The Nashville housing market has been bustling with remarkable growth and activity lately. It’s a vibrant market showcasing a variety of property types at different price points, drawing in more buyers.

Condominium affordability and the range of available properties add to Nashville’s allure. The number of pending sales underscores the market’s attractiveness and the swift average time properties spend on the market, signaling strong demand and a competitive environment.

Looking ahead, it’ll be fascinating to see how these trends develop. Will Nashville’s housing market maintain its upward trajectory? In this article, you’ll find a comprehensive Nashville real estate market forecast for 2024.

Nashville Real Estate Market Trends

Nashville, nestled in Davidson County, is home to approximately 683,622 residents. Renowned for its association with country music, the iconic Parthenon recreation, and the legendary Grand Ole Opry, it is a key tourist attraction in the Midwest.

While most inhabitants reside in Murfreesboro and Davison, Nashville boasts a mix of rented and owned properties. For those eyeing single-family homes, one and two-bedroom detached houses are the norm.

Yet, the city also offers options like duplexes, expansive apartment complexes, and charming row houses.

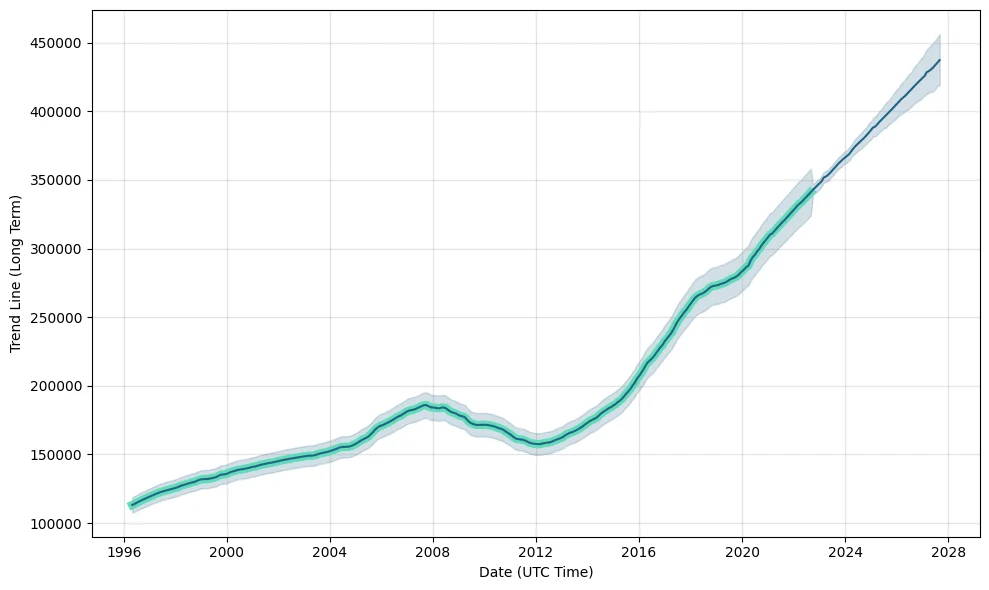

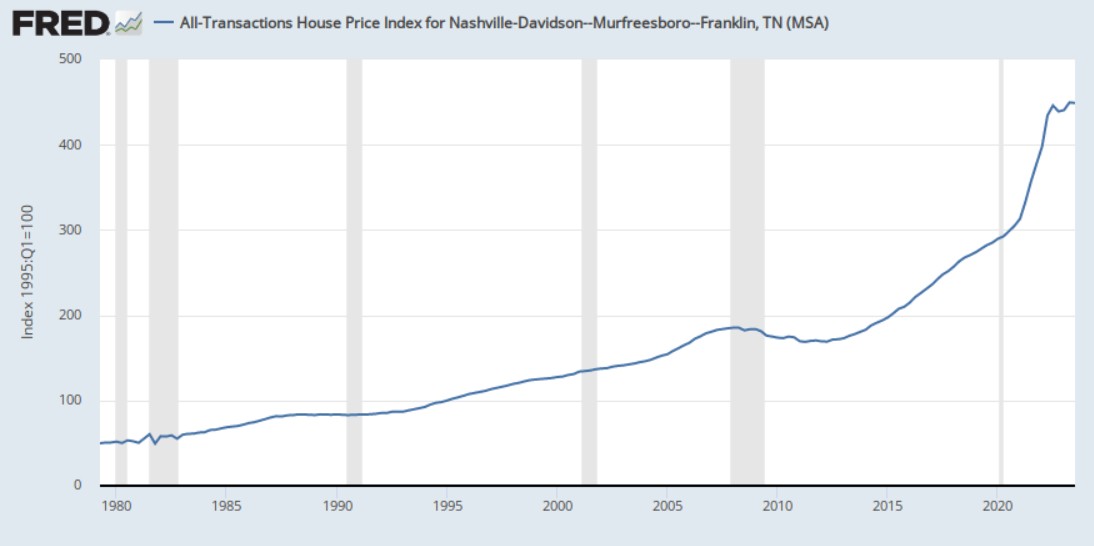

Investing in Nashville’s real estate market is touted as a secure long-term bet. Experts foresee slower but steady appreciation in home prices, potentially aligning with or slightly outpacing the national average.

The city’s standout feature is its median home prices, which are comparatively more affordable than other leading markets. Despite limited inventory, Nashville maintains its reputation as the swiftest-moving market.

To better understand the prevailing Nashville real estate market trends, here is a snapshot of statistics from Redfin.

- Median home price in Nashville – $443,000

- Median days on the market – 54 days

- Sale-to-list price – 97.6%

Nashville, TN, Real Estate Market 2024 Forecast

Image source

In 2024, projections for the real estate market point towards a widespread decline in both prices and sales nationwide. According to realtor.com the market is anticipated to hold slightly more allure for potential homebuyers.

A significant highlight for many is the expected decrease in mortgage rates. In 2023, the average mortgage rate stands at 6.9%, with an anticipated year-end increase to 7.4%.

However, the forecast for 2024 suggests a similar average of 6.8%, followed by a noteworthy drop to 6.5% by the year’s close.

Realtor.com indicates that a vast majority of mortgages, over 90%, fall below the 6% mark, indicating a favorable scenario for potential buyers and those considering refinancing options.

Realtor.com’s 2024 housing forecast paints a picture of declining home prices in Nashville, with an expected drop of nearly 5%. Additionally, three other major cities in Tennessee are projected to experience decreasing sales.

While the national average for mortgage rates is estimated to shift marginally from 6.9% in 2023 to 6.8% in 2024, insights from Realtor.com suggest that the persisting high costs will likely impact existing homeowners.

Affordability emerges as a focal point in the report, highlighting an expected median monthly cost of slightly below $2,200 for listed homes, signifying a 2% decrease in monthly expenses.

Key Predictions for Nashville Housing Market in 2024

Here is a snapshot of how the Nashville real estate market in 2024 may look like:

A Return of the Home Sellers

It’s anticipated that in 2024, the Nashville real estate market will witness a resurgence of home sellers who refrained from entering the market in 2023.

Many among them are individuals compelled by new job opportunities or seeking relocation to more affordable regions. This convergence of factors indicates an uptick in the availability of housing units for sale.

Steady Mortgage Rates

In October 2023, mortgage interest rates peaked at 7.79%, marking the highest point in 23 years. However, by November, interest rates declined to 7.35%, attributed to a softening labor market and a slowdown in the economy.

This shift was mirrored in the annual inflation rate, which decreased from 3.7% to 3.2%.

Looking ahead, it’s anticipated that mortgage rates will persist above the 6% mark yet stabilize during the latter half of 2024. This will bring a sense of steadiness to the market after a period of fluctuations.

The trajectory of mortgage interest rates has been a rollercoaster due to the Federal Reserve’s repeated adjustments to the federal funds rate in recent years. Will this trend reverse in 2024?

That’s a bit of a challenge as predicting the Fed’s moves is difficult, even for financial experts on Wall Street.

Here’s the gist: Even if interest rates decrease in 2024, the drop might not be significant. For instance, the National Association of Realtors foresees a decline in 30-year mortgage rates from 7.5% to 6.3% by the year’s end.

Such a marginal decrease might only shave off a few hundred dollars from monthly mortgage payments.

What does this mean for the Nashville housing market? It could potentially result in a dip in buyer demand, as many may still find it challenging to afford mortgages.

Nonetheless, the demand for homes is anticipated to surpass the available supply, which should maintain home prices at relatively stable levels throughout 2024.

The takeaway? If you’re financially prepared to purchase a home, waiting might not be necessary, as rates might not significantly improve. The market dynamics suggest that the time might be ripe for those ready to dive into homeownership.

Number of Homebuyers Likely to Rise

In 2023, historically high interest rates deterred potential homebuyers, impacting demand. However, following the decline in interest rates to 7.35% in November, there was a notable uptick in mortgage demand.

As inflation eases and rates stabilize, there’s an expectation that more prospective buyers will rejoin the housing market. This shift suggests a resurgence in house hunters as the conditions become more favorable for potential buyers.

Home Prices to Continue Upward Its Trajectory

There’s been a consistent upward trajectory in home prices year over year across the prominent metropolitan areas in Tennessee, hitting $367,000 by September 2023.

Forecasts suggest that this upward trend in home prices will persist as long as the prevailing dynamic of low supply and high demand remains unchanged. This trend indicates a continuation of increasing home prices in the foreseeable future.

Home Construction to Rise

In September, new home purchases accounted for 12.3% of the market, marking the highest percentage since 2022. In efforts to entice buyers in 2023, home builders provided incentives worth up to $30,000.

Looking ahead to 2024, it’s anticipated that builders and sellers will continue this competitive trend as they vie for buyers’ attention. This competition suggests an environment where buyers might encounter attractive offers and incentives as builders and sellers seek to attract their interest.

iBuyers to Continue With Lowball Offers

The trend with iBuyers reflects a significant decrease in their offers over the past few years. In 2021, they offered 104.1% of the market value, which dropped to 86% in 2022 and further decreased to approximately 70% in 2023.

Companies like Opendoor and Offerpad faced substantial financial losses in 2023, leading to their struggles for survival. As a result, it’s expected that these iBuyers will continue making lowball offers as they navigate their financial challenges.

A Housing Market Crash in 2024?

If fears about a housing market crash in 2024 are on your mind, there’s reassuring news. Projections indicate that not only are substantial price drops unlikely, but there’s a stronger likelihood of prices continuing to climb.

The National Association of Realtors anticipates a 2.6% increase in existing home prices by August 2024 compared to the previous year. Additionally, Freddie Mac expects a more moderate yet still positive uptick of 0.8% during the same timeframe.

These forecasts suggest a trend of ongoing price appreciation rather than a significant downturn in the housing market.

Tennessee’s allure stems from its affordable living, welcoming communities, and an array of outdoor pursuits, drawing continual interest from new residents.

Compared to other states in the South and Midwest, Tennessee boasts a relatively lower cost of living. The state thrives on a robust economy supported by diverse sectors such as manufacturing, healthcare, and tourism.

Tennessee’s job market showcases strength, boasting an impressively low unemployment rate of 3.30%. Notably, private sector employment in Tennessee surged by 5.9% in September 2023, outpacing the national average of 2.0%. Favorable tax policies further sweeten the deal for residents.

With an average cost of living at $42,469 and a median household income of $67,008, Tennessee maintains affordability while being in proximity to major employment hubs.

These factors collectively indicate that the state’s housing market is poised to remain resilient, showing little vulnerability to significant downturns in the foreseeable future.

Foreclosures in 2024

Foreclosure rates are expected to continue their upward trend in 2024, mirroring the increase observed last year. In October 2023, foreclosures rose by 6% compared to the previous year.

However, if concerns arise regarding a repetition of the staggering foreclosure numbers witnessed in 2010 during the Great Recession, a reassuring statistic provides some relief.

Despite a 67% increase in foreclosure repossessions in 2022 compared to 2021, this figure remained substantially lower: 70% down from 2019 and a striking 96% decrease from the peak foreclosure levels recorded in 2010 during the Great Recession.

Moreover, the landscape today differs significantly. Many of the properties in foreclosure are unlikely to be repossessed by lenders as was common during the Great Recession.

This shift is due to the positive equity that many borrowers hold in their homes, where the value surpasses what they owe. This equity can be leveraged by homeowners to sidestep foreclosure by opting to sell their homes, offering a viable alternative to foreclosure proceedings.

For homeowners, the uptick in foreclosures isn’t expected to flood the market with distressed properties. This means you can likely feel reassured that your home’s value won’t drastically plummet due to a sudden surge in home inventory.

However, for homebuyers hoping to snag a great deal on a foreclosure, it might not be worth holding out for such opportunities. Unlike the Great Recession, the current market landscape isn’t conducive to an abundance of foreclosure bargains.

Additionally, buying a foreclosed home might present its own set of potential issues. It’s crucial for potential buyers to conduct thorough research on any property of interest and fully comprehend the associated nuances and potential challenges before making a purchase.

2024: Is It a Buyer’s or Seller’s Market?

It looks like 2024 is shaping up to be a fantastic year for both sellers and buyers in Nashville’s housing market.

The upward trend in home average house cost in Nashville is expected to persist until there’s a shift in the supply-demand balance.

With just 31,000 houses available for sale in Tennessee as of September 2023, sellers have the advantage of a limited supply, enabling them to command better prices for their homes. This sets the stage for an optimal time to sell a house in the state.

In November, the mortgage rate experienced a significant drop, moving from a two-decade high of 8% to 7.35%. This decline led to an increase in new listings hitting the market.

It indicates that individuals who previously hesitated to sell due to the higher mortgage rates are gradually adjusting to the new 7% rate environment.

Anticipations for spring 2024 include an influx of homeowners following suit and listing their properties on Tennessee’s MLS, further diversifying the available options for buyers.

The surge in new home listings isn’t just expanding options; it’s enticing those who were hesitant before. Recent spikes in mortgage applications signal a comeback for buyers who were previously observing from the sidelines.

Additionally, individuals who faced challenges finding affordable homes in 2023 are expected to actively resume their house hunting in 2024.

This surge in buyer activity foretells an increasing demand for houses across Tennessee. Consequently, sellers might find themselves in a commanding position, as the heightened demand could give them a strong foothold in the market.

It seems that new construction homes will pose strong competition for attention from buyers in Tennessee. Homebuilders enticed buyers in 2023 with significant mortgage buydowns valued at $30,000, and this trend of offering concessions is expected to continue into 2024.

Consequently, home sellers might find themselves in a competitive landscape, potentially needing to strategize to attract buyers amidst these offerings from builders.

Moreover, the market is poised to witness a surge in listings from various sources. These include new constructions entering the market, baby boomers looking to downsize, and sellers in urgent need to sell. This influx will likely contribute to an increase in available properties for sale throughout Tennessee.

Whether your preference leans towards a condo in Nashville or a single-family home in Knoxville, the prospects for finding your dream home appear promising, particularly next spring when this anticipated surge of listings hits the market.

Should You Buy a House in Nashville in 2024?

Preparing to purchase a house in 2024 involves ticking off a checklist of financial readiness. To embark on this significant step, consider these essential boxes to ensure you’re well-positioned:

Firstly, achieving a debt-free status lays a strong foundation. Coupled with an emergency fund that covers 3–6 months’ worth of expenses, you establish a safety net for unforeseen circumstances.

Additionally, ensuring that your monthly house payment remains within 25% of your monthly take-home pay on a 15-year fixed-rate mortgage is prudent financial planning. For the down payment, aiming for 20% is ideal to bypass private mortgage insurance (PMI).

However, if you’re a first-time buyer, 5-10% is acceptable, albeit PMI will be part of the equation. It’s advisable to steer clear of FHA and VA loans due to higher associated fees.

Lastly, having the capability to cover closing costs without tapping into your down payment signifies financial readiness for this significant investment. These checkboxes ensure a solid financial footing before stepping into the realm of homeownership in the upcoming year.

Even if the market seems favorable, overlooking this checklist could turn buying a home into a burden rather than a blessing. It’s crucial not to rush into homeownership if you don’t meet these criteria.

Take the necessary time to bolster your financial standing. Purchasing a house should align with your financial readiness to ensure it’s a step taken in the right direction, setting the stage for a secure and fulfilling homeownership journey.