“The purchase of a home is one of the most significant financial milestones in your life. It provides both monetary prosperity and emotional security,” says financial guru Suze Orman.

That home is an investment that helps build a family’s financial future. A less-than-stellar credit score shouldn’t keep you from pursuing a dream of homeownership. There are several mortgage solutions designed for buying a house with bad credit. That would be for individuals who fall within the Very Poor to Fair/Poor credit score brackets.

Your credit score is represented by a three-digit number within the 300 to 850 range, signifying your creditworthiness. It is a pivotal factor in the lender’s assessment of your mortgage application. A bad credit score could mean higher interest rates. Fortunately, there is a path to follow on how to buy a house with a bad credit score.

Step 1: Check Your Credit Score

Generally, a credit score below 620 is categorized as unfavorable. Mortgage providers typically employ one of two credit scoring systems for a credit report, FICO (Fair Isaac Corporation) or VantageScore, to ascertain your creditworthiness. Each system establishes a specific credit score range and assigns grades from Very Poor to Exceptional/Excellent. Where your score falls on this scale dictates the strength of your credit profile.

Regularly monitoring your credit report offers a window into how potential creditors perceive your creditworthiness when you apply for loans or credit cards. Incorporating credit report checks into your financial maintenance routine serves several vital purposes. It helps you see your current credit status and detect any red flags for identity theft.

You can get a free copy of your credit reports once a year from the three nationwide credit bureaus by visiting Annual Credit Report.

Step 2: Improve Your Credit Score (If Possible)

There are several proactive steps you can take to improve your credit score. Here are a few steps to take for higher credit scores:

Paying Bills on Time Every Time

Consistently paying your bills on time is the cornerstone of maintaining a good credit score. Payment history constitutes a significant portion of your FICO score. Consider setting up autopay or reminders for due dates to ensure punctual payments.

While minor delays typically aren’t reported as late to credit bureaus until at least 30 days overdue, it’s still advisable to avoid missing due dates, which can result in late fees and increased interest rates.

Paying Down Credit Card Debt

Reducing your revolving debt, such as credit card balances, can quickly enhance your credit score. The utilization ratio, which represents how much of your available credit you’re utilizing, plays a significant role in the credit scores reflected in the FICO score’s “amounts owed” factor.

To maintain a favorable ratio, strive to keep your debt to income ratio at or below 30%. Vigilantly monitoring your the balances on your credit accounts and avoiding crossing this threshold can positively impact your credit profile. Remember that revolving debt encompasses not only credit cards but also personal lines of credit and home equity lines of credit (HELOCs).

Keeping Your Credit Utilization Low

To prevent high utilization from harming your score, paying off credit card balances regularly is advisable. These balances are typically reported to credit bureaus approximately three weeks before the bill’s due date, so even if you pay in full each month, high utilization at reporting time can negatively affect your score.

For those struggling with managing substantial balances, a personal loan can consolidate and pay off credit card debt. That ultimately contributes to an improved credit score over time.

Avoiding New Credit Inquiries

When considering new credit applications, exercise caution to minimize potential adverse effects. Each application generates a “hard inquiry,” which temporarily lowers your credit score by 5 to 10 points and remains on your reports for two years.

Frequent applications can signal desperation to a mortgage lender, reducing your chances of approval. Additionally, opening new accounts decreases your average age of accounts, an element that contributes to your credit score.

Step 3: Get Pre-Approved for a Mortgage

A pivotal initial step in the home-buying journey is obtaining a mortgage pre-approval from reputable mortgage lenders. That provides buyers with essential information that helps them make an informed decision about the types of mortgages they qualify for and the extent of the home they can afford.

The mortgage pre-approval process involves an evaluation of your employment history, creditworthiness, and a theoretical home-buying scenario. This process calculates your maximum allowable purchase price, expected mortgage interest rate, and probable monthly mortgage payments.

Getting a mortgage pre-approval provides buyers with an idea of how much money they can borrow and what the monthly payment will be. Those pre-approvals can be obtained from a bank, credit union, private lenders or mortgage broker. It is important to compare interest rates and terms from multiple lenders. That will put you in a stronger position.

Step 4: Find a Real Estate Agent

Finding the right real estate agent is a crucial part of the home-buying process to pay careful attention to. An experienced real estate agent has the list of homes in your budget range and location wish list.

Real estate agents also help negotiate the purchase of a home. Even after your initial offer is accepted, there will be opportunities to bring that final price down based on the inspection and other contingencies.

Here are some helpful tips for finding a real estate agent:

Seek Recommendations From Family and Friends

Start your real estate search by talking to friends and family members who recently purchased a home and asking about their real estate agent. First-hand experience provides insights into the quality of service and professionalism offered by that agent.

Consult Your Bank or Credit Union

If your bank or credit union also serves as your mortgage lender, consider tapping into their resources to find a reputable real estate agent. Many financial institutions have programs in place to connect customers with qualified agents. That collaboration between the banking institution and the agent allows for a comprehensive evaluation of your financial situation.

Conduct Interviews

Arrange interviews with three or four candidates. During these interviews, delve into their experience in selling homes within your local market and inquire about their availability. Prepare a set of questions to pose to each candidate, allowing for a straightforward comparison of their responses.

You and your real estate agent will be entering into a close relationship. You want to make sure you get along with your agent and never feel put off by asking them questions.

Step 5: Make an Offer

Once you find a home that meets your needs, you’ll want to put in an offer. That could happen within minutes of leaving an open house. That offer will include the purchase price, down payment amount, and financial terms. All of that information will be drawn up in an official offer document prepared by your real estate agent.

That offer can include contingencies that cover elements such as home inspections and appraisals. Those contingencies serve as safeguards that permit you to exit or renegotiate your offer if unexpected issues or discrepancies emerge during the upcoming inspection process.

You also have the flexibility to include non-financial incentives to enhance your offer’s appeal. For instance, if the seller is in a hurry to move, you might propose a swift closing. On the other hand, if the seller is looking for a new home, you could offer to rent the property to them post-closing. That could pay for your first couple of your monthly mortgage payments.

After your real estate agent transmits your offer to the seller, it will either be accepted or rejected. That will also happen fast. If the offer is rejected, you can offer a counter. That initiates a negotiation process that can continue until an agreement is reached or one party decides to withdraw.

Once your offer is accepted, a purchase agreement is signed. That is the official start of the contract. This phase is referred to as the contingency period. That is when there will be inspections, appraisals, or addressing any other terms outlined in your purchase agreement.

Step 6: Close on the House

The closing day can be an intimidating prospect that involves a substantial amount of paperwork and several hours of your time. Closings generally occur at a title company’s office. It will be you, your real estate agent, a closing agent, any co-borrower(s), and the seller’s real estate agent.

You can expect a notary to be present, so you must bring your state-issued photo ID and all relevant documents pertaining to your purchase. That should encompass evidence of homeowners insurance and a copy of the purchase contract.

You will be required to provide a cashier’s check to cover any outstanding escrow items or closing costs not incorporated into your home loan.

During the closing, you will be presented with a series of documents to review and sign. It is important to carefully read and fully comprehend these documents, as they hold legal significance and outline your financial responsibilities and homeowner rights.

Understanding the intricacies of the closing process is essential for arriving well-prepared on your settlement date. Take your time, and ensure that you have your trusted team alongside you to address any questions or concerns that may arise. After all the documents are signed, you’ll be handed the keys to your new home!

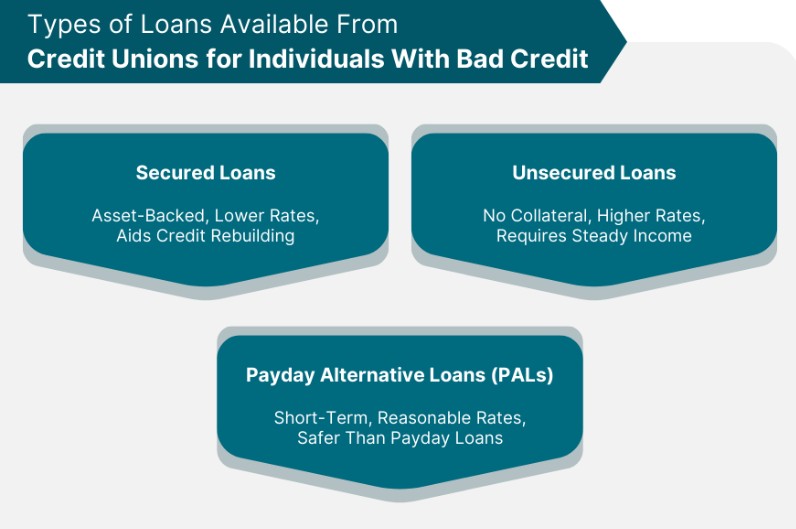

Types of Loans Available to Borrowers With Bad Credit

Buying a home with bad credit means exploring all your mortgage options. The following are the different types of loans for bad credit that you could activate for your home-buying plans:

FHA Loans

The Federal Housing Administration backs the FHA loans, which is a popular option for many first-time home buyers. Typically, FHA loans have lower qualifying requirements, starting with the credit score.

Most FHA lenders will accept an applicant with a low credit score of 580. You could even find lenders who accept a 500 credit score, provided you put down at least 10% as a down payment for these bad credit home loans.

USDA Loans

The U.S. Department of Agriculture is another government agency that backs home loans for properties in rural areas. Most USDA loan applicants have a credit score of 640 to qualify. That makes a USDA loan as a viable option for couples with lower credit scores.

Conventional Loans With A Larger Down Payment

Conventional loans with a larger down payment are another option to consider if you have enough savings. Typically, that down payment amount could be as high as 20% of the total loan amount.

Hard Money Loans

A hard money loan is also called a bridge loan. That type of loan involves collateral such as a second home or other significant property. That means you can use the equity of one house to buy a new home.

Challenges and Risks of Buying a House With Bad Credit

Buying a house with bad credit is possible, but it is a process that is not without challenges. One of the most significant risks is higher interest rates. That translates into spending thousands of dollars more on interest rates, which will take longer to pay off the loan.

Before any home loans for bad credit are approved, you might need a larger down payment. That could be between 10 to 20 percent of the loan total. That is significant money for any family to draw out of their savings.

You might also find it more challenging to qualify for a loan. There could be more application rejections that will have you seeking out a non-traditional lender. Again, that could still come with higher interest rates and down payments.

Finally, there is an increased risk of foreclosure. If the financial struggles that caused a low credit score persist, you could miss payments, triggering a foreclosure process. That is not something any homeowner wants to face.

FAQ

The following FAQ about buying a home with bad credit can help your thought process.

What is the lowest credit score you need to buy a house?

Certain government-backed home loans for bad credit, such as the FHA loans and USDA loans, allow you to qualify with a minimum credit score as low as 500 points. The higher the score, the better the rate.

Can I get a mortgage with bad credit?

Yes, you can get a mortgage with bad credit, provided you can prove you have a steady source of income and a substantial downpayment.

How much money do I need to buy a house?

The amount of money you need to buy a home depends on where you’re making that purchase. According to the financial resource website Money Under 30, if you buy a home for $400,000 with a 10% minimum down payment, most lenders will need you to have $70,000 upfront to close the deal.

What are the benefits of owning a home?

Homeownership provides security and a solid financial future for a family. There are also tax incentives for homeownership that can help lower annual returns. Finally, owning a home provides a legacy for the family.

What are the challenges and risks of owning a home?

Owning a home means you’re in charge. Unlike a rental property, if repairs are needed on a home, you have to pay for them. A home can also be damaged by weather or other disasters. If there is a loss of income, there is a risk of losing the home and any investment you made into that home altogether.

Additional Tips

Your home-buying process could begin with bad credit, but it doesn’t have to stay that way. Some credit counselors help you boost your credit score by working with you to develop a realistic plan to bring up that credit score. That can help you secure more favorable loan terms and potentially lower interest rates.

Additionally, getting pre-approved for a mortgage with bad credit before starting your home search is a smart move. That pre-approval provides a budget range that lets you focus on properties within your financial reach.

You will also need to have a minimum down payment saved up. That will demonstrate to your mortgage loan for bad credit lender you are committed to the process but also reduce the amount you need to borrow.

Negotiating with the seller is a skill that can be invaluable when buying a house with bad credit. Be prepared to make an offer that appeals to both parties.

Finally, consider that buying a house with a lower credit score may take longer, but it is possible. Remaining patient as you work to improve your financial situation, qualify for more favorable loan terms, and identify the right home for your needs is essential.

You Can Own a Home Even With Bad Credit

If you ask yourself, “How can I buy a house with bad credit,” the answer can be found by putting the above tips into action. By staying committed to your homeownership goals, you can overcome the challenges associated with buying a home with a lower credit score and turn the keys into the front door of your new home.