With a rich history, affordable living costs, a burgeoning arts scene, and a strong sense of community, Buffalo is ideal for individuals and families seeking a well-rounded and fulfilling place to call home. It is also an attractive market for investors looking to expand their property portfolios, with the market showing growth evident in its home prices.

In this article, we will provide an overview of Buffalo’s real estate market and forecast for 2024. We will also cover tips for buying and selling a home in the “City of Good Neighbors.”

Buffalo Real Estate Market Trends

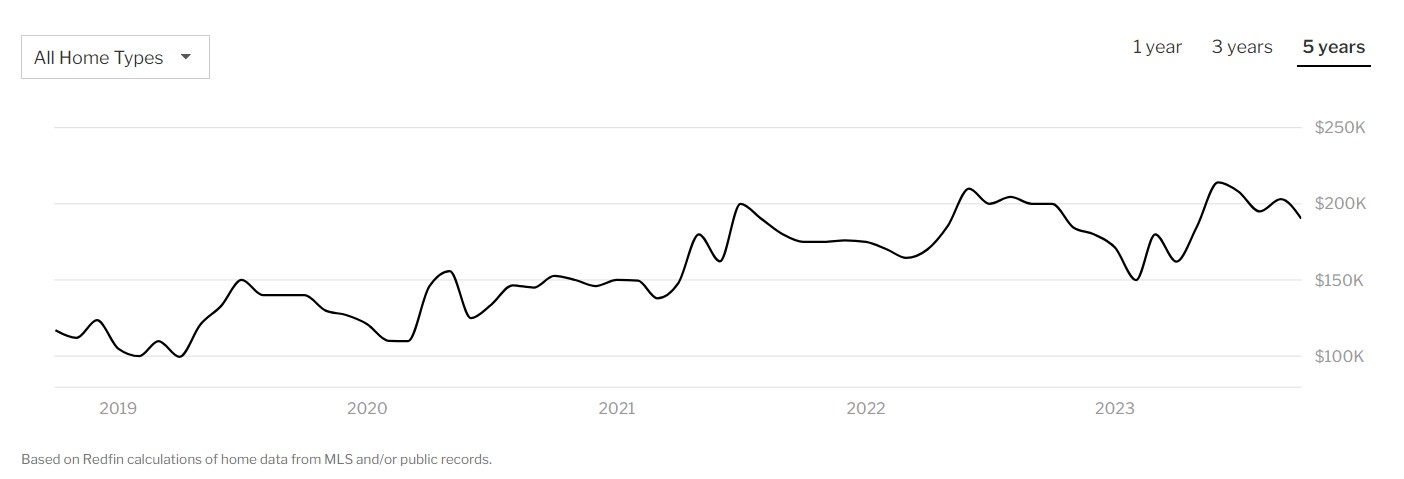

Figures from real estate resource Rocket Homes show that Buffalo’s median home prices jumped 26% to $225,100 in October 2023 from $179,900 the year before.

Prospective buyers should also know how long a home stays on the market. In December 2023, the average sale time was 20 days.

These trends show that Buffalo has shifted to a seller’s market, meaning prospective buyers need to act fast to get an accepted offer. For sellers, they can entertain several offers to find the best one.

Buffalo’s economy is also a primary driver of real estate trends. Instead of relying on a single industry, you’ll find that Buffalo is home to a mix of industrial, light manufacturing, high technology, and service-oriented companies.

According to the neighborhood research site Best Places, Buffalo recorded a job market increase of 1.0% from 2022 and is seen to achieve a 21.9% job growth in the next ten years.

Popular Buffalo Neighborhoods

Buffalo offers an eclectic variety of homes, from cottage style to craftsman. The size of the homes ranges from single bedrooms to six-plus bedrooms. These are the popular Buffalo neighborhoods to consider if you are in the market for a new home:

- Rapids: Located in Niagara County, Rapids is considered by many to be one of the best places to live in New York. The schools are highly rated, and most residents are homeowners who take pride in their properties.

- Williamsville: This is a smaller community with just a population of 5,419. The layout of the properties is described as “dense suburban.” That means the homes are closer together but still amiable. It is 20 minutes from downtown and has a school district that serves around 10,000 students.

- East Aurora: Located just 30 minutes southeast of Buffalo, this is the village where the American Arts and Crafts movement began over a century ago. Its charming Main Street is a popular destination for tourists and the locals. Homes are a mix of new construction, condos, and townhomes.

- Clarence Center: It is a small suburban town a few miles outside of Buffalo. There are many neighborhood amenities like bike paths, parks, and a library that are appreciated by the locals. The available properties are a blend of classic single and two-family homes.

- Parkside: This is a community that is made of two historic districts: East and West. It is considered one of the most family-friendly neighborhoods in Buffalo.

- Kenmore: Kenmore is a small suburban community outside of the city. It has a population of approximately 15,000 and earns raves for its excellent school district. Property types include a mix of single-family homes and luxurious apartments.

Investment Potential

Buffalo’s housing market stands out with its diverse neighborhoods and strong rental demand. Another attractive feature of Buffalo is its low cost of living. City research site Best Places finds that Buffalo’s cost of living is 7.9% lower than the national average. That means a family can live comfortably in Buffalo on an annual income of $39,240.

With its historical significance, vibrant cultural scene, flourishing job market, and access to scenic outdoor attractions, Buffalo is more than just an economic haven. It is a well-rounded community where residents can thrive and enjoy a fulfilling lifestyle.

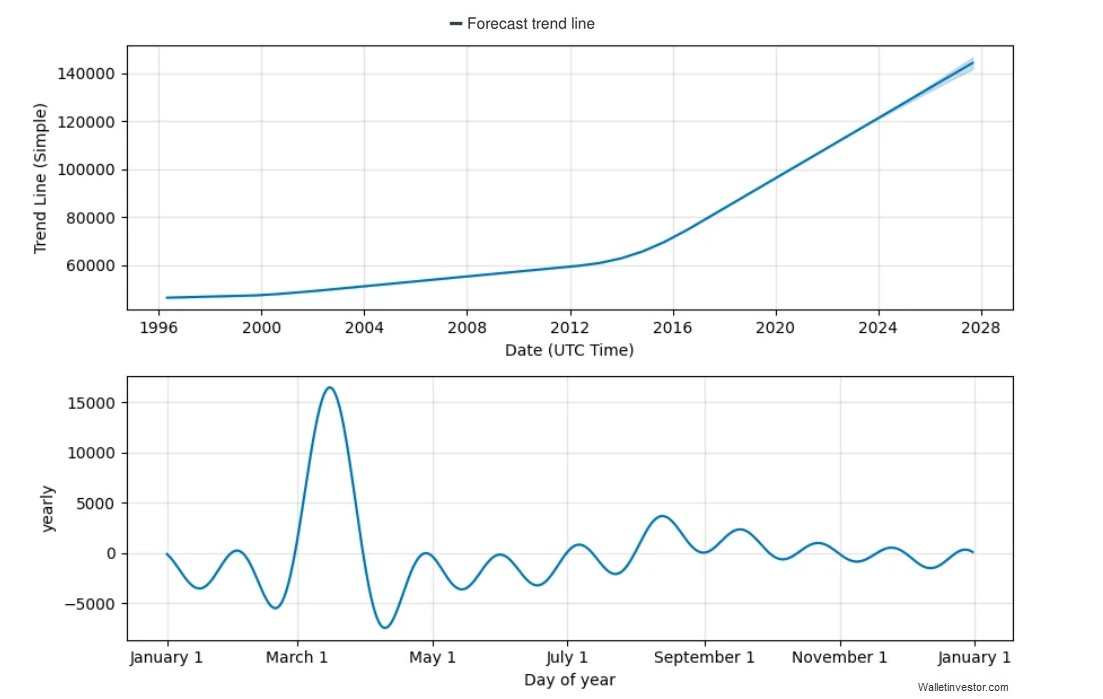

The Buffalo, NY, real estate market also offers many opportunities for investors, especially with home prices 39.5% lower than the national average.

In addition to commercial buildings, rental properties are good investments. One Buffalo real estate market trend is investors’ zeal to acquire two-family homes, as these home types are lucrative short-term and long-term rental options.

Tips for Buying a Home in Buffalo in 2024

When buying a property, being proactive with your preparations is vital. Here are some helpful tips to put into action for buying a home in Buffalo in 2024:

Determine Your Budget

Before you look at your first house, you want to understand your finances clearly. That understanding begins with assessing your income and monthly expenses. There are various online home mortgage calculators that can help with this task.

Remember that your budget should cover the mortgage and additional homeownership expenses, including insurance, potential HOA fees, taxes, landscaping, utilities, and maintenance.

Select the Right Real Estate Agent

While it may seem optional, working with the right real estate agent can significantly streamline the home-buying process. An experienced agent can provide valuable insights, answer your questions, identify crucial property features, assist with offers, and negotiate prices.

The agent often possesses insights into the local market and knows off-market properties. Access to that information gives you an edge in securing the ideal home.

Balance Your Desires With Reality

You’re searching for a dream home, but that doesn’t mean you’ll find the perfect one. Concentrate on your top priorities and be willing to compromise on less important aspects of a property. It’s essential to envision your long-term satisfaction in the home.

Avoid being swayed solely by attractive furnishings or decor staged by the current owners. Instead, focus on the property’s fundamental features. Is it practical for your family? Is the location ideal for the job commute and schools? Is this a place you can see yourself in for years to come?

Improve Your Credit Score

Your credit score significantly affects your ability to secure a home loan and the interest rates you get. A credit score of at least 700 will put you in a solid position to secure a decent mortgage.

To improve your credit score, reduce debt, and keep credit card balances below 20% of the available credit. Don’t close accounts; this can diminish your credit history’s length. Make every effort to pay your bills on time to improve your credit score.

Get a Pre-Approved Home Loan

Once you find a home you like, don’t reveal all your cards to the seller’s agent right away. Instead, remain reserved and be ready to negotiate effectively. It will also help to get pre-approved for a home loan. Most sellers prefer working with buyers who are already pre-approved, as it shows that you are a serious and capable buyer.

If you meet with a lender before you start your home search, you can clarify any financial concerns and secure pre-approval documentation. That will also allow you to diligently compare various lenders’ mortgage interest rates and terms to secure the best possible deal.

Tips for Selling a Home in Buffalo in 2023

On the other side of the real estate transaction is the seller. The following are some helpful tips to get the best deal for your home.

Collaborate With A Seasoned Real Estate Agent

Just as home buyers need to partner with an experienced agent, so do sellers. A top-notch agent guides you through every step of the selling process, offering insights on upgrades, effective listing strategies, showcasing your property, and evaluating offers.

Their expertise becomes particularly crucial in challenging markets, where they can leverage their knowledge to secure you a great deal.

Prioritize Cleanliness

A pristine home is an undeniable draw for potential buyers. Make sure your property is thoroughly cleaned before listing or photographing it. If necessary, consider hiring professional cleaners for a comprehensive move-out deep clean that leaves your home looking its best.

Assess and Address Necessary Repairs

Rely on your real estate agent to assess essential repairs required before the sale. In markets with healthy inventory, buyers typically expect fundamental necessities, such as a sound roof and an updated, smoothly functioning HVAC system.

Consider a pre-listing inspection to identify and address any problem areas, preventing potential complications during appraisals or buyer inspections.

Consider Targeted Upgrades

Your agent may suggest minor upgrades that can significantly enhance your home’s appeal, such as a fresh coat of paint, carpet replacement, or other simple improvements. These projects often yield a favorable return on investment.

However, be cautious with extensive renovations like kitchen or bathroom remodels. Those renovations may not provide as much financial benefit in the final sale.

Enhance Curb Appeal With Exterior Maintenance

Give the exterior of your home a facelift by power washing and repainting where necessary. Eliminate dirt buildup on windows, siding, walkways, driveways, and patio. Consider hiring professionals for power washing if you are unfamiliar with the process.

While landscaping might seem like a substantial undertaking, simple improvements can make a significant difference. Trim overgrown plants, refresh flower beds with new mulch, and consider planting seasonal flowers to add a touch of vibrant color without overwhelming potential buyers with high-maintenance requirements.

Optimize Outdoor Spaces

If you have a patio or deck, ensure it is well-maintained and furnished appropriately to showcase its potential as an inviting outdoor living space. For properties without a patio or deck, you can still create an inviting atmosphere in your yard by strategically placing furniture or even installing a pergola to add an attractive feature without the commitment of a complete construction project.

Depersonalize Your Living Space

Remove personal items like family photos, trophies, or memorabilia to allow potential buyers to envision themselves in the home. A neutral, depersonalized space fosters a welcoming environment for prospective buyers to visualize their own lives within the property.

Consider hiring a professional stager to enhance the visual appeal of your home. They can utilize your existing furniture or suggest storing some items temporarily to create an inviting atmosphere that appeals to potential buyers.

Highlight Your Home With Professional Photography

Invest in professional listing photos to showcase your property in the best possible light. Work with a recommended photographer, especially one skilled in virtual staging, if time constraints prevent physical staging. Quality visuals are essential in capturing the attention of potential buyers and generating interest in your property.

Financing Options Available for Home Buyers in the Buffalo Real Estate Market

Homebuyers should explore available grants and programs designed to aid in home purchase. These programs can offer benefits like reduced interest rates, assistance with down payments and closing costs, and potential tax incentives.

There are many loan and grant programs available to assist first-time home buyers. Those programs include the following:

- State of New York Mortgage Agency (SONYMA) – The SONYMA program offers down payment assistance and funds to make repairs and remodeling. The agency provides options for assistance for single-family, condos, and co-ops.

- Achieving the Dream – The Achieving the Dream program helps low-income, first-time home buyers with reduced interest rates and low down payment requirements for a loan.

- FHA Plus Program – FHA loans are a good option for buyers with a low credit score. Those loans often require a smaller down payment. These loans can also be used by existing homeowners.

In addition to the financial assistance programs, there are various types of mortgage loans that are available to homebuyers. Your financial options for buying a home can include adding the funds from assistance programs into one of the following mortgage loans:

- Conventional Loans – A conventional loan is the more popular type of mortgage and is available in two different formats: conforming and non-conforming. Conforming loans follow the standards set by the Federal Housing Finance Agency (FHFA). Those standards include credit, debt, and loan size. That means there are loan limits depending on location. The current loan limit is $726,200. A non-conforming loan does not have to meet FHFA standards.

- Jumbo Loans – A jumbo loan is a home loan that goes beyond the loan limits set by the FHFA. Jumbo loans require a higher credit score and higher down payment.

- Government-backed Loans – There are several government agencies that support homeownership through loan programs. These include FHA, VA, and USDA loans. Each loan type has its own set of standards. For instance, the USDA loans are primarily for homes in rural areas.

- Fixed-rate Mortgages – With a fixed-rate mortgage, you’ll pay the same interest rate over the life of the loan. That means you’ll always know what your monthly mortgage payment will be, and that can be a big help with budgeting expenses. These loans are typically fixed for 15 to 30 years.

- Adjustable-rate Mortgages – An adjustable-rate mortgage starts out with a lower introductory rate. However, that rate only lasts for a specific amount of time. After that, the rate could go up or down depending on the current economic conditions. With this type of loan, you could find yourself paying a significantly higher rate at some point. That loan works best for people who don’t plan on staying in a home beyond a few years.

Tax Implications of Buying and Selling a Home in the Buffalo Real Estate Market

The profit generated with the sale of a home is considered a capital gain. New York is one of 48 states that charge tax on capital gains. According to investor real estate source Smart Assets, the New York state capital gains tax can be as high as 8.82%, depending on the location and transaction.

Homeowners pay property taxes each year. Currently, those rates for Buffalo are around 2.6%. A home that costs $175,000 translates to $4,603 in annual property taxes.

Buffalo Housing Market Comparison With Other Markets

How do the house prices in Buffalo, NY, compare to comparable homes in nearby markets? Property research site Best Places compares a home worth $204,600 in Buffalo to same-size homes in the following cities:

- Rochester – $130,900.

- Niagara Falls – $141,800

- Toronto – $125,000

The number of homes sold in Rochester in October 2023 was 228. That is a decrease of 7.7.% from the previous year. However, those homes that did sell only spent 12 median days on the market.

In Niagara Falls, the number of homes sold in the same period was just 55. That represents a drop of 28% from the previous year. It means you will have fewer properties to consider in this area.

When you consider that the median home price in Toronto is nearly four times more than the price in Buffalo, it is clear that home buyers who want to relocate to another country will be paying a lot more across the board. Given the restrictions for border crossing, this might not be a viable option for most prospective buyers.

Making the Buffalo Move

Embracing a compelling blend of a storied past, affordable living, a thriving arts community, and strong communal bonds, Buffalo emerges as an enticing haven for homeowners and investors.

Prospective buyers would be wise to evaluate all their financial options, collaborate with seasoned real estate professionals, prioritize their housing choices, bolster credit scores, and secure pre-approval for a smoother home-buying process. Sellers, on the other hand, are encouraged to team up with experienced agents, address necessary repairs, boost curb appeal, and consider the impact of professional staging and photography to achieve the best price possible for the property.

Additionally, it is imperative for buyers and sellers to comprehend the implications of New York State’s capital gains tax and annual property taxes on home transactions. In this dynamic market, informed decision-making is key for all parties involved.