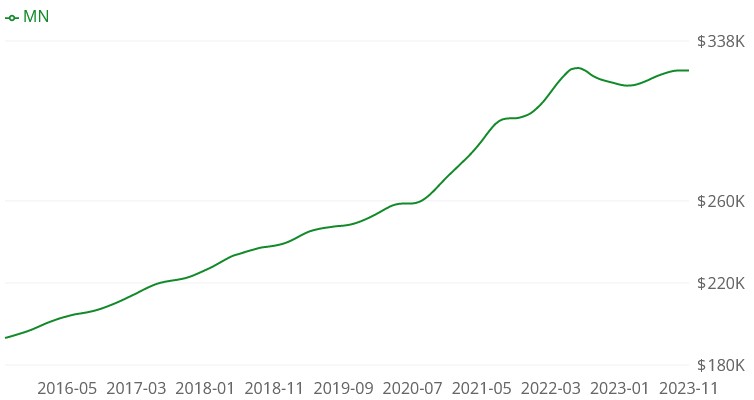

Market figures show that Minnesota achieved steady growth for the last decade until mid-2022. Let’s look at key trends shaping the Minnesota real estate market:

Steady Increase in Minnesota Median Home Prices

The median home price in Minnesota was around $238,000 by the end of 2018. By November 2023, it had appreciated by about $86,000 to $324,215, translating to an average yearly growth of 7.2%. This is a healthy growth rate for any housing market despite the slight depreciation in the last part of 2022.

The median home price in Minnesota is below the national average ($346,048), making it an affordable market with room for appreciation. However, the national year-over-year appreciation rate is slightly higher (+2.2%).

The most affordable markets in Minnesota are Brainerd and Ironton, with median home prices of $281,208 and $251,035, respectively. These markets cater to high-end buyers, with areas like East Gull Lake and Lake Shore having median home prices well above $600,000.

The following metros have recorded the highest sales price hikes in recent times:

- Austin – 30.9%

- Shoreview – 30.9%

- Mankato – 28.2%

- Plymouth – 22.7%

- Edina – 22.4%

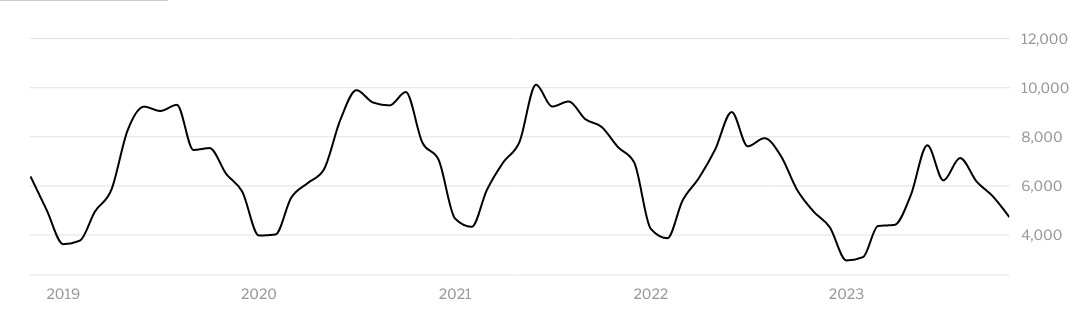

Number of Homes Sold in Minnesota

In November 2023, 4,727 homes were sold in the Greater Minnesota area. Although a 4.6% decrease from the same period last year, this is still a healthy sales volume given that mortgage rates steadily rose for the period in between. This shows high demand for homes in the area — a great promise for buy and hold real estate investors.

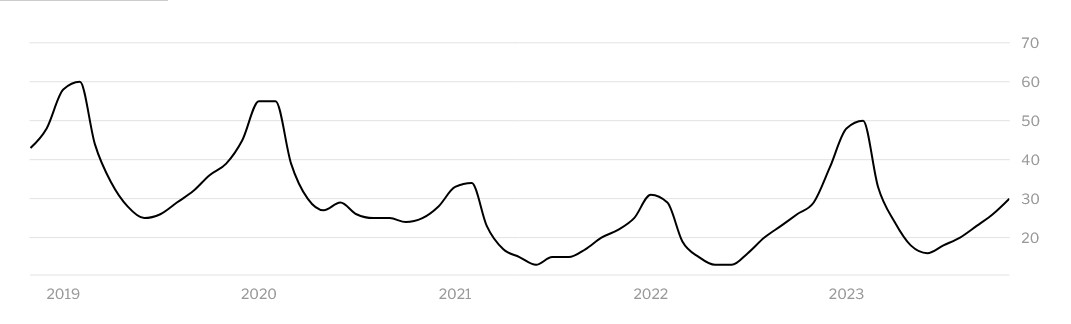

Housing Inventory in Minnesota

In November 2023, the MN housing market had 4,969 newly listed homes, bringing the tally of active listings to 15,221. The Federal Reserve Economic Data shows a sharp increase (almost double) from February to October 2023 despite the skyrocketing mortgage rates. This underscores the buzz surrounding the Minnesota real estate market. It also holds a promise for a balanced market with stable home prices.

Considering the available inventory and number of homes sold in November, the housing market in MN has around three months of housing supply, while the ideal months of inventory are between four and six. This means that the market slightly favors sellers. However, the dipping mortgage rates could spark a listing frenzy and thus increase the inventory, meaning the trend could balance in the course of the year.

Days on Market in Minnesota

The average Minnesota home sat on the market for around 30 days in November 2023. November 2022 had homes sitting on the market for the same days despite lower mortgage rates. This implies that demand has increased nominally, sustaining real estate activity.

How Competitive Is the Minnesota Housing Market?

The MN housing market was highly competitive in 2023. 31.3% of homes sold in November 2023 fetched prices above their list price, an increase of 2.4 points year-over-year. Only 30.0% of properties experienced price drops, down from 31.0% in November 2022.

Furthermore, the sale-to-list price ratio rose by 0.1 percentage points year-over-year at an impressive 98.9% as of November 2023. The growing number of houses selling above list price shows that the housing market in Minnesota has multiple offers situations and bidding wars, a characteristic of a seller’s market.

The most competitive markets in Minnesota are:

- St. Paul Park

- Osseo

- Arden Hills

- Circle Pines

- Montrose

Minnesota Housing Market Forecast for 2024

What’s in store for homebuyers and investors in the MN housing market for 2024? Below are some data-driven projections of what the market will look like throughout the year:

Minnesota Housing Prices Will Continue to Rise

Experts predict a modest increase in Minnesota housing prices by the end of 2024, with a potential rise of about 2.4%. However subtle, the growth is sustainable, with a five-year investment expected to yield 8.93% returns. This assures homebuyers of a reliable means to preserve wealth. For investors, it promises a value increase in their real estate holdings but may not be the hottest market in terms of return on investment.

Inventory Levels Will Increase

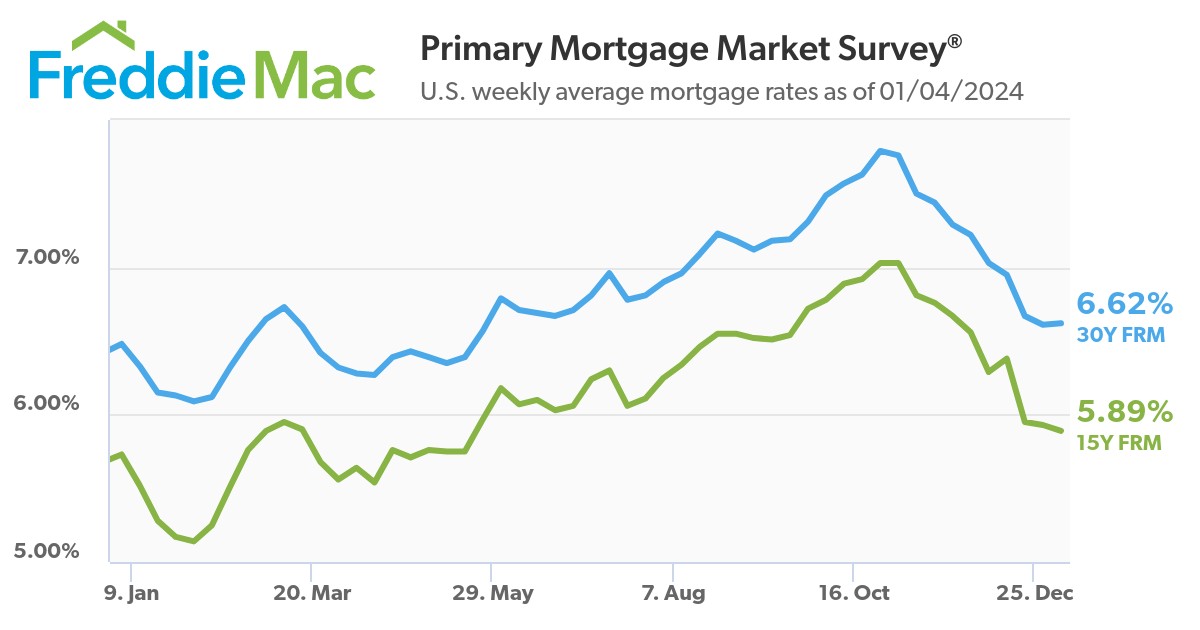

After over a year of hikes, mortgage rates started trending down in late October 2023. This had a significant shift in the dynamics of housing markets, including Minnesota, as mortgages finance most real estate purchases. The lower mortgage rates have spurred listings of existing homes and home buying.

With the downward trend in mortgage rates expected to continue throughout 2024, inventory levels will likely rise. This will give buyers more options and ease the pressure on demand and, thus, home prices. This explains the modest rise in Minnesota housing prices.

A Probable Shift Towards a More Balanced Market Is Likely

With the increased inventory levels, the housing market in MN could return to a balanced state. This mainly depends on mortgage rates continuing with their downward trend. If this happens, we will likely see more price reductions and homes staying longer in the market.

Demand for Housing Will Remain High

With lower mortgage rates, more buyers can afford to get housing loans, driving up demand. Demographic changes will also have an impact on demand, and so will economic growth. As a result, we could see a counter effect on the potential shift towards a buyer’s market.

Factors Influencing the Minnesota Housing Market

As much as the above projections are data-driven, they are also influenced by macroeconomic factors. Mortgage rates and economic growth are undeniably the primary determinants of the direction of any real estate market, Minnesota included. Besides this, other factors will affect the interplay of demand and supply, hence the market’s overall performance.

Demographic Trends in Minnesota

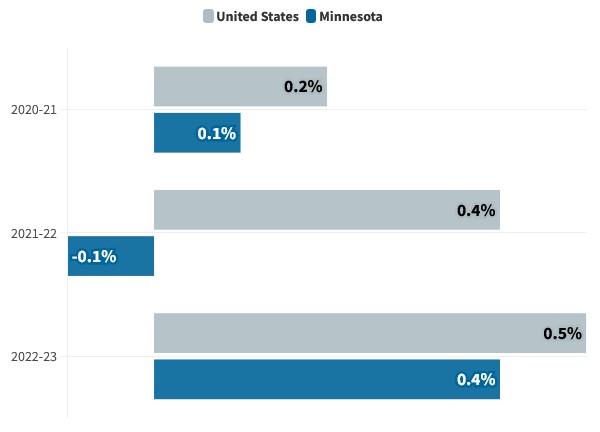

Demographic shifts will influence demand in 2024. Minnesota was one of the 11 states that experienced a population decrease in 2022, losing nearly 4,000 residents. In 2023, the situation drastically flipped, with 23,615 people moving into the state, bringing its population to 5,737,915, according to estimates from the US Census Bureau.

The 2023’s 0.4% population growth rate was consistent with the national average of 0.5%, ranking Minnesota as the 25th fastest-growing state in terms of population. If the trend continues in 2024, which is highly likely, demand for housing will remain high.

Should You Invest in Minnesota?

The Minnesota housing market is ripe for investment. While its future may be optimistic, its volatility allows room for varying outcomes. For instance, if the trend in mortgage rates or its impact is more pronounced than predicted, the slowdown in home price growth could be more drastic, or even worse, the market could turn on its head.

However, this doesn’t negate the prime conditions that make the housing market in Minnesota great for real estate investing. If anything, it strengthens the state’s prospects as highly predictable markets are usually a magnet for many investors, which often leads to price bubbles.

Is Now a Good Time to Buy a House in Minnesota?

The best time to buy a house in Minnesota is now. It may be tempting to wait out the market for a more favorable time, say when the less likely drop in prices happens or when mortgage rates drop.

However, a rise in Minnesota housing prices is more likely. Also, the drop in mortgage rates may not be significant enough to offset the home price increase. As a result, waiting could price you out of the market, or you could pay more for a similar house. In addition to financial losses, you could also lose out on time, which is valuable in building equity.

The market is currently favorable for buyers as mortgage rates and home prices are low. In addition, if mortgage rates drop, you can always refinance to take advantage of the lower rates, and if housing prices in Minnesota drop moderately, you will have gained equity anyway.

It’s imperative to assess your personal situation before deciding on the best time to buy a house in Minnesota. You should only buy if you are able and willing to; otherwise, it’s always better to wait.

A Snapshot of the Minnesota Housing Market Forecast in 2024

After a strong year, the housing market in Minnesota will continue to grow but at a moderate pace. Housing prices in Minnesota are expected to rise modestly while inventory levels will increase, leading to a more balanced market. Mortgage rates are expected to decrease further, which might spark market activity and increase inventory.

Demand will likely remain high as a result of demographic shifts and economic growth. However, there may be unexpected fluctuations, hence the need to work with a seasoned Minnesota real estate agent and study the Minnesota housing market trends.