Banks are financial institutions we rely on to keep our money safe, so we don’t expect them to fail. But bank failures do occur. The past 30 years have seen over 500 banks failing. Most recently, five banks collapsed in 2023.

In this article, we dissect the causes, effects, and context of bank failures. We’ll also discuss some of the biggest bank failures that shaped America’s banking system.

What Is a Bank Failure?

Each year, an average of 25 banks collapse in the U.S. The most serious concern, however, is how these failures occur.

A bank crashes or closes when it fails to deliver the financial obligations it owes to:

- Depositors

- Creditors

- Borrowers

This doesn’t mean that the bank will close voluntarily. There are federal and state regulators to oversee whether a bank can meet its obligations.

When a bank’s ability to keep up with financial obligations diminishes, these regulators can authorize a bank closure. This power rests with two distinct entities:

- Federal government regulators, aka the Federal Deposit Insurance Corporation (FDIC), have the authority to close national banks.

- State banking commissioners or regulatory agencies have the authority to close state-chartered banks.

Depositors are insured up to a certain amount at their bank. As a result, the FDIC covers the depositors’ insured amount when a bank fails.

The FDIC was established in 1933 to relieve the customers of failed banks. Before this time, bank crashes were common, and customers incurred significant losses. There was no way for them to retrieve their deposits until the FDIC began issuing insurance coverage.

When Do Bank Failures Happen?

Although it is difficult to foresee, these are the three main reasons a bank might fail:

- The bank is unable to pay the debts owed to its creditors and depositors, known as insolvency.

- The bank lacks sufficient liquid assets to see through its financial functions.

- The bank’s asset worth falls below the market value of its liabilities or financial obligations, possibly due to severe investment losses.

Bank failures are fairly common, but there have been years where none collapsed, such as:

- 2022

- 2021

- 2018

- 2006

- 2005

It’s worth mentioning that only three banks failed during the coronavirus outbreak. These were:

- The First State Bank

- First City Bank of Florida

- Almena State Bank

The FDIC assessed that the above banks had financial problems previously, and the crash was long overdue.

What Happens After a Bank Failure?

Bank bankruptcies have unique consequences for both the bank and its depositors. Here are a few things you can expect when a bank fails:

- The announcement of a bank failure is bound to induce panic among depositors. As soon as they smell trouble, depositors rush to withdraw their funds from the insolvent bank, resulting in what’s known as a “bank run.”

- As more depositors withdraw funds from the bank in a short time, the bank’s liquid assets decrease. This further heightens their insolvency or likelihood of defaulting on payments to borrowers or creditors.

- At this point, a bank needs a line of credit to pay off its obligations. They may borrow money from solvent banks for this purpose.

- If you’re a depositor at an FDIC-insured bank, you have protection. So long as you meet FDIC guidelines and insurance limits, you should be able to receive up to $250,000 of insured bank deposits.

- For every bank failure, the FDIC conducts assessments to determine the cost to the Deposit Insurance Fund (DIF). Despite the number of bank failures since the new millennium, few depositors have lost money thanks to FDIC-insured funds.

- The collapsed bank may be sold to or absorbed by another bank to address its insolvency. When this happens, depositors with money in the bankrupt bank automatically become customers of the new bank. They can access their funds but may receive new debit cards or checks.

Most Recent Failures: Bank Closures in 2023

Early 2023 saw some of the biggest bank closures in a decade. The Silicon Valley Bank (SVB) and Signature Bank collapsed at the start of the year in 2023, causing ripples in the financial world. In May, the First Republic Bank followed suit.

| Bank Name & Place | Closing Date | Assets at Closing (approx.) in millions | Deposits at closing (approx.) in millions | Acquisitions |

| Silicon Valley Bank, Santa Clara, CA | March 10, 2023 | $209,000 | $175,400 | FDIC transferred all SVB bank deposits to a “bridge bank” held by the FDIC itself in a bid to protect depositors. Fifteen days later, the FDIC signed an agreement with Raleigh-based First-Citizens Bank & Trust Company. They agreed to place the Silicon Valley Bridge Bank under receivership. |

| Signature Bank, New York, NY | March 12, 2023 | $110,400 | $88,600 | On March 12, 2023, The New York State Department of Financial Services appointed the FDIC as “receiver”. Later that week, the FDIC made a purchase and agreement deal for Signature Bank with Flagstar Bank, Hicksville, NY. |

| First Republic Bank, San Francisco, CA | May 1, 2023 | $229,100 | $103,900 | All deposits and assets of First Republic Bank were acquired by JPMorgan Chase Bank. |

| Heartland Tri-State Bank, Elkhart, KS | July 28, 2023 | $139 | $130 | Dream First Bank assumed all deposits and assets of the Heartland Tri-State Bank. |

| Citizens Bank, Sac City, IA | November 3, 2023 | $66 | $59 | Iowa Trust & Savings Bank acquired all deposits and assets of Citizens Bank. |

When SVB collapsed, it was considered one of the largest bank failures in U.S. history. However, the collapse of First Republic Bank, a major institution in California, was an even bigger loss.

SVB held $209 billion in assets in December 2022. As word of the bank’s collapse spread, there was a massive bank run of depositors. They ended up withdrawing $42 million in just two days.

Signature Bank, which also closed following SVB’s crash, held nearly $110 billion in assets the previous year. First Republic Bank recorded the most assets held before closure, totaling $232 billion.

All three banks were renowned for funding major startup companies and tech giants in the U.S. SVB and First Republic Bank were among the top 20 biggest banks in the country.

On FDIC’s comprehensive list of failed banks, you will see mostly regional bank failures through the years. It was possibly the first occasion that banks of this size closed back-to-back in the same year. The combined assets of these banks were far more than the total assets of the 157 banks that failed in 2010.

The failure of these notable banks impacted their customers significantly. Since they catered to large corporations and wealthy customers, their deposit balance wasn’t sufficient for coverage under FDIC’s insurance limit of $250,000.

Takeaways and Analysis of the SVB Failure

The downfall of Silicon Valley Bank has stood out in recent times as one of the biggest and most rapid failures in U.S. financial history. We examine what went wrong, key moments during the closure, and the consequences.

Quick Action By the FDIC

Things at SVB began to unravel on the Wednesday before the crash. The bank announced the sale of shares worth $2.25 billion to compensate for the loss from selling some securities.

Depositors conducted bank runs en-masse, causing the bank’s assets to deteriorate and forcing an intraday closure five hours into Friday.

By this point, the California state regulator had already intervened and announced SVB’s closure. FDIC took over as the acting receiver of the bank, liquidating the bank’s assets to pay off creditors and depositors.

Since SVB’s clientele included mainly U.S. tech and healthcare firms, their deposits were much larger than anything the FDIC could have insured. Even so, the FDIC promised the insured amount to all creditors and depositors by Monday morning.

Customer Loss

SVB was the go-to bank for many domestic and foreign investors. Per the bank’s most recent annual report, it held $13.9 billion in uninsured foreign deposits and $151.5 billion in US-based deposits.

The classic bank run during the closure paid off for a few companies that were able to salvage some portion of their funds. However, other companies like video-game giant Roblox and streaming gadget Roku are still facing a fallout.

Tech Startup Woes

Many startup companies with an account at SVB are suffering due to their inability to recoup all their funds. As businesses, they have their expenses to cover and payrolls to make.

While some are waiting for a bailout to retrieve their money, others are getting creative by holding blowout sales on their merchandise to recover some funds.

Experts Dismiss This As a “Banking Contagion”

Understandably, other lenders and banks are feeling the sting of the SVB’s demise and wondering if they’ll be next. Experts believe SVB was a one-of-a-kind case, attributing its abrupt closure to its volatile depositor base. There is no reason to believe that this will have any impact on the bigger banking system.

Despite this assurance, other lenders in the U.S. believe it’s better to liquidate assets voluntarily if they are in financial turmoil.

Stocks Affected by SVB Closure

The collapse of a bank as major as this was bound to affect the market. Here’s how it reacted on the day that SVB ceased operations:

- The S&P 500 index plummeted 1.5% on the day of the collapse and then fell 4.6% in the following week.

- The Nasdaq Composite lost 1.8% on Friday and then fell 4.7% the following week.

- The Dow was behind by 1.1%, losing 345 points. In the week that followed, it declined by another 4.4%.

More Accountability for Banks

In light of SVB’s closure, numerous politicians rallied in favor of depositors. They also called for SVB to be held accountable for financial mismanagement.

The Biggest Bank Failure in the U.S.

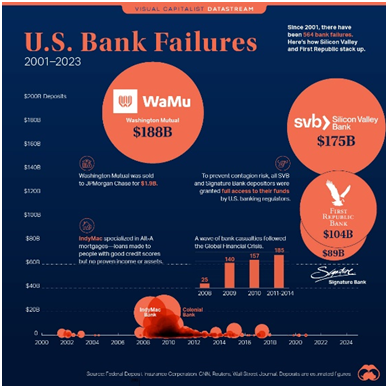

The 2008 financial crisis brought challenging instances in the nation’s financial history. This included the closure of Washington Mutual (WaMu), which went down as the biggest bank failure in the U.S.

At its closing, the bank held a whopping $307 billion in assets. There were many reasons for its failure, including:

- Poor housing market

- Risky mortgage loans to unqualified borrowers

- Reckless branch expansion

- The Lehman Brothers’ bankruptcy in September 2008 induced panic, prompting a bank run at WaMu. In 10 days, WaMu depositors withdrew nearly $16.7 billion, or over 11% of the bank’s deposits.

- The U.S. Treasury or Federal Reserve didn’t consider WaMu large enough to bail them out as they did other institutions like Bear Stearns.

Ultimately, FDIC reached an agreement with JPMorgan Chase, which acquired WaMu for $1.9 billion.

List of the Biggest Bank Failures Since 2001

During the 2000s, a spate of subprime mortgage loans sent several banks into a tailspin. Many banks went bankrupt as a result of multibillion-dollar mortgage losses.

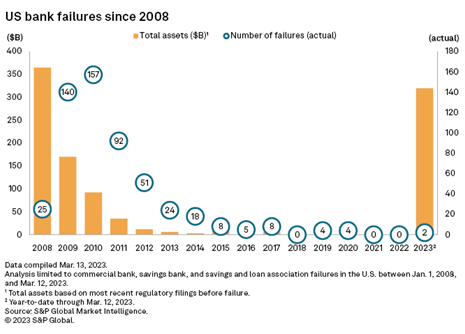

2008-2020 were the peak years for major bank shutdowns, with 157 bank failures happening in 2010.

The following table represents a list of banks in trouble and the biggest losses that significantly affected the banking sector since 2001.

| Bank Name | Date | Deposits (in billions) | Assets (in billions) | |

| 1 | IndyMac Bank | Jul-08 | $19.1B | $32.0B |

| 2 | Washington Mutual Bank | Sep-08 | $188.0B | $307.0B |

| 3 | Franklin Bank | Nov-08 | $3.7B | $5.1B |

| 4 | Silverton Bank | May-09 | $3.3B | $4.1B |

| 5 | BankUnited | May-09 | $8.6B | $12.8B |

| 6 | Colonial Bank | Aug-09 | $20.0B | $25.0B |

| 7 | Guaranty Bank | Aug-09 | $12.0B | $13.0B |

| 8 | Corus Bank | Sep-09 | $7.0B | $7.0B |

| 9 | Downey Savings and Loan Association | Nov-08 | $9.7B | $12.8B |

| 10 | California National Bank | Oct-09 | $6.2B | $7.8B |

| 11 | Park National Bank | Oct-09 | $3.7B | $4.7B |

| 12 | AmTrust Bank | Dec-09 | $8.0B | $12.0B |

| 13 | First Federal Bank of California | Dec-09 | $4.5B | $6.1B |

| 14 | R-G Premier Bank of Puerto Rico | Apr-10 | $4.3B | $5.9B |

| 15 | Amcore Bank | Apr-10 | $3.4B | $3.8B |

| 16 | Doral Bank | Feb-15 | $4.1B | $5.9B |

| 17 | First NBC Bank | Apr-17 | $3.5B | $4.7B |

| 18 | Silicon Valley Bank | Mar-23 | $175.4B | $209.0B |

| 19 | Signature Bank | Mar-23 | $88.6B | $110.4B |

| 20 | First Republic Bank | May-23 | $103.9B | $229.1B |

Another major collapse was Downey Savings and Loan, one of the country’s largest savings and loan banks. It closed in late 2008, mainly due to the weak portfolios it held during the 1980s.

Colonial Bank, which held nearly $20 billion in deposits, folded in 2009 after a profitable sprint throughout the 1980s and 1990s. In the 2000s, it invested in a series of Florida-based construction projects that suffered huge losses. Owners of these projects defaulted on massive loans from the bank, leading to its demise.

Another factor that contributed to its collapse was the involvement of the bank’s senior vice president in a billion-dollar fraud scheme.

Guaranty Bank was another bank that didn’t survive the 2009 housing crisis. Many borrowers defaulted on housing loans after the real estate market crashed. The bank failed to recoup its losses from foreclosures as real estate prices fell to historic lows.

Bank Failures By Year

Technically, bank failures do not happen every year, but the real answer is more complex. In the early 2000s, notably between 2001 and 2007, there were at least 3.57 bank failures in the U.S. on average. After the Great Recession, this figure skyrocketed, with an average of 93 failures per year from 2008 to 2012.

The years between 2008 and 2012 account for roughly 80% of total bank failures over a two-decade period until 2023.

Image source

Despite the discouraging figures you see from 2008 to 2012, bank failures slowed down between 2015 and 2020.

Whereas it was common to see dozens of bank failures each year, this number has since fallen to an average of 5. Recently, we’ve also seen years unaffected by bank failures, such as 2021 and 2022.

Only in 2023 did one of the longest no-bank-closure streaks end, with the closure of Silicon Valley Bank. Even so, five bank failures in a year are still below the historical average.

The Sensitive Timing of Bank Failures

You may believe the day of the week doesn’t matter in bank failures. The truth is, it matters more than you think.

To a large extent, FDIC tries to strategically schedule a bank’s closure, with the favored day being Friday. As banks operate from Monday to Friday, it gives the FDIC a chance to:

- Sort and settle accounts over the weekend

- Liquidate assets

- Draw up an agreement and transfer the bank to a new management

Taking care of this business over the weekend offers a better chance of containing customer panic and avoiding bank runs. The fall of a major bank almost always induces widespread fear. Depositors envision one closure affecting other banks, prompting bank runs across the country.

This domino effect can send even the most stable banks into sudden losses. If left unchecked, it can lead to a financial crisis. To avoid this, bank closure timings are crucial.

Even the most strategic plans are vulnerable to exceptions, as was the case with Signature Bank. Signature Bank was the only bank closure since 2000 to happen on a Sunday.

The failure of SVB bank, sudden as it was, sparked bank runs on deposits in Signature Bank. As a result, the bank collapsed suddenly on a Sunday, forcing FDIC to take care of business overnight.

Bank closures also usually occur early on in a new quarter. Since 2000, many banks have closed in January, April, July, and October. This allows regulators to cushion the fall and sort accounts well before the start of the next quarter.

Where in the U.S. Are Bank Failures Most Frequent?

An analysis of the history of bank failures reveals that these collapses occurred more frequently in some states than others. Bank failures were most common in these four states:

- Florida

- Illinois

- California

- Georgia

Ironically, New York State, long regarded as the country’s banking capital, has been relatively safe from bank collapses. It saw only six closures since the new millennium. This number includes the Signature Bank closure in 2023.

Georgia and Florida have seen the most bank failures, state-wise. The bank failure rate in these two states accounts for at least 30% of all national bank collapses. It’s not surprising, given that both states were in grave financial straits during the 2008 downturn.

California has witnessed 42 bank failures since 2000, including the most recent Silicon Valley Bank collapse.

Bank Failures: An Unpredictable Phenomenon

No one can forecast a bank failure, but there may be strong reasons that may point to a collapse. These may include declining economic conditions, housing and loan crises, and large-scale deposit withdrawals in a short time.

The good news is that things aren’t as dire as they were a century ago. At the time, bank failures were a common theme in the years preceding the Great Depression. Now, with the establishment of regulators like the FDIC and deposit insurance, the consequences of a bank closure aren’t as severe.

However, depositors should note that failures will continue to be a feature of the banking landscape. To better prepare for this uncertain time, consider talking to a financial advisor about protecting your finances.