One of the first things new homeowners discover after moving into the Orlando metro area is how popular they have become among their friends and family. When you are just minutes away from Walt Disney World, Universal Orlando, SeaWorld, and a wide array of other fun family attractions, your Orlando home will see many visitors. That’s a good thing!

Whether you’re moving to Orlando metro area to retire and work on your golf game, or you want to live in a vibrant community where there are always fun things to do, you won’t be disappointed. Everything you love about Florida can be found in Orlando’s housing market, which makes it a great place to call home.

Current trends in the Orlando single-family home market

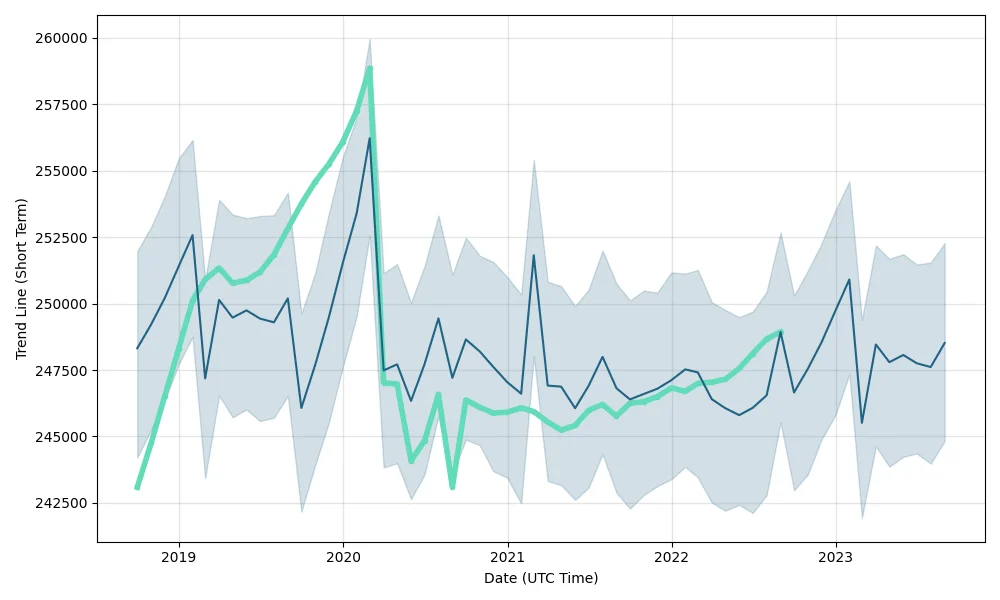

According to the popular real estate listing website Realtor, the median home price in the Orlando housing market is $393,000. That breaks down to around $244 per square foot. The median Orlando home price is a decent baseline for prospective homeowners, but it might not always reflect the “sold price.” Realtor finds that the price is $370,000. That provides a good range of what to expect when looking at Orlando real estate trends.

The other current state of Orlando real estate trends to consider are the average days a home spends on the market once it is put up for sale. According to Realtor, that number is 40 days. Recently, there have been 3,944 homes for sale.

If all those homes went on the market the same day, they could be sold in just a month and a half. That makes the Orlando real estate market one of the fastest-moving markets in the country. The strong demand for homes in Orlando means you have to act fast.

Orlando real estate market information

The Orlando housing market has a diverse range of potential homebuyers, sellers, and investors, and everyone has their own particular goals for what they want to accomplish with buying and selling property.

Homebuyers typically fall into two general groups: Families and retirees. Both groups need to pay close attention to the changes in Orlando’s real estate forecast to help them determine when they will get in or out of the market. There are also young professionals who want to live in the warm weather that the Orlando real estate market offers.

Those potential homebuyers also keep an eye out on the inventory of new listings coming onto the market. The larger the number, the better the home prices as the laws of supply and demand take effect. There are also primary homebuying factors to consider, such as the increasing interest rates that directly impact mortgage rates. Those numbers will determine the buying budget.

For the current homeowners who are looking to sell, they want to find the maximum price in the minimum amount of time. Sellers need to get their homes ready for prospective buyers. That often means making repairs, renovations, and staging their homes based on the recommendations of their real estate agents. All of that effort will go a long way to increase home values.

Sellers also have to pay close attention to the Orlando real estate trends. When mortgage interest rates go up, some buyers could be squeezed out of the market. Does that mean the seller needs to lower their asking price or hold out?

Investors view the Orlando market as a promising avenue for financial growth. They focus more on properties that generate a consistent revenue stream through rent.

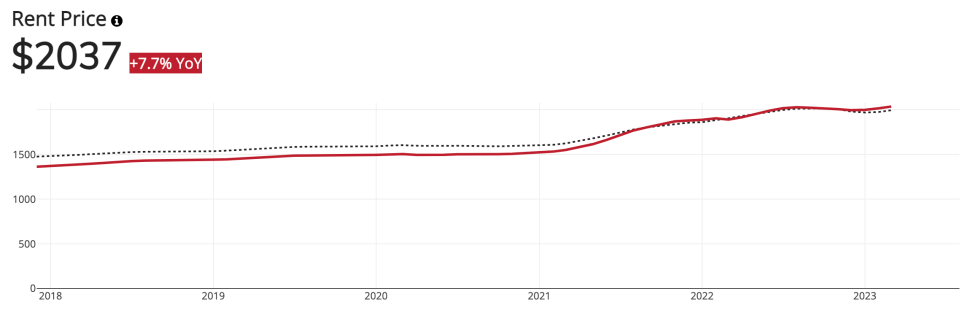

According to the apartment rental site RentCafe, the average rent in Orlando is $1,940. Multiplying that over several units makes it easy to see why rental properties are an enticing prospect for investors.

Important Factors to Consider When Buying a Home in Orlando

Along with the median home price, the number of homes for sale, and the trends in the market, prospective homebuyers take into account several more factors, starting with the best neighborhoods to buy in. A good gauge of that can be found in Realtor’s list of median listing home price for various Orlando neighborhoods. Consider the following areas with a strong demand for homes in Orlando:

- Metro West $249.5K

- College Park $790K

- Lake Nona South $699.9K

- Florida Center North $205K

- Vista East $485K

- Ventura $199.5K

- South Semoran $189K

- Orlando Central Business District $274K

- Baldwin Park $843K

- Rosemont $192.5K

- South Eola $240K

- Storey Park $525K

- Pineloch $225K

Those are just a few of the many neighborhoods worth exploring throughout Orlando. And all of those neighborhoods are home to accredited schools for all ages. Those are even more reasons to consider a move to Orlando.

The Commute

Orlando serves up a fantastic array of transportation options for its citizens. The primary public transportation in Orlando is the extensive Lynx bus system. According to the city review site BestPlaces, those bus lines cover 37 million miles throughout Orlando.

In addition to all the buses, Orlando has multiple rail systems and shuttles that new residents can take advantag of. The SunRail service efficiently traverses the state via commuter rail, while the local Lymmo streetcar system facilitates quick journeys around downtown Orlando.

For residents who want to get in a good cardio workout for a commute to work, bike-share programs, like Juice Bike Share and Spin, provide access to hundreds of bicycles across the city.

With so many choices in public transportation options, you’ll find that getting to and from work in Orlando is a stress-free experience. There is no need to deal with traffic jams or parking when you can hop on a bus, bike, or train.

Of course, if you want to take your car to work, you can expect to spend a one-way commute of around 25.4 minutes. That is shorter than the national commute average of 26.4 minutes. How do Orlando residents get to work? Here’s the breakdown:

- 78.3% drive their car alone

- 8.2% carpool with others

- 5.1% work from home

- 4.2% take mass transit

Information Sellers Seek in Orlando’s Real Estate Market

Getting the best home price is a goal that every seller aspires to; that happens with a strategic approach to the process. Accurately pricing your home is crucial. Overpricing can discourage potential buyers, while underpricing can lead to missed opportunities.

It will help to conduct a comparative market analysis, which involves assessing recent sales of similar properties in your area. That will help you determine a competitive and realistic listing price. It’s essential to stay open to market feedback and be prepared to adjust your price if necessary.

Staging your home for sale is another essential step in attracting buyers and securing the highest level offer. A well-staged home can create an emotional connection with potential buyers and make them envision their family making that space their home.

Begin by decluttering and depersonalizing your home to allow buyers to imagine their belongings in the space. Consider freshening up the paint, making necessary repairs, and enhancing curb appeal to make a lasting impression. Professional staging services can also be an option for those seeking expert guidance on optimizing the visual appeal of their property.

It will also help to sharpen your negotiating skills. Your real estate agent will help you make sense of the current home inventory and market conditions in your neighborhood. Be prepared to respond to offers promptly and professionally. Carefully review each proposal and consider the price, terms, and contingencies.

An experienced real estate agent can be invaluable in this phase, offering guidance on negotiation strategies and helping you navigate counteroffers. Effective negotiation can lead to a successful sale and, hopefully, the best possible price for your home.

Orlando Housing Market: What Investors Are Looking For

For investors, the Orlando housing market presents an enticing landscape ripe with potential opportunities. The key attraction is the city’s steady population growth and robust job market, factors that continually drive demand for housing.

According to the U.S. Census Bureau, Orlando’s current population stands at 316,081. That is a 2.7% increase from the 2020 census. Of course, the regular influx of tourists causes that population number to swell.

Data from Visit Orlando finds that there were 74 million visitors to Orlando in 2022. That is why real estate investors like their chances in the Orlando’s housing market.

The range of rental properties for savvy investors includes single-family homes, apartments, and condominiums. Any of those properties can become short-term vacation rentals, and that can generate a significant amount of revenue.

Of course, investing in real estate presents risks. Those rental properties are not immune from changes in the market that are attributed to the economy. Real estate investors need to consider the forecast of where the market might be headed.

Orlando is a year-round tourist destination that differentiates it from other investment opportunities nationwide. Working with an experienced real estate agent helps investors identify properties with strong earning potential.

Orlando Real Estate Market Trends

The Orlando housing market has been the focus of buyers, sellers, and proactive real estate enthusiasts. Real estate investment site Norado Real Estate Investments has curated the recent data on the Orlando housing market trends to lay out a forecast.

According to their data, as of July 31, 2023, the average home value in the Orlando area stood at $389,109. That represents a 0.3% of the Orlando home price increase from the preceding year. That is a good indication of the market’s steadfast stability.

That stability is reflected in Orlando’s “somewhat competitive” rating as assessed by the online real estate site Redfin. They put Orlando’s competitive rating at 69. Nearby Kissimmee, the rating is 58, while in Winter Park, it is 64.

Redfin comes to that rating by considering a sale-to-list price of 98.3%. The amount of homes that sold above the list price is just 21.9%, while homes with price drops were 34.2%

Orlando Real Estate Forecast

The outlook for the Orlando’s housing market in the near future remains robust and promising. Several factors contribute to the city’s strength. Those factors include a steady population growth fueled by job opportunities and its appeal as a desirable place to live, which continues to drive housing demand.

Additionally, Orlando’s status as a popular central Florida tourist destination creates a consistent market for vacation and short-term rental properties, appealing to investors and diversifying the real estate landscape.

One potential factor that could put a crimp on the positive outlook is the potential for interest rates to tick up. If those rising rates cause mortgages interest rates to go up, the market’s momentum can slow down. A homebuyer with reduced purchasing power will reduce the type of homes they can afford.

The current climate still presents favorable opportunities for those considering buying a home in Orlando, but readiness and quick decision-making are paramount. In a hot market, buyers should be prepared to act swiftly when they find a home that meets their criteria. Being pre-approved for a mortgage and clearly understanding their budget can help buyers make confident offers and secure properties promptly.

On the seller’s side of the real estate equation, there is an opportunity to capitalize on the Orlando metropolitan area market’s strength by pricing their homes competitively. When the right property is listed at the right home price, it will attract serious buyers ready to close the deal.

Sellers need to be prepared to negotiate. By being open to working with buyers, sellers can increase their chances of a rapid sale at a price that will make everyone happy.

- Miami Real Estate 2023: Prices, Trends, and Forecast

- Naples Real Estate Market Trends 2023

- Wilmington Real Estate Market in 2023

Making a Move to Orlando

Orlando’s housing market continues demonstrating opportunities for buyers and sellers. Both sides of that equation need to pay attention to the shifts in home sales dynamics. That means paying attention to potential interest rate fluctuations.

Buyers should be open to exploring the wide range of attractive Orlando neighborhoods. There is no telling what gem they might discover when they broaden their searches. They will also need to be decisive and act fast. Heading into an open house with a pre-approved mortgage will give them a stronger buying position. Investors also need to expand their searches and consider that consistent rentals are better than no rentals. Overall, there are opportunities in the Orlando’s housing market that make it a smart move for buyers and an excellent opportunity for sellers. It is the best of both worlds.