US Department of Agriculture (USDA) loans provide a favorable option for attaining homeownership in rural areas, particularly if you are short on funds for a down payment. What sets them apart are their distinct features and eligibility criteria compared to other mobile home loans programs and bridge loans.

If you are considering a USDA home loan, there are significant benefits worth checking. However, whether you’re a first-time homebuyer or seeking a change of location, having the right information is key to determining if a USDA loan aligns with your homeownership goals.

This article takes an in-depth look into USDA loans and the different types of home loans available and provides insights into eligibility requirements for these loans.

Understanding USDA Home Loan

Here are a few aspects to improve your knowledge about USDA home loans:

What Is a USDA Mortgage?

USDA home loans are issued to eligible low-income borrowers by partner lenders or directly by the US Department of Agriculture.

They stand out for eliminating down payment and typically have lower interest rates than conventional mortgages. This is because the government assumes lending risks, even in cases where the USDA directly issues loans.

Additionally, USDA loans don’t require traditional private mortgage insurance (PMI). That’s why USDA loans are an attractive option for qualified rural borrowers looking into homeownership.

Definition and Purpose

A USDA home loan, commonly known as a Rural Development (RD) loan, is a mortgage that doesn’t require a down payment. It is designed specifically for low- to moderate-income individuals looking to buy homes in predominantly rural areas.

These loans are offered by the US Department of Agriculture, aiming to provide financial help to first-time homebuyers or those who may not qualify for traditional mortgages.

Government Backing

USDA loans receive backing or funding from the US Department of Agriculture, aiming to assist low-income borrowers in constructing or purchasing homes within eligible rural regions.

A government-backed loan is secured by a federal agency. If you face difficulties and default on the mortgage, the agency pays the lender on your behalf.

Opting for a government-guaranteed mortgage is akin to the lender obtaining insurance on your loan. This makes it comparatively easier to qualify for than a conventional mortgage.

Exploring the USDA Home Loan Types

Familiarizing yourself with the different types of home loans under USDA is crucial for optimizing your home-buying experience.

This knowledge lets you choose the loan that aligns with your specific requirements. You can then streamline the entire process and ensure it’s straightforward and advantageous.

Overview of USDA Loan Varieties

There are three USDA home loan programs available.

- USDA Direct Loans

USDA direct Loans are funded directly by the USDA and are specifically designated for borrowers with low income, determined by the median income in their area.

The loan term can extend up to 33 or 38 years, depending on income levels, and subsidies may reduce the interest rate to as low as 1%.

Typically, borrowers make no down payment and are exempt from mortgage insurance premiums.

- USDA Guaranteed Loan Program

To qualify for a USDA home loan guarantee, your income must be below 115% of the median income in the area. Private lenders finance these mortgages, with the USDA insuring 90% of each loan against default.

This guarantee assures lenders, enabling them to offer mortgages with below-market interest rates and no down payment requirements. However, borrowers are responsible for two types of mortgage insurance: an upfront guarantee fee of 1% of the loan amount and an annual fee of 0.35% of the principal balance.

- USDA Home Improvement Loans

USDA home improvement loans enable homeowners to repair or upgrade their homes. Loan limits are set at $40,000, while grants have a maximum of $10,000.

Moreover, packages can combine both a loan and a grant, providing a total assistance of up to $50,000. Loan terms span 20 years with a 1% interest rate.

If the property is sold within three years, the homeowner is required to repay any grant funds received.

Eligibility for USDA Home Loans

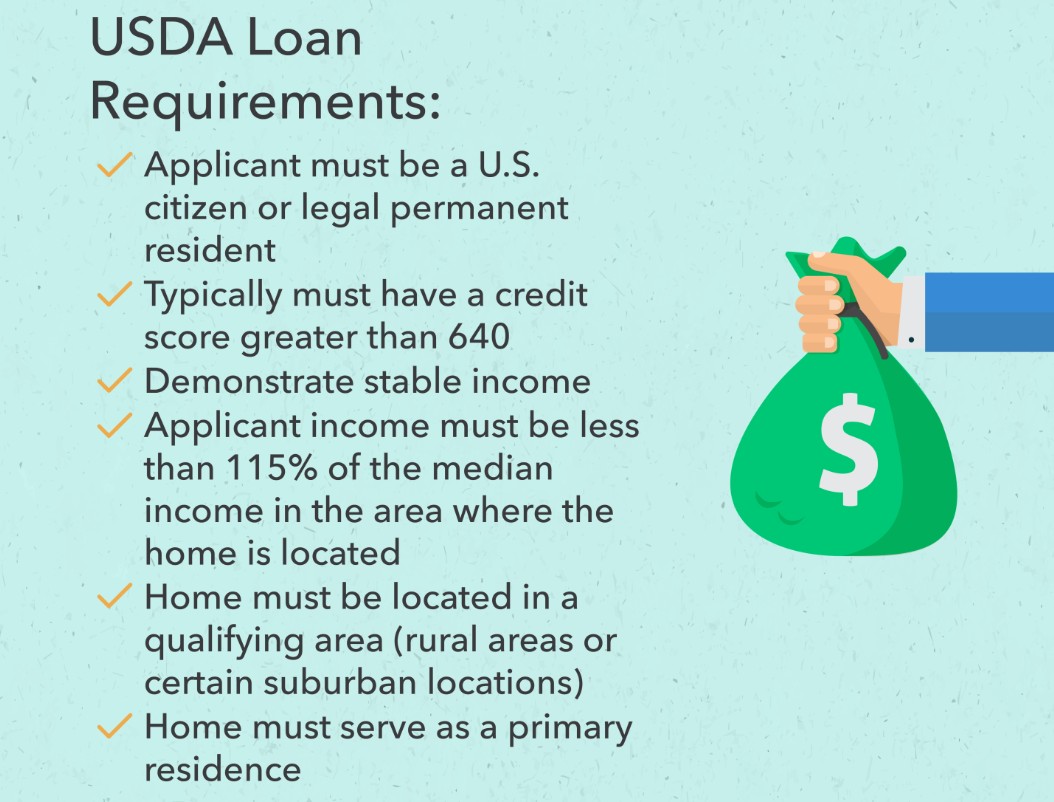

To qualify for a USDA home purchase loan, home buyers must meet specific eligibility criteria.

Income and Property Requirements

Here are the key requirements to qualify for a USDA home loan:

- Income Limits and Criteria

USDA loans are designed for families with financial need, requiring an adjusted gross income below 115% of the local median.

Income eligibility can be verified on the USDA’s website under “Income Eligibility.” A steady income and the capacity to make mortgage payments for at least 12 months, considering assets, savings, and current income, are prerequisites.

Lenders assess the debt-to-income (DTI) ratio, ideally below 43%. DTI is computed by dividing monthly recurring debts, including rent, student and auto loan payments, and credit card payments, by gross monthly income.

- Property Eligibility Essentials

Properties acquired with USDA loans must be situated in eligible rural areas, as defined by the USDA.

These areas encompass open country or any town, village, city, or place, including the immediately adjacent densely settled area, which is not part of or associated with an urban area.

USDA mortgages exclusively apply to these rural regions, aligning with a government initiative to encourage homeownership and foster economic growth. These loans play a crucial role in attracting and retaining individuals in these locations.

Credit and Employment Criteria

Lenders evaluate your creditworthiness through your credit history. They also assess your employment record to gauge financial stability.

Maintaining a positive credit score and a steady employment record are key factors in securing approval for a USDA loan.

- Credit Score Requirements

If concerns about qualifying for a home loan due to a few negative marks on your credit report are looming, USDA loans could be a suitable choice.

With the federal government insuring the mortgage, lenders are less anxious about your ability to repay. That allows them to ease their credit requirements for USDA borrowers.

It’s essential to note, however, that while a rural home loan aims to assist low- to moderate-income borrowers in securing homes, some lenders may set higher credit score expectations to manage potential risks.

While USDA doesn’t impose a uniform credit score requirement for all borrowers, most USDA-approved lenders seek a minimum score of at least 640.

- Employment History Considerations

When you apply for a USDA loan, your employment history is a crucial factor in the approval process. Lenders review your work history as part of assessing your financial stability.

Although the specific employment duration requirements can differ among lenders, having a consistent and reliable employment record enhances the strength of your application.

Applying for a USDA Home Loan

Looking to apply for a USDA home loan? The next section gives you how to go about it.

The Application Process

When applying for a USDA loan, the initial step involves determining your eligibility. The next step is to decide whether a guaranteed or direct loan suits your needs.

Upon deciding, gather and submit financial documents detailing your income, assets, and debt. Expect a credit check as part of the process.

If pre-approved, you can commence your home search within USDA-eligible areas.

Steps in the Application Journey

Here’s an overview of the general process to follow when applying for a USDA home loan:

- Get pre-approved for a USDA home loan: Prior to house hunting, connect with a USDA-approved lender for preapproval. The lender assesses your income, debt, and assets to determine eligibility. Upon approval, you’ll receive a preapproval letter specifying your borrowing capacity.

- Shop for a USDA-approved home: Utilize the USDA’s property eligibility map to identify suitable areas. You can overlay eligible zones on platforms like Zillow or Realtor.com. Alternatively, find a property and verify its eligibility in the designated area.

- Submit your mortgage application: After selecting a home and having your offer accepted, choose a USDA-approved mortgage lender and proceed with the application. During underwriting, provide documentation on income, employment, debts, and assets. The lender ensures your income aligns with program limits.

- Approval by the local USDA office: Once your lender approves the loan, the USDA reviews your application and documents to confirm eligibility for both you and the property. The closing timeline may vary, with the USDA’s additional review taking a few extra days. After USDA approval, proceed to the closing table to sign the paperwork and settle the transaction.

Required Documentation

Whether you’re applying directly with the USDA or through a private lender, certain documentation is essential to verify details such as your residence and income.

Examples of the documentation you’ll likely need to provide include:

- State photo ID

- Social Security card

- One month’s worth of your most recent pay stubs (if employed full-time)

- Tax returns for the past two years (if self-employed or retired)

- Copy of earnest money check

- Personal financial statement

- Homeowners insurance policy quote

- Termite inspector’s report

Selecting USDA-Approved Lenders

Choosing the right USDA-approved lender is crucial for a successful loan process. To navigate the selection process, use the USDA website and consult local banks and credit unions.

Seek recommendations from real estate professionals or friends, and conduct online research to ensure a smooth and well-informed application process.

Financial Insights on USDA Home Loans

Get financial insights to guide you in the USDA home loan application process.

Understanding Financial Terms

USDA home loans typically require the following:

- Down Payment and Mortgage Options

USDA loans provide many buyers the opportunity to own a home with no down payment. The federal government backs these loans, reducing risk for lenders.

This increased confidence allows lenders to finance most of the purchase, often covering 100%.

- Interest Rates and Funding Fees

Interest rates for direct USDA loans are determined by the mortgage market, while rates for guaranteed loans are set by individual lenders.

The interest rate on direct loans can drop to as low as 1% with USDA’s payment assistance. Shopping around and comparing quotes can help find the best deal, with a higher credit score potentially securing a better rate.

Notably, USDA mortgages involve two fees:

- Upfront guarantee fee of 1% of the loan amount, often rollable into the mortgage

- Annual fee of 0.35% for the life of the loan.

These fees are charged to the lender and passed on to the borrower.

- Closing Costs and Financial Planning

Closing costs typically range from 3-5% of the home’s purchase price. However, opting for a USDA loan allows you to include these costs in your loan amount, eliminating the need for immediate out-of-pocket expenses.

In specific market conditions, it may even be possible to negotiate with the seller to cover your closing costs, alleviating this financial burden entirely.

Pros and Cons of USDA Home Loans

Considering a USDA home loan? While it can be an excellent choice for many homebuyers, it’s important to note that individuals residing outside designated rural areas or exceeding the income limit threshold may not qualify.

Take a moment to weigh the pros and cons before submitting your application.

Analyzing the Benefits

One significant advantage of a USDA house loan is the absence of the down payment requirement. This program is particularly beneficial for budget-conscious homebuyers who are open to various living locations.

Advantages of USDA Loans

- Minimal upfront costs: Most borrowers are not required to make a down payment. Expenses like repairs, closing costs, and the guarantee fee can also be financed into the loan. Sellers can contribute up to 6% of the sales price towards closing costs.

- Diverse loan options: USDA loans can be used for building, improving, moving, purchasing, or refinancing a home.

- Flexible eligibility criteria: There’s no strict minimum credit score requirement. Individuals with non-traditional credit histories, such as those who don’t use credit cards or take out loans, may still qualify.

- No prepayment penalties: Borrowers won’t incur fees for paying off the mortgage ahead of schedule.

Acknowledging the Limitations

It’s crucial to acknowledge the limitations associated with USDA home loans. Primarily, they revolve around eligible purchase locations and income thresholds for families.

Restrictions and Income Limits

To qualify for a USDA loan, the property must be situated in a designated rural area. Additionally, guaranteed USDA loans come with an annual fee, but borrowers have the flexibility to include this fee in the loan amount for added convenience.

Moreover, eligibility for a USDA home loan is contingent upon all adult members of the household meeting low-income requirements.

Real Stories: Impact of USDA Home Loans

Seeing is believing, right? Read real-life stories about the impact USDA homes have had on homeownership.

USDA Loan Success Stories

A couple’s dream of homeownership becomes a reality with the assistance of USDA and Four Directions Development Corporation.

After facing housing challenges and cramped living conditions, Michael Carlos and Sakoya Blackwell, along with their daughters Zaraiah and Zarayda, sought assistance from Four Directions Development Corporation.

Over four years, they worked on financial counseling to improve their credit score. Securing a rural USDA home loan proved challenging in a competitive housing market, but they eventually found a special house – right across the street from Michael’s childhood friend’s home.

The move transformed the girls’ lives, providing space to play and a sense of home. Living close to family and a trusted child care provider, the new home offers safety and happiness.

Sakoya and Michael see this achievement not only as a relief but also as an opportunity to create generational wealth for their daughters.

USDA Home Loan Case Study: Long-term Tenant Attains Homeownership

Linda Pickett, a lifelong renter at 62, fulfilled her dream of homeownership with the support of Rural Development programs.

Despite facing repeated rejections from conventional lenders due to a lack of a 20% down payment, Pickett’s path changed when she connected with Rural Development Specialist Sherri Sisk.

With Sherri’s expertise and guidance, Pickett navigated the mortgage process, completed a first-time homebuyer education course, and became eligible for a Rural Development 502 home loan.

Offering 100% financing and a low, fixed interest rate for 33 years, this solution allowed Pickett to purchase her dream home, investing in her future. Instead of paying rent, she now builds equity with a monthly payment of less than $500.

Rural Development provides various housing products to aid individuals and families in achieving homeownership, catering to diverse income levels.

Broadening the Perspective: Related Financial Topics

If you are looking beyond USDA home loans, here are good alternatives you can consider for your homeownership or investment property loans.

- Veterans Affairs (VA) Loans

VA loans are mortgage loans guaranteed by the Department of Veterans Affairs. They offer eligible veterans, active-duty service members, and surviving spouses the opportunity to purchase or refinance homes. These loans are tailored to honor and support individuals who have served in the military.

- Federal Housing Administration (FHA) Loans

FHA loans are mortgage loans insured by the Federal Housing Administration, a division of the US Department of Housing and Urban Development (HUD). These loans aim to enhance accessibility to homeownership, particularly for first-time buyers and individuals with lower credit scores or limited financial resources.

- Financial Planning for Homeownership

Here are a few tips for financial planning for homeownership:

- Manage your finances: Save 5-20% for a down payment, possibly using existing home equity for better interest rates. Be mindful of 3% closing costs, and maintain a strong credit score, especially for second or vacation home purchases.

- Assess affordability: Understand mortgage components, consider additional costs for second homes, and utilize online tools to target a DTI ratio below 43%.

- Understand your mortgage: Take into account credit score, loan term, federal funds rate, lender choice, and residence type to influence interest rates. Differentiate between FHA and conventional loans based on credit score and down payment. Grasp the implications of mortgage insurance.

- Pre-qualify or pre-approve: Recognize the distinction; give priority to preapproval when making offers on properties.

- Locate a property: Collaborate with a real estate agent for expert guidance. Understand their fee structure and leverage their knowledge in addressing housing needs, suggesting financing options, negotiating, and coordinating the closing process.

- Building Credit for Loans

To build credit from scratch, consider the following steps:

- Open and use a credit card: Use the card responsibly to establish a strong credit score, emphasizing timely payments.

- Become an authorized user: Build credit by becoming an authorized user on a trusted individual’s account. Consistent on-time payments positively impact credit scores.

- Report bill payments: Explore third-party services to include regular payments (rent and utilities) in your credit history.

- Consider a credit builder loan: Credit builder loans, available from smaller banks, require an upfront deposit. Timely payments are reported to credit bureaus, contributing to credit score improvement.

- Use a cosigner for credit: Improve approval odds by having a cosigner with a positive credit history, and maintain financial responsibility to protect both your credit and the cosigner’s.

Embarking on Your USDA Home Loan Journey

USDA mortgage loans play a crucial role in enhancing the affordability of home purchases for individuals in eligible rural areas. While closing costs are still applicable, qualifying for a USDA loan means benefiting from a lower interest rate and the exemption from a mandatory down payment.

To determine eligibility, you can conduct a preliminary check on the USDA eligibility site, verifying whether the address of your prospective home and your income meet the criteria.

However, for a thorough understanding of your mortgage options, it’s recommended to seek assistance from a knowledgeable expert who can guide you through the process.