The Oregon housing market is thriving as more residents flock in. Homes are selling rapidly, creating a competitive market with rising home values and limited inventory. Key factors like increasing interest rates, low inventory, and strong buyer demand are at play.

Therefore, it’s crucial for potential investors to grasp current market dynamics and future projections to make informed decisions in the competitive Oregon real estate market.

Considering a property move to Oregon? Dive into this article for the latest Oregon property market predictions and trends.

Current Oregon Housing Market Landscape

The Oregon real estate market is experiencing significant shifts. To help you make educated choices about real estate investments, go over the latest housing market trends – data courtesy of Redfin:

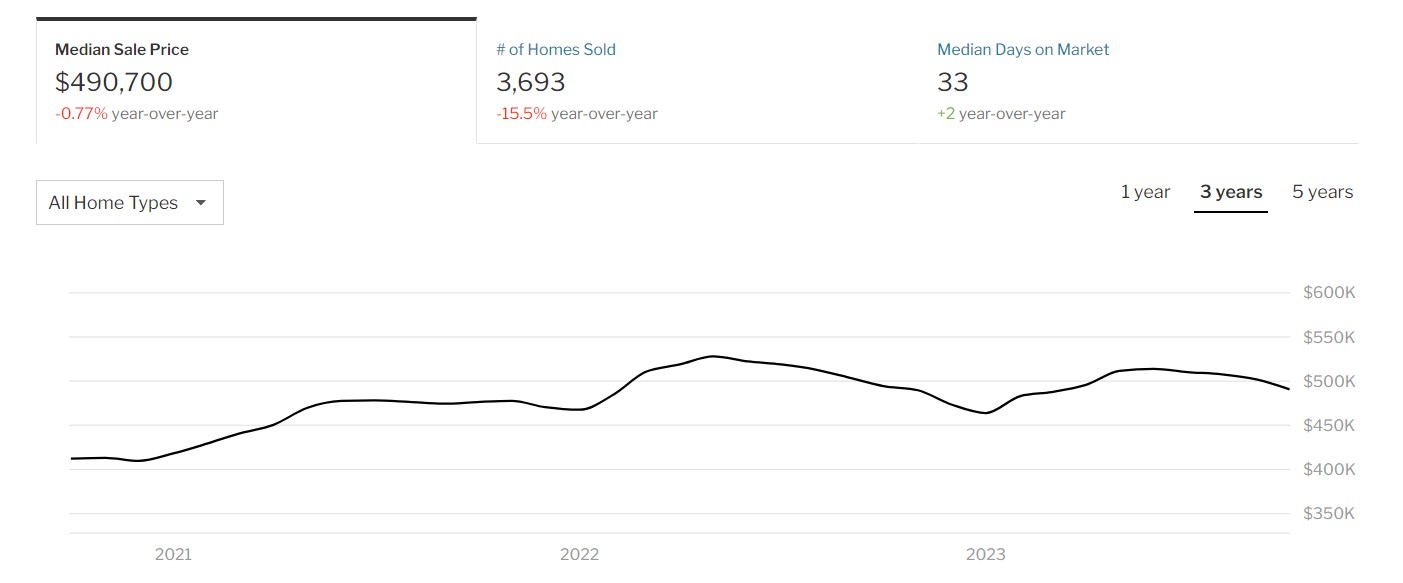

Median Home Prices Update

As of October 2023, the median home price in Oregon stands at $491,200. This figure reveals a 0.47% decrease year on year, signaling a modest decline in home Oregon housing prices.

Home Sales Volume Insight

On average, the number of homes sold has undergone a noteworthy decrease, showing a 16.0% decline from the previous year. In October 2023, a total of 3,631 homes were sold, reflecting a drop from the 4,322 homes sold in the corresponding month of last year.

Inventory Levels

The housing market in Oregon is grappling with low inventory levels, a factor that may be influencing observed trends, including a slight decrease in median home prices and an uptick in the median days on the market.

Days on Market Update

In October 2023, the median days on the market in Oregon increased by two days compared to the previous year, reaching 34 days.

Sale-to-List Price Ratio

As of September 2023, the sale-to-list price ratio in Oregon stood at 1.000. This means homes are selling for their full list price. This reflects a balanced and competitive market where properties are generally being sold at the price initially listed.

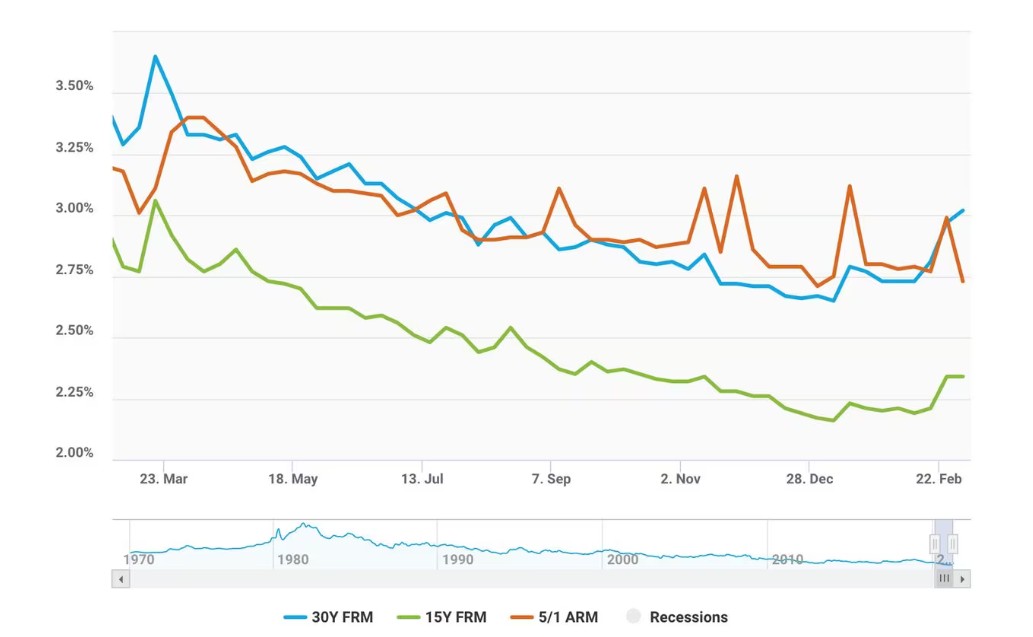

The Impact of Rising Interest Rates on Buyer Affordability

High mortgage interest rates are having a big impact on the Oregon real estate market. The rates are at all-time highs, making many potential buyers hesitant.

As a result, there’s a 12% decrease in home purchase applications compared to last year. Let’s see how the rising interest rate is affecting other key factors in the market:

Affordability Challenges

Because of the higher rates, more people and families in Oregon find it harder to afford homes. This is seen in an 8% drop in home sales compared to last year.

Also, it takes longer for houses to get sold, with a 20% increase in the average time a property stays on the market, showing that transactions are happening more slowly.

Buyer Demand and Market Slowdown

Rising interest rates are dampening buyer demand and the overall real estate situation in Oregon. As of Oct. 31, 2023, there were 14,928 homes available for sale, with 4,213 new listings.

This reflects a complex relationship between the supply and demand in the Oregon housing market. The scarcity of housing inventory is helping keep Oregon home prices stable despite the increasing interest rates.

Limited Housing Supply: A Driving Force Behind the Higher Home Prices

The shortage of available homes is a crucial factor shaping the course of the Oregon house market. Let’s delve into a few key aspects here:

Supply-Demand Imbalance: Understanding the Market Equation

Many real estate markets throughout Oregon face a limited supply. With inventory unable to meet the demand, home values are rising. In fact, Oregon is among the states with some of the shortest inventory supplies nationwide.

Factors Contributing to Limited Inventory: Construction Delays, Population Growth

Oregon’s housing market has been significantly influenced by steady population growth. The state’s appeal, driven by natural beauty and job opportunities, resulted in a 9.3% population increase from 2010 to 2020, making it the ninth-fastest-growing state in the U.S.

This growth has bolstered housing demand, leading to higher prices across the state. Experts emphasize that restoring the supply of newly constructed residential properties to pre-2007 levels is crucial for making a meaningful impact on inventory.

Moreover, Oregon residents are hesitant to purchase land and navigate the intricate regulatory approval process, contributing to a persistently low inventory and higher home prices.

Impact of Limited Supply on Home Prices: Upward Pressure and Market Dynamics

Over the past year, there has been a slowdown in the construction of single-family homes, aggravating the ongoing issue of low inventory. In October 2023, the demand for homes continued to influence prices, with a substantial 25.5% of homes selling above their list price — a 0.4-point increase from the previous year.

This heightened competition is reflected in the reduced number of homes with price drops, accounting for only 37.4%, down from 39.0% in October of the previous year.

Expert Predictions for the Oregon Housing Market: Short-Term Outlook (2023-2024)

Anticipated Trends in Median Home Prices: Growth Projections and Moderation

Zillow’s Oregon’s housing market forecast for 2023-2024 anticipates a 2.8% increase in the median home price from May 2023 to May 2024, aligning more closely with historical trends observed over several decades.

Home Sales Volume: Stabilizing Market and Adapting Expectations

Industry experts forecast a potential 10% decline in home sales by 2024 due to rising interest rates. Moreover, they anticipate listings to linger longer in the housing inventory, with March 2023 trends indicating a likely increase of 10 days or more in the median days on the market.

Inventory Levels: Potential Increases and Market Balancing

Oregon continues to grapple with low inventory, standing at a mere two months of supply. Yet, experts suggest this won’t shift unless prices increase or properties become less affordable, potentially due to higher interest rates.

Days on Market: Extended Selling Periods and Buyer Opportunities

When the housing market faces tight inventory conditions, several trends emerge. These include heightened competition among buyers as available options decrease. Homes tend to sell swiftly, creating a fast-paced market environment. Oregon may face this situation going into 2024.

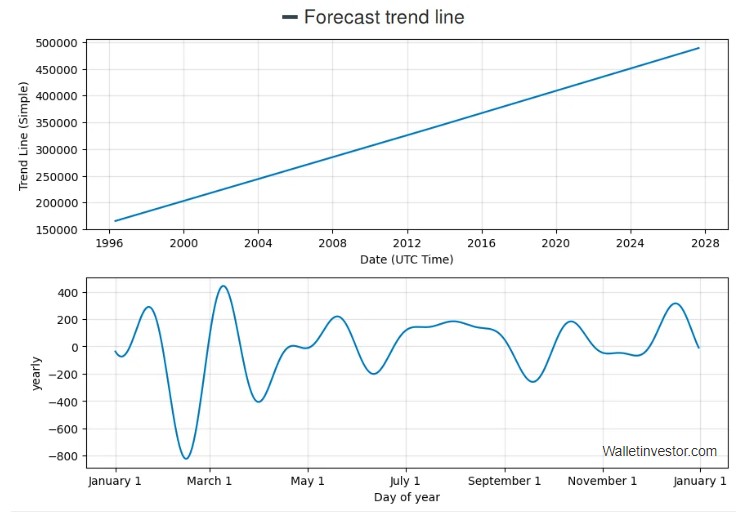

Expert Predictions for the Oregon Housing Market: Long-Term Outlook (2025-2030)

Looking into the long term, the Oregon property market is likely to be influenced by multiple factors such as job growth, interest rates, and government policies.

Here is what experts predict about the Oregon housing market forecast 2024:

Economic Factors Influencing Market Trends: Job Growth, Migration Patterns

A rosier economic and stock market forecast might benefit jobseekers by sparking increased hiring and investment. As businesses gain confidence and expand, more job opportunities could arise, potentially offering career growth and better wages, hence increasing demand for housing.

Government Policies Impacting Housing Affordability: Tax Incentives, Regulatory Changes

Government policies have a significant impact on the real estate market. A supportive political environment can bolster growth, whereas an adverse one might weaken it.

In July 2023, for instance, Oregon Governor Tina Kotek approved a set of bills to tackle the state’s housing crisis. These include measures to cap rent increases, mandate local approval for emergency shelters based on the homeless population, and exempt certain affordable housing from local planning hurdles.

Anticipated Regional Variations: Diverse Market Dynamics Across Oregon Cities

The diverse dynamics across Oregon’s cities will considerably affect the state’s real estate market. Each city possesses distinct economic, cultural, and demographic traits shaping the local housing trends.

Urban centers, like Portland known for their job opportunities and vibrant lifestyle, often see higher demand and property values. Meanwhile, smaller towns might offer more affordable housing but with potentially slower appreciation rates.

Factors like population growth, job markets, and amenities in each city will continue to create varying landscapes for buyers, influencing prices, inventory levels, and market competitiveness statewide.

Overall Market Forecast: Stability, Moderate Growth, and Adapting Strategies

Oregon, with its promising job prospects, robust income potential, top-notch education, and advanced healthcare facilities, stands as an appealing hub for real estate investments.

Despite a dip in the housing market this year marked by declining home prices since January, Redfin’s data indicates a scarcity in housing inventory, tipping the scales in favor of sellers during negotiations.

Yet, it remains a seller-friendly market overall. Major cities like Portland, Eugene, and Salem, boasting high population densities, continue to allure numerous buyers in search of their ideal homes.

Strategies for Buyers: Finding Affordable Homes, Making Competitive Offers, and Securing Financing

When you’re looking to buy a home, you need to do a decent amount of background research to get it right. Merely skimming over your research process can make you lose sight of important variables.

Proper research, on the other hand, enables you to find great properties, draw competitive offers, and secure competitive financing.

Utilizing Real Estate Market Data: Understanding Trends and Identifying Opportunities

Data is valuable for consumers in various decisions, including real estate transactions. From the initial search for a real estate agent to the final offer, there’s an array of data sources you can use for your real estate endeavors. The right data can be the key to making decisions that save you money.

Buyers particularly benefit from real estate market data. It helps them decipher fair pricing, spot promising neighborhoods, and make savvy offers by analyzing market trends and statistics.

Moreover, details like the average time properties spend on the market and available inventory levels shed light on how competitive the market is and how fast you need to react.

Preparing Preapproval Letters: Enhancing Competitive Edge and Financial Readiness

A mortgage preapproval is like a thumbs-up from a lender saying, “You can borrow this much money for a home.” To get it, you’ll need to submit paperwork to the lender, including tax returns, pay stubs, and bank statements. These documents help them understand your financial history and current situation to figure out how much they can lend you for a house.

After looking through all those papers, the lender will decide the maximum amount they’re comfortable lending you. They consider these factors: your credit score, how much you make, and how much you owe. Then, they’ll give you a preapproval letter confirming the amount you’re cleared to borrow.

When the housing market is hot, that preapproval letter becomes your secret weapon. It makes your offer stand out in a crowd, giving you an edge over others vying for the same place.

Crafting Compelling Offers: Demonstrating Strength and Adapting to Market Conditions

An offer is like a detailed plan that lays out how much the buyer wants to pay, how they’ll pay for it, and any conditions they need to be met. It kicks off the back-and-forth talks between the buyer and seller. Knowing how to craft a strong offer can be the key to scoring the home you want.

Coming up with a winning offer for a home is all about digging into research first. Knowing the trends in your area and what similar homes are selling for is a big deal. It helps you figure out if the price tag on the house you like is fair and gives you some bargaining power when you’re making your offer.

Using local market info can back up your game plan and help you lock in that dream home.

Picking the right safety nets, called contingencies, is a big deal for buyers. They’re shields that protect you, but too many can scare off sellers. It’s like a balancing act—think about what you really need to stay safe, like checking the house’s condition, and what you can skip.

Market vibes, how the place looks, and your wallet should help you decide. When you pick the smartest contingencies for your offer, it boosts the chances of the seller saying yes and you snagging that perfect home.

Working With Experienced Real Estate Agents: Navigating the Process and Securing Representation

When you are buying or selling a house, having a seasoned real estate agent is a game-changer. Inexperienced ones might mess things up, costing you time, money, and possibly your dream home.

Homes come with loads of paperwork and rules, but a savvy agent knows the drill in your area. An experienced agent will keep the process smooth sailing, preventing hiccups and pricey errors.

Exploring Mortgage Options: Comparing Interest Rates, Terms, and Repayment Plans

Finding the perfect home is just the start — next up is nailing the right mortgage. Unless you’re paying upfront in cash, this is a major decision.

Think of it as a long-term deal you’ll be chipping away at for years. So, finding a mortgage that fits your needs and wallet is important.

Your mortgage payment has two parts: the principal, which is the loan amount, and the interest, which is the extra money the lender charges you for borrowing. It’s a percentage of the loan that you pay back over time.

You chip away at this total through monthly payments based on a schedule set by the lender. If you’re a first-time borrower, the sea of financing options might feel overwhelming.

Take a breather to figure out what you can comfortably afford before taking the next step. Matching your budget with your dream home is key when choosing how much to borrow.

It’s a balancing act — getting a bigger loan has its perks but comes with risks. When you opt for a larger loan, especially during the interest-only phase, the interest rates can change with the market. If rates go up, your costs might spike, too.

Think about it this way: if your income doesn’t increase, but your borrowing costs go up, it could put a squeeze on what’s left of your paycheck. So, while a bigger loan might offer more at first, keep an eye on how it could affect your wallet down the road.

Tips for Sellers: Preparing Homes for Sale, Setting Realistic Asking Prices, and Negotiating Effectively

If you’re gearing up to sell your home, giving it some TLC can boost your chances of a successful sale. That might involve repairs and easy fixes, giving it a good clean, and sprucing it up a bit. It’s a lot of work, but it pays off. More offers and a quicker sale can be the reward.

Now, about the price tag: getting it right is key. Too low, and you might be leaving money on the table. Too high, and finding a buyer might take longer than you want. Finding that sweet spot makes all the difference in finding the right buyer in your timeframe.

Enhancing Home Appeal: Staging, Repairs, and Curb Appeal Strategies

When you’re getting ready to sell, even the smallest details can work wonders. You don’t need a massive overhaul or a complete home makeover. Sometimes, it’s those little touches — a fresh coat of paint, tidy landscaping, or some well-placed decor—that really catch a buyer’s eye.

It’s surprising how those small changes can make a big impact on how your home feels and looks to potential buyers.

Staging plays a pivotal role in preparing a home for the market. It allows potential buyers to envision themselves living in the space. Properties that undergo staging tend to achieve a higher selling price compared to those that are not staged.

The condition of a house significantly influences its selling price. When potential buyers notice various pending repairs in a home, either on their own or through a professional inspection, they may either seek other options or consider making a lower offer.

Check the following areas:

- Foundation and structure

- Damp walls

- HVAC system

- Electrical systems (including wiring)

- Plumbing

- Appliances

- Chimneys

Nearly every expert in the housing industry agrees — boosting a home’s curb appeal before listing it is crucial.

A study from the Journal of Real Estate Finance and Economics found that homes with excellent curb appeal sold for 7% more than similar homes with less curb appeal. In sluggish markets where buyers are pickier, this difference jumped to 14%.

Determining Realistic Asking Prices: Balancing Market Value and Buyer Expectations

Setting the right price for your home is a major factor in how quickly and for how much it will sell. Homeowners naturally aim for a higher price to get the most out of the sale. Yet, pushing it too high might scare off potential buyers. Striking that balance is key to attracting buyers without overpricing your home.

The ideal price aligns with what similar homes in Oregon are selling for. Undervaluing means selling yourself short, but overpricing might push buyers away.

A good real estate agent can assist in gauging the market accurately. Your agent will help you steer clear of pricing too low or too high, ensuring your home gets the value it deserves.

Negotiating Effectively: Understanding Count

In the home-selling process, a sale happens when a house is listed with a price, and a potential buyer makes an offer through an agent. The seller then decides whether to accept the offer or not.

Negotiating a house sale can be tough, whether it’s your first or fourth time. There’s a lot to handle — deciding on the house price, managing counteroffers, and tackling various details, including closing costs, loan terms, and repairs.

Typically, negotiations involve a series of exchanges between the seller, buyer, and their real estate agents until they reach an agreed-upon price. It’s a bit of a dance, finding a price that works for both parties.

Comparative Analysis of Housing Market Trends in Portland, Eugene, and Salem, Oregon

Whether you’re an Oregon local or moving from out of state, it’s smart to dig into the housing market before making any buying or selling moves. Oregon is diverse, and each area, like Portland or Salem, has its own unique market.

Taking the time to research helps you understand the differences and make informed decisions tailored to the specific area you’re interested in.

Overview of Portland’s Housing Market

It seems like the housing and rental markets nationwide started to ease up in 2023 after a period of intense activity. In Portland, specifically, there are signs that the market might be leveling out.

Zillow data indicates a shift: the median rental price in August 2022 was $1,950 per month, but by August 2023, it had decreased to $1,750. This downward trend could suggest a stabilization in the Portland rental market.

This shift could indicate that the market is stabilizing. Given this steadier phase and the ongoing demand, investing in Portland’s housing market now could be a wise move.

Examining Eugene’s Housing Market Dynamics:

Over the last decade, Eugene’s housing market has shown significant patterns. A prominent trend has been the continuous rise in home prices. The city’s growing population has spurred a higher demand for housing, creating intense competition among buyers.

The strong demand has pushed prices upward, primarily due to limited housing availability. Zoning rules and land-use policies have also worsened the situation by constricting the housing supply.

Eugene’s housing market has seen a notable surge in energy-efficient homes. As environmental consciousness has grown, buyers are seeking properties that align with their eco-friendly values.

In response, builders and developers have stepped up, incorporating green building practices and eco-friendly features into new constructions. This shift reflects the rising importance of sustainability in new homes and the proactive response of the industry to meet these demands.

The housing market in Eugene has also been significantly influenced by infrastructure upgrades and urban development efforts. Improvements in transportation, like the introduction of light rail and better public transit, have boosted accessibility and connectivity throughout the city.

Moreover, efforts to revitalize downtown areas and create mixed-use developments have reshaped the urban scenery, sparking greater interest in city living. These initiatives have played a pivotal role in shaping the housing landscape and drawing more attention to urban living in Eugene.

Exploring Salem’s Housing Market Characteristics:

Salem, a sizable city in Oregon, is home to around 177,723 residents and encompasses 46 distinct neighborhoods, ranking as the state’s third-largest community.

The housing market in Salem tends to be fairly competitive. On average, homes receive about two offers and sell within approximately 59 days. In Salem, a notable percentage of people opt to work from home.

Around 10.52% of the city’s workforce telecommutes. Although it might seem small, Salem ranks among the highest proportions in the country relative to the total workforce.

In October 2023, Salem witnessed a slight decline in home prices, down by 1.2% compared to the previous year, with a median selling price of $420,000. Homes stayed on the market for an average of 59 days, slightly longer than the 52-day period seen last year.

The number of homes sold in October this year totaled 136, marking a drop from the 168 homes sold during the same period last year.

On average, homes sold for about 1% below their listed price, taking around 51 days to go pending. However, in more competitive scenarios, homes categorized as hot were able to fetch approximately 1% above the listed price, with a pending time of about 28 days.

Comparative Analysis of Trends Across the Three Cities

Portland is the most populous city in Oregon, housing around 645,000 residents within its city limits. Other cities in the state with populations exceeding 100,000 include Salem, with approximately 169,000 people, and Eugene, with around 168,000,

Here is a snapshot of the housing market and other factors across the three cities of Portland, Salem, and Eugene.

- The housing costs in Salem are approximately 25.7% lower than those in Portland.

- The housing costs in Eugene are roughly 15.3% higher than those in Salem.

- In terms of overall cost of living, Eugene is about 2.5% more expensive than Salem.

- On average, residents of Salem have a commute that’s approximately 4.5 minutes shorter compared to residents of Portland.

Get Help From the Experts to Navigate the Housing Market in Oregon

Oregon’s real estate market has shown recent fluctuations, marked by falling home prices. While the state typically boasts one of the nation’s robust housing markets with high prices, recent trends indicate instability.

When considering investments, it’s essential to weigh the current trends, statistical data, your budget, and personal preferences. Seeking guidance from experienced real estate agents can provide valuable insights and professional opinions on potential investments.