The Tampa housing market has consistently been a hotspot for investors, potential homeowners, and real estate professionals.

Nestled in Hillsborough County in Florida, Tampa has proven to be more than just an appealing metropolitan hub. It has become a sought-after tourist destination known for its pristine beaches, rich history, and spirited culture.

While the population of the city of Tampa is close to 400,000 as of 2022, the Greater Tampa Bay area (specifically Tampa-St. Petersburg-Clearwater) boasts over 3 million residents. As such, the city has witnessed a growing demand for real estate properties over the years.

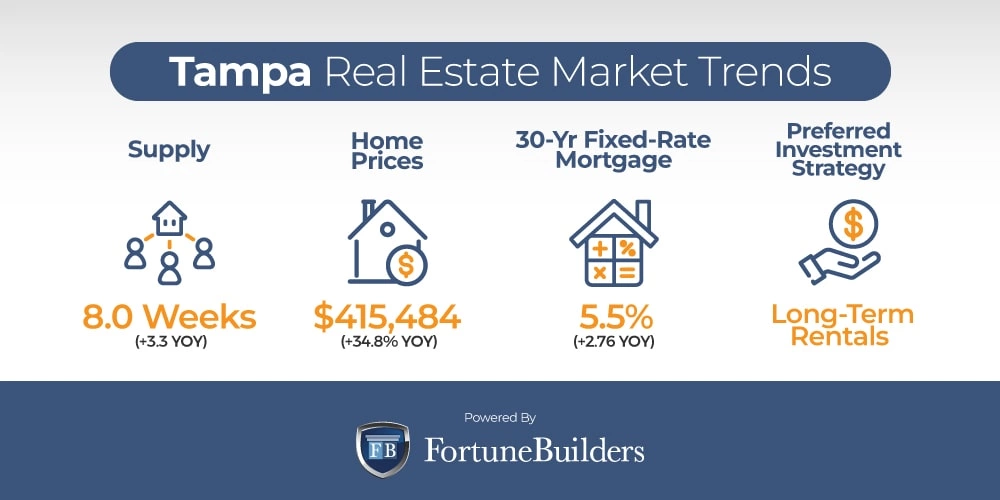

As of December 2023, the median home price in Tampa was around $416,000, up 14.8% year on year. Buyers and sellers can still expect strong housing demand and a 96.8% average sale-to-list price.

On the other hand, buyers will be happy to know that homes are selling slower than they did in 2022. Days on market fell by a day to 35 days on average. This indicates that the market is shifting towards a balanced state where buyers may have leeway in negotiating prices.

Needless to say, buyers and sellers may find promising opportunities in Florida’s third-largest city. Some of the most desirable neighborhoods in Tampa include:

- Hyde Park

- Palma Ceia

- Davis Islands

- Beach Park

- Uptown Tampa

- Harbour Island

- Seminole Village

- West Tampa

In this article, we will comprehensively review the Tampa housing market. We’ll provide the Tampa real estate market forecast for 2024 and share invaluable Tampa real estate advice for both buyers and sellers.

image source

Factors Driving the Tampa Real Estate Market

Several factors influence the Tampa real estate market and drive it to its current state. The city’s strong job market, tax-free luxuries, and limited housing supply are among the most instrumental.

Strong Job Growth

Tampa’s robust job market has become an appealing come-on for many, especially those considering Tampa relocation.

The city has proven its economic resilience, especially after the COVID-19 pandemic, with an average annual job growth of around 12%. It also has an impressively low unemployment rate of 3.2%.

Tampa ranks fifth among states with the most full-time job opportunities at major companies and boasts one of the highest job security rates in the U.S.

Tax Luxuries

One of the most inviting qualities of Florida is its tax luxuries. This attracts migrants and businesses into the state, boosting the real estate market.

Florida offers its residents a range of tax benefits that contribute to a relatively low tax burden. These include:

● No Personal Income Tax: Florida is one of the only seven states in the U.S. that does not have a state income tax.

● No Estate and Inheritance Tax: Florida does not assess estate or inheritance taxes. This means what is willed to an individual is entirely theirs.

● No Intangibles Tax: Thanks to the law repeal in 2007, Florida no longer requires residents to pay taxes on intangible goods like investments.

● Corporate Income Tax Exemptions: Florida corporations are typically subject to a 5.5% corporate income tax rate. However, entities like sole proprietorships and S Corporations may be exempt from this tax.

● Property Tax Exemptions: Florida is known to have one of the highest property taxes in the country. However, the state provides several exemptions to lighten the property tax load. These include homestead exemptions, widow/widower exemptions, senior citizen exemptions, and exemptions for disabled individuals and veterans.

● Reemployment Tax: Formerly called Unemployment Tax, this tax is charged to eligible businesses. The aim is to provide temporary income support to workers who lose their jobs without fault.

These tax structures have shaped Florida’s reputation as a state with a relatively low tax burden. Thus, it has become an attractive destination for residents and businesses alike.

Growing Demand

Given the city’s growing population, inviting job market, and an influx of migrants, the growing demand for Tampa homes is unsurprising.

According to Bankrate, Tampa is one of the five largest markets in the U.S. This is driven by its impressive ranking among the top 50 metropolitan areas. It was second in property appreciation and was ranked third in the low unemployment rate.

Moreover, Redfin named Tampa the second most popular city for relocating homebuyers in 2022.

Similarly, Tampa topped the list as the best place to retire in the U.S. by Travel + Leisure.

Out of 180 cities, and based on 45 key metrics, the city scored the highest. Retiree activities, quality of life, affordability, and taxation are among the many significant criteria discussed. As such, there is a wide range of Tampa retirement communities for retirees to settle in.

Limited Housing Supply

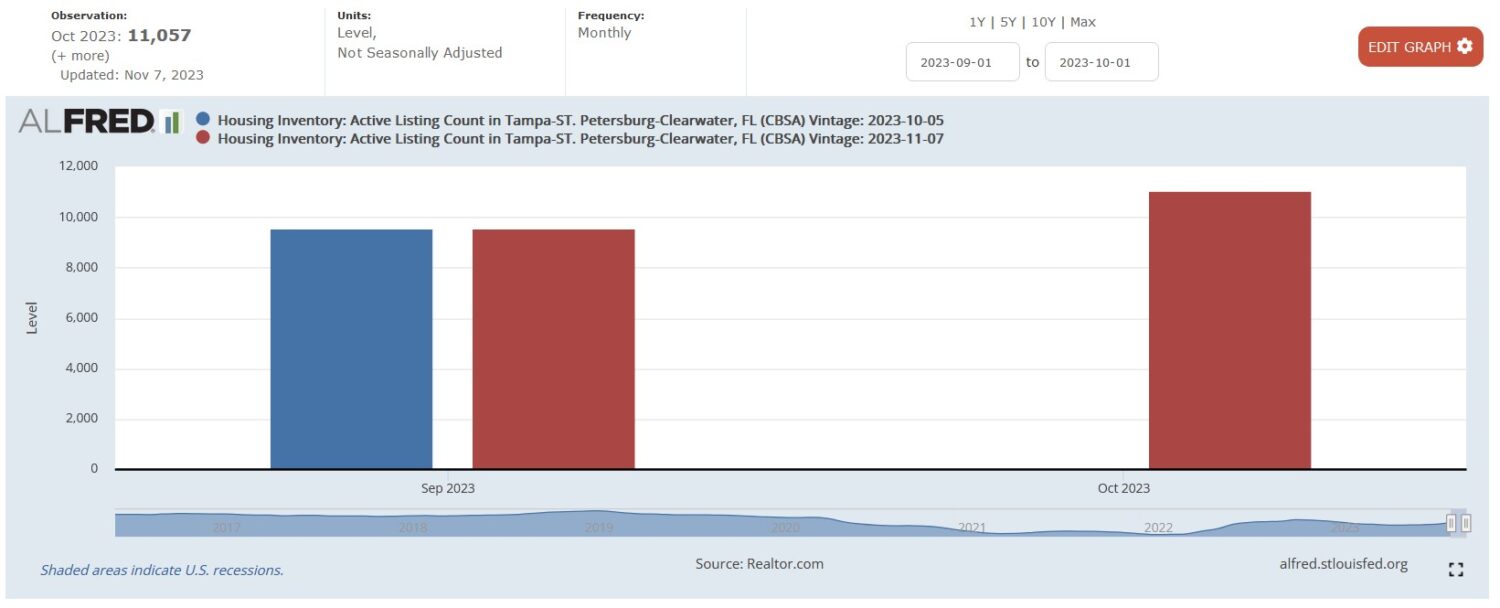

According to Fred Economic Data, the entire Tampa-St. Petersburg-Clearwater area had 12,399 active listings in December 2023.

Although a spike has been noted since May 2023 and an overall upward trend post-pandemic, inventory remains below the balanced count experienced in the last decade.

For buyers, this could mean rising home prices, fierce competition, and possible bidding wars.

For sellers, this could lead to an increase in sales above the listing price. However, it may also go the other way around, as buyers may pause house hunting.

Either way, the limited Tampa housing supply is a major contributor to the increase in home prices. As such, buyers and sellers must be ready to negotiate.

High-interest Rates

Rising mortgage interest rates are a trend seen across most major markets around the U.S., and Tampa is no exception.

In such cases, the increase in home prices and high-interest rates may be a setback for buyers. However, given Tampa’s appeal and popularity, it does not seem too big of a problem for the city.

image source

Favorable Weather

Like the rest of Florida’s Gulf Coast, Tampa is known for its humid subtropical climate, with short, warm winters and long, hot summers. This makes it an appealing destination for those looking to escape harsher climates in other parts of the country, consequently driving up housing demand.

However, its prime location on the Gulf Coast makes it highly susceptible to hurricanes — an essential factor to consider in the current market of skyrocketing home insurance costs.

Tampa Real Estate Market Forecast for 2024

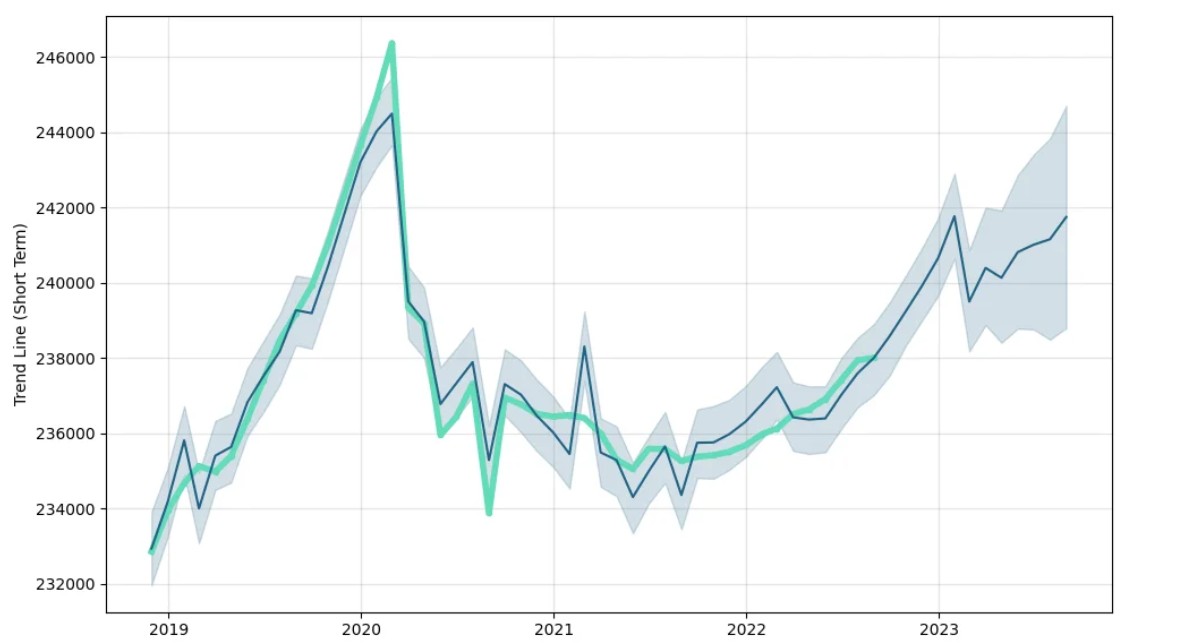

Predictions for the Tampa real estate market for 2024 remain generally positive. Considering the city’s reputation as a major metropolitan hotspot, it stands to benefit from an influx of residents, builder confidence, and continuous economic growth.

Also, the current downtrend in mortgage rates and expert predictions point towards a stable real estate market in the near future. Mortgage Bankers Association has projected that mortgage rates will hover around 6.1% by the end of 2024 and 5.5% by 2025.

Although slow, the downshift will increase affordability, leading to higher demand and sales. Inventory will also increase thanks to an influx of existing homes from owners wanting to sell but locked in at lower rates.

Home Prices

Below is a breakdown of the median sale price per home type:

● Single-family homes: $419,900, a 0.2% increase vs. October 2022

● Townhouses: $555,000, a 26.9% increase vs. October 2022

● Condominiums: $233,000, a 38.7% decrease vs. October 2022

While owners of single-family homes and townhouses will benefit from this growth, condo owners may need to settle for lower buying prices. This is likely due to the desire for homes with a bigger space.

The good news is, compared to initial listing prices, Tampa homes reportedly sell at 97.5% of the asking price on average.

For sellers, this indicates a promising return on their investment. Buyers may also see the good in this situation as they can negotiate for a slightly lower price.

Looking ahead at the Tampa real estate market in 2024, home prices are projected to increase further. Norada Real Estate Investments projects an 8% increase by June 2024.

This potential increment may be fueled by growing demand and limited supply. Remember that these insights may change depending on several factors over the next year.

Median Days on Market

As for current sales timelines, Tampa homes spend an average of 35 days on the market before selling. Hot homes can go much faster.

Although this presents a one-day increase from 2022, reliable Tampa real estate market forecasts suggest the market will be lucrative for sellers in the long run.

Sales Volume

Based on data from Redfin, 438 homes were sold in December 2023,a decrease of 50 compared to 2022.

While there is a sales slowdown in the area, experts are not worried about the future of Tampa real estate. As long as there is a strong demand, the limited inventory may increase and sales may pick up.

The sales volume is anticipated to be influenced by several factors in 2024. These include builder sentiment, construction trends, and economic indicators.

Rental Market

Tampa boasts a strong rental market, especially given its popularity among tourists, migrants, and short-term residents. It is one of the hottest rental markets in Florida.

According to Rent.com, the median rent in Tampa is between $1,608 and $1,895 as of January 2024. The breakdown of median rent per property type is as follows:

● Studio: $1,801, down 1% from last year

● One-bedroom unit: $1,608, down 2% from last year

● Two-bedroom unit: $1,895, up 1% from last year

Figures show that owners of 60% of Tampa apartments charge rent of more than $2,100.

The most affordable neighborhoods include Sulphur Springs, Temple Crest, and University Square. Rent in these areas hovers around $1,200 for a one-bedroom unit.

On the other end of the spectrum, Hyde Park and Harbour Island are the most expensive neighborhoods. Rent can range from $2,500 to over $3,000 for a one-bedroom unit.

Overall, the promising Tampa rental market is a good route for homeowners looking to earn without selling their properties. Moreover, this may also entice interested buyers to invest in Tampa real estate property.

Advice for Buyers and Sellers

Although the Tampa real estate scene sees an increase in home prices, high interest rates, and limited inventory, the city continues to see an influx of relocating residents, workers, and families. As such, buyer demand, home sales, and rental remain strong.

So whether you’re looking to buy or sell your home in Tampa, the market shows healthy growth and competition, making Tampa real estate a worthwhile investment.

To help you through your decision-making process, consider our Tampa real estate advice for buyers and sellers:

Tampa Buyers Advice

● Know your top priorities for your ideal home (i.e., location, lifestyle, space, price, etc.).

● Research as many options as possible before zeroing in on one.

● Be ready to make an offer immediately due to the limited inventory of Tampa homes.

● Do not be afraid to negotiate the asking price. Sellers may still be open to negotiations, especially due to buyer reluctance from high home prices and interest rates.

● Consider homes with lower prices. These include homes in less popular areas or older homes, which you can later renovate when able.

As for looking for the best areas in Tampa, the city has 96 different neighborhoods. Whether you’re a Tampa first-time homebuyer or a Tampa move-up buyer, you’ll find various options to choose from, catering to different budgets and preferences.

Here are some desirable neighborhoods to look into:

● For Tampa luxury real estate, the most expensive neighborhood is Beach Park. Realtor.com estimates a median home price of $2.3M.

Downtown Tampa is another obvious area with high-priced homes. This is due to its proximity to city life, public transportation, and other convenient perks.

Other prominent Tampa neighborhoods include Bayshore Beautiful, Golfview, Historic Hyde Park, Palma Ceia West, Parkland Estates, Ridgewood Park, and Stoney Point.

● For Tampa waterfront real estate, buyers may want to explore the following neighborhoods: Culbreath Isles, Davis Islands, Sunset Park Isles, Beach Park, and Ballast Point.

● For Tampa’s affordable real estate, Sulphur Springs is the most budget-friendly, according to Realtor.com. The median listing price is at $282,000.

Other affordable neighborhoods to check out are College Hill Belmont Heights, Rainbow Heights, Ybor Heights, North Tampa, and Seminole Heights, to name a few.

Tampa Sellers Advice

For sellers in Tampa, the prevailing low inventory presents a big advantage. This gives them the opportunity to set competitive prices and maximize returns. To attract multiple offers, make sure to present a pristine and high-quality property to potential buyers.

Another option for those selling Tampa investment properties or considering Tampa downsizing is to rent out your property. This allows a steady flow of profit and a chance to sell down the road once prices are even higher.

Tampa Real Estate: A Promising Market for Buyers and Sellers

Tampa presents many opportunities for buyers and sellers.

The city has a rich culture, beautiful landscapes, progressive city life, and economic growth. And as more people flock into the area, the more we can expect from the Tampa housing market.

Sellers have a chance to benefit from multiple offers and high returns. On the other hand, buyers have the assurance of a profitable investment in the long run.