Everyone wants to own a home. At least 78% of U.S. adults do, according to Bankrate’s March 2024 Home Affordability Survey. However, as home affordability becomes a major concern, realizing this dream can seem more difficult than ever before. At one time, many interior pockets of the country were home to some of the cheapest states to buy a house in the USA.

Then came the pandemic, which encouraged remote work. It prompted young Americans to leave urban comforts for affordable interior towns. This put pressure on the housing market and shrunk the affordability gap.

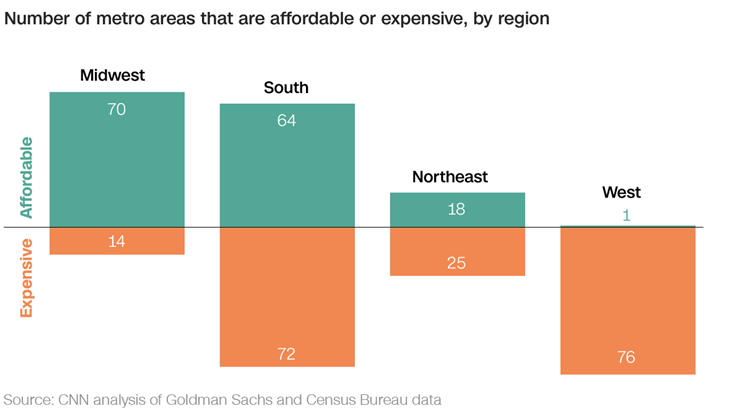

Despite these fluctuations, the Midwest remains one of the cheapest regions in the U.S. to buy a home in. The South comes in a close second. If you want to buy a home in the Midwest, you can qualify for a mortgage with a median annual income of just $78,000.

This article lists more affordable housing options where finding a home is not a pipe dream. We looked at certain affordability metrics while compiling this list, including:

- Median home value

- Cost of living

- Property tax rate

- Homeowners insurance cost

Which Is the Cheapest U.S. State to Buy a House?

West Virginia tops the list of the cheapest states to buy a house in the USA. Buying a home here will cost you around $167,862 on average. Despite a 5.7% increase over the past year, this price is less than half the U.S. national average of $360,681.

Many states have homes selling for an average of $730,000 (Hawaii). Then, there are some states where you can buy a home for less than $300,000. Many of these states are spread across the South and the Midwest.

Owning a home in these places is reasonable. However, there is an important caveat. Lower home values and cost of living imply a lower median household income.

With that in mind, here are some of the cheapest states to buy a house in the USA.

Arkansas

Arkansas, a southern state on the Mississippi, is one of the cheapest states to buy a big house. As of mid-2024, the average home value in the state is $207,880. This is almost half the national median of $420,800. Arkansas also offers some relief if you are looking to rent. The state’s median rent is $1,352, nearly $800 less than the national median.

Managing expenses in Arkansas can seem easier if you’ve migrated from pricey areas such as Los Angeles or New York City. The Missouri Economic Research and Information Center (MERIC) estimated the state’s cost-of-living index to be 88.5 in 2024. This means you’ll pay roughly 14% less for products and services than the rest of the country.

Another factor that makes Arkansas the best place to buy cheap houses is its low property tax rate. It averages 0.57%, the 16th-lowest in the U.S.

Some cities in Arkansas where you can find affordable housing include:

- Forrest City

- Blytheville

- Helena

El Dorado and West Memphis are other towns worth considering if you’re looking for better job prospects. However, they are more expensive.

Despite its affordability, Arkansas fares poorly in overall rankings. It ranked low in healthcare (#47) and crime (#49), so it’s worth considering these factors before moving here.

Oklahoma

Also known as The Sooner State, Oklahoma has come a long way in real estate since its early settlers staked their claim to the land. As of June 2024, Oklahoma is a buyer’s market, with many properties selling for 2.22% below their asking price.

Its median listed home price recently fell 7.7% year-over-year to $300,000. However, the average property value remains at $207,178. This is much lower than the national average. The real estate market in Tulsa, a major city, remains affordable, with housing 32% cheaper than the rest of the country.

Oklahoma City, the state’s capital, is another affordable housing market. It has an average home value of $205,300. Both cities also have a thriving job market, so you’ll likely land a well-paying job if you move here.

Oklahoma’s cost-of-living index is 86. Its housing options (buy and rent) are 28% cheaper than those in the other states. With these factors in mind, Oklahoma is easily one of the best places to buy cheap houses in the U.S.

Louisiana

Louisiana is home to Baton Rouge and New Orleans, two major cities with affordable housing. The average home value in the state fell by 2.5% from the previous year to $202,170. As of 2024, Louisiana has an average of three months of housing supply, which points to a balanced inventory.

If you’re looking to rent, expect to pay upwards of $1,000 each month. The state’s typical rent is $1,500, $650 lower than the national norm. This rental average has remained stable since July, indicating a slow housing market.

Other factors that make Louisiana one of the cheapest states to buy a house in the USA include:

- Property tax rate: The statewide average tax is 0.51%

- Cost-of-living index: At 92.1, this is 9% lower than the rest of the country.

Louisiana is home to world-class universities, including Tulane and Louisiana State. It is also the home of Cajun-Creole cuisine. However, one might wonder if these factors are enough to prompt migration.

According to U.S. News, Louisiana finishes last in its rankings of the country’s most livable places. It fails spectacularly on parameters like infrastructure, economy, and crime. The state’s median household income is $57,852. Despite increasing by 7.99% in the past year, it is dramatically lower than the national average ($74,580).

Mississippi

Home to densely forested expanses, Mississippi has less than 1% of the country’s total population. Its population growth has stagnated throughout the years, relieving pressure on its housing market. This makes it one of the cheapest states to buy a house in the USA.

On average, you’ll find homes for $180,452 in Mississippi, with a median sale price of $222,385. In April 2024, only 13.2% of the sales exceeded the listed price. Mississippi also has a low statewide property tax rate of 0.81%, making it one of the cheapest places to buy a house in the United States.

Despite its affordability, housing demand in the state remains low. The number of newly listed homes for sale rose 5.6% from last year. There are many reasons for low housing demand:

- Mississippi has a slow job market with low wages. However, this might change with emerging private sector investments driving down unemployment rates.

- Mississippi has the 4th weakest economy in the country, with the lowest number of high-tech industry jobs.

- Historically, the state has suffered many natural disasters like flooding and hurricanes. This risk discourages real estate investors from buying properties, keeping housing prices low.

Iowa

Aside from being a top-ranked state in terms of infrastructure, economy, and job opportunities, Iowa is also one of the cheapest states to buy a house in the USA. Despite a 4.6% increase in home prices since the past year, Iowa’s average home price remains below $500,000 at $220,855.

Home rentals in Iowa can cost you less than $1,000. Even in major towns like Des Moines, one-bedroom apartments cost an average of $964 monthly.

Other variables that make Iowa one of the cheapest states to buy a house in the USA are:

- A low cost-of-living index at 89.2

- A low homeowners’ insurance premium that costs $1,200 annually on average.

- A median household income of $62,000, which is decent compared to the low cost of living.

Iowa’s median home sale price is more than $200,000, but you can find many affordable options in cities like Keokuk and Burlington. You can buy homes for as little as $73,000 here.

Fort Madison and Oelwein are other budget-friendly options for rental homes. These cities rank well on the overall liveability index, making them a viable option for first-time homebuyers.

If you don’t find a home in any of the states listed above, do not despair. The United States has many affordable housing options under $500,000. Some other cheapest states to buy a house in the USA include:

- Kentucky, with an average home price of $207,528

- Alabama, with an average home price of $230,383

- Ohio, with an average home price of $231,604

- Indiana, with an average home price of $243,877

How to Find the Cheapest Place to Buy a House in the United States

Many states offer affordable home prices for homebuyers, but it’s not always easy to find them. You can get closer to finding your dream home with these steps:

- Keeping track of the latest housing market data is worth the work. You can use housing websites like Zillow and Realtor.com to compare home listings and prices across states. Comparing rates to the national average can help you find homes within your budget.

- If a home has been on the market for more than 15 days, the seller is more likely to be willing to negotiate. Prospective homebuyers should look for such listings, as they can sell for up to 10% less than the quoted price.

- Targeting a foreclosed home can get you an attractive sale price. When a borrower defaults on their loan, the lender forecloses on the property and sells it at auction. You can find foreclosure auction listings on local, county, and state websites. Buying a foreclosed home can be tricky. Therefore, we recommend enlisting the help of a real estate agent to manage the sale.

- Check if you qualify for a government-sponsored loan program. The U.S. Department of Housing and Urban Development (HUD) offers diverse programs for prospective homeowners, from Fannie Mae credits to downpayment assistance.

Finding the best place to buy cheap houses can seem daunting, especially when buying your first home. Consider hiring a professional agent to walk you through the process. Keep looking, and who knows, you might find your dream house as soon as today!