Naples, Florida, remains one of the hottest real estate markets in the country, and understandably so.

Nestled in southwestern Florida, this coastal city is characterized by beautiful crystal-clear beaches, upscale homes, and a sophisticated lifestyle. It is also known for its vibrant art scene and retail shopping, adding to its appeal as a cultural haven.

Given its high quality of life and strong economy, recent years have given it a reputation as a popular destination for retirees and snowbirds.

That said, it’s easy to see why the Naples housing market has been all the buzz in 2023. This is confirmed by key trends surrounding the city’s real estate. For one, there is a strong demand for rental properties in Naples. Demand is more than the current supply of homes, making it a competitive market for buyers.

This leads to another key insight: rising median home prices. Real estate data shows an increase in the average home price versus 2022. Naples home prices are expected to rise even further, a good indicator of a profitable market for sellers and investors.

For a closer look into the Naples real estate market, continue reading this guide on everything you need to know, including market trends, forecasts, and tips for homebuyers and investors.

Naples Housing Market Analysis

A coastal city in Collier County, Florida, Naples is known for its refined, laid-back lifestyle, vibrant city character, numerous golf courses, and luxury houses by the beach.

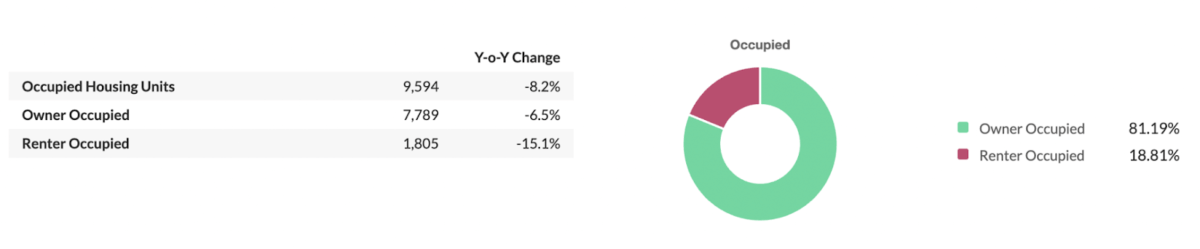

As of the 2020 census, it was home to 19,115 locals. Of the housing units in the city, it is reported that homeowners occupy 81.19%, while renters occupy 18.81%. Around 32% of homes are still tied to mortgages.

If you’re considering joining the bandwagon and buying a home in Naples, here are important points to note.

Pros of Buying a Home in Naples

According to a February 2023 article by the Miami Herald, research company Scholaroo declared Naples the best city to live in the United States. The study included 151 cities, all of which were ranked based on the following indicators of happiness and satisfaction:

- Crime and safety

- Affordability

- Economy

- Quality of life

- Health care

- Education

- Opportunity

- Leisure and entertainment

- Infrastructure

Of these factors, Naples ranked No. 1 in quality of life and healthcare, having the most hospitals. It also belonged to the top 10 for education (with the most public schools), safe and systematic infrastructure, and economic strength. Considering all criteria, the city earned the highest total score.

Apart from these figures, there are obvious reasons for Naples’ charm – its pristine beaches, year-round pleasant weather, bustling commercial and cultural life, and an overall ambiance of polished streets and luxurious homes.

Needless to say, there are many pros that make Naples one of the hottest real estate markets in the country.

Moreover, Florida state is known to be a tax haven. Compared to other states, residents enjoy the following luxuries when it comes to taxes:

- No state income tax. Florida is among seven U.S. states that do not make residents pay personal income tax. While they still need to pay federal taxes as per the law, this remains a big advantage for Floridians.

- No estate tax or inheritance tax. This means that heirs or beneficiaries do not need to pay a portion of what is willed to them.

- No intangibles tax. Florida residents are also not taxed on intangible goods, such as investments.

- Property tax exemptions. Apart from tax-free benefits, the Florida state also grants exemptions on certain groups, including senior citizens, widows and widowers, blind persons and the disabled.

Additionally, Florida companies benefit from tax credits and refunds, which encourage new businesses and new jobs. All these financial benefits further attract workers, investors, and retirees to the state.

Cons of Buying a Home in Naples

Now, when it comes to cons, living in Naples still poses a few challenges, as is the case with any city in the world.

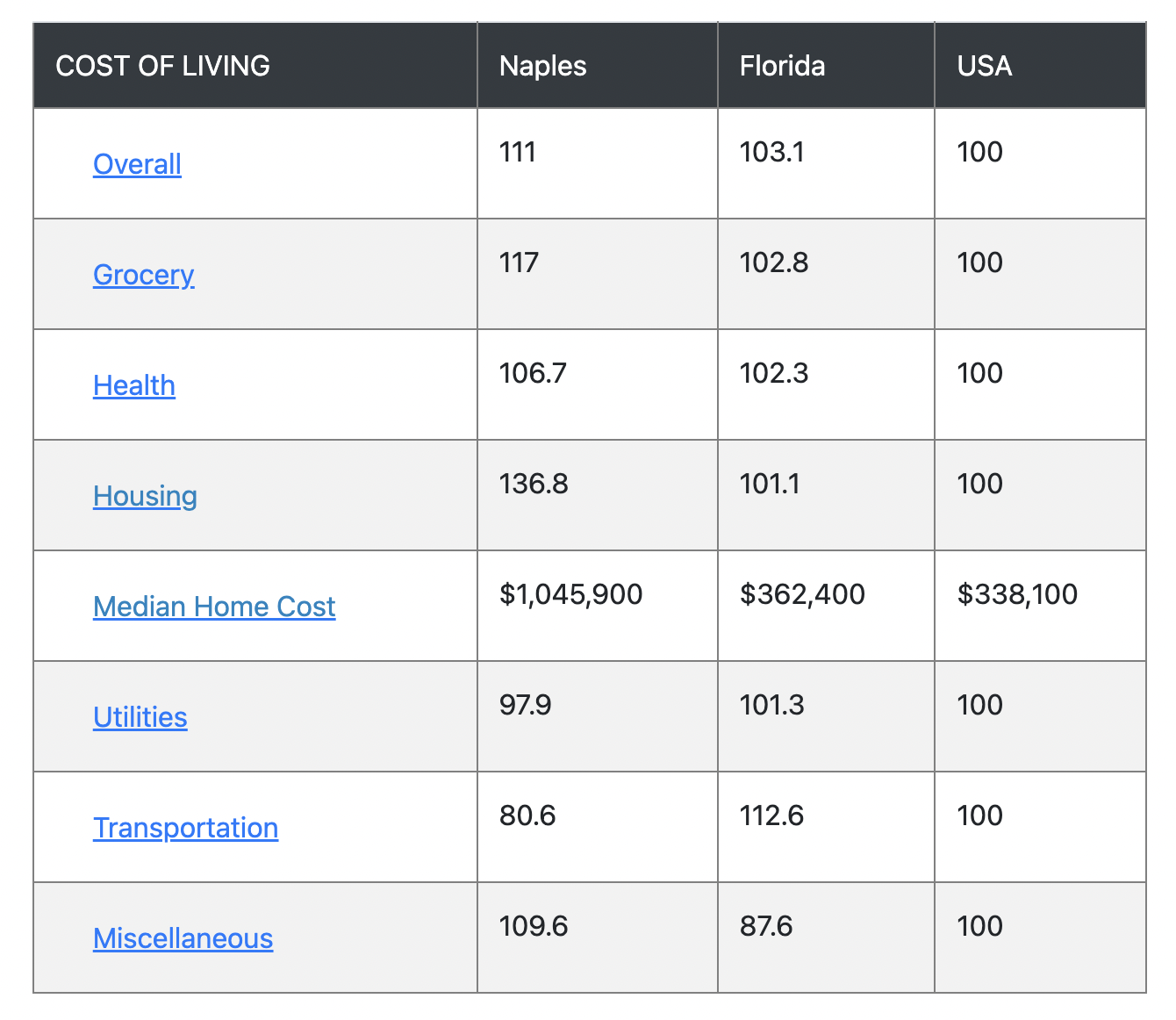

For one, expect this affluent city to have a high cost of living. According to research, Naples has an 11% higher cost of living versus the national average and is 8% higher than the Florida average. This covers typical expenses like housing, food, transportation, healthcare, and the like.

Another con to consider is the traffic. Because the city has only a few major roads, traffic congestion is likely, especially during rush hour windows.

Moreover, those living in Naples need to get used to its hot, dry summers, wherein the months of June to August can reach average highs of 80. Luckily, daily trips to the beach can help beat the heat.

While these cons may not be big issues for some people, they are still worth taking into account when looking for a place to settle down long-term.

Key Factors Influencing the Naples Real Estate Market in 2023

Alongside the pros and cons of a potential home, it also pays to understand the different factors influencing the market – including prices, supply and demand for homes, and inventory.

For the Naples real estate market, the focus is on two significant factors: the COVID-19 crisis and the appeal of Florida as a retirement state.

- The Impact of COVID-19

A widely reported fact in recent years is how the COVID-19 pandemic saw people leave big cities in exchange for a more peaceful life, better work opportunities, or closer proximity to family and friends.

Whatever the reason, there was a growing interest in slow-paced yet still progressive states like Texas, Florida, South Carolina, and Tennessee, among many others. Florida, in particular, was ranked #2 in the list of 10 states people are moving to.

This influx in domestic migration had a great impact on the Naples housing market.

- The Appeal of Florida As a Retirement State

Even before the COVID-19 pandemic, Naples was already touted as a popular destination for retirees and snowbirds.

Just a two-hour drive from popular Florida cities like Miami and Tampa, Naples attracts a profile of rich, older residents seeking year-round warm weather and an elegant lifestyle.

According to the US News statistics, almost 60% of the community is aged 45 years and older. These residents are said to likely own multiple homes, settling in Florida during the winter months and leaving during the hot summer months.

As such, the community demographic has greatly influenced the reputation of Naples as an affluent city and, consequently, its home prices.

In light of these factors, the increase in buyer demand and median sale prices for Naples homes comes as no surprise. This makes for a competitive market where home appreciation is good and investment opportunities are promising.

That said, according to research done by the Naples Area Board of REALTORS® (NABOR®), buyers and sellers should take note of these recent real estate trends shaping the Naples housing market:

Recent Trends in the Naples Housing Market

- High demand, low supply of Naples homes

As already established, the high demand for Naples real estate is driven by the city’s high quality of life, strong economy, and growing appeal as a peaceful and refined place to settle down.

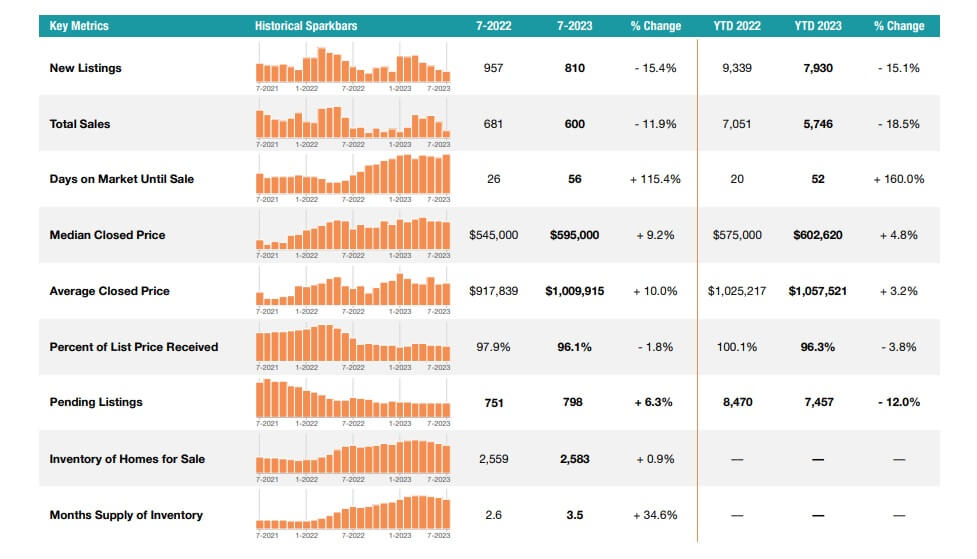

However, the increase in buyer demand is met with a shortage in the supply of Naples homes. Compared to July 2022, data shows a 15.4% decrease in new listings this July 2023. Moreover, inventory is down by half compared to pre-pandemic times – 5,200 Naples properties for sale in July 2019 vs. 2,583 Naples properties for sale in July 2023.

The limited inventory of homes can be attributed to many reasons. A significant one is that sellers may be opting to wait for the market to stabilize post-pandemic before putting their homes up for sale.

In effect, the current high-demand-vs-low-supply nature of the Naples realty market has fueled a spike in home prices, as seen in the next point:

- Rising Home Prices in Naples

According to the July 2023 data of NABCOR, the median home price in Naples is $595,000, a 9.2% increase versus July 2022.

Broken down further, the median home price of single-family homes is at $735,000, while condominium prices stand at $455,000 – both rising from July 2022 prices. This appreciation of property values indicates good opportunities for homeowners and sellers.

For homebuyers, on the other hand, the increasing prices may seem like a challenge. The good news is the Naples housing market is expected to continue growing, making homes a good investment property down the line.

- A Thriving Naples Rental Market

Apart from owner-occupied homes, Naples is also known for vacation rental properties. Given its reputation as a popular tourist destination, homebuyers have the option to put their property up for rent in the future, assured of high occupancy rates and lease income.

- Steady competition and growth

Overall, the Naples real property market boasts moderate competition and steady growth.

As of July 2023, homes reportedly take an average of 56 days in the market before selling. This is a significant difference compared to the 26 days in the market in July 2022. However, figures still suggest a growing interest in the area as demand is higher than supply.

Moreover, sellers are said to receive 96.3% of the home list prices. This means home sales prices are only slightly below their asking prices.

Data assures interested homebuyers that a Naples home is a worthwhile investment.

Investment Outlook

Considering these real estate market trends and insights, the Naples housing market is expected to remain competitive for the foreseeable future.

For those interested in investing in this South Florida hotspot, below is a summary of Naples real estate forecast points for you to consider.

Risks of Investing in Naples Real Estate

The Naples real estate market is driven by rising home prices, high demand, and a limited supply of homes, thus prompting competition among buyers. This reality poses one major risk: market volatility is a possibility.

Prices may fluctuate depending on supply and demand. In such cases, buyers must be prepared to act quickly and may need to make offers above the asking price.

Rewards of Investing in Naples Real Estate

On the contrary, the high buyer demand may pose an equal reward for buyers: good investment returns.

As the city continues to grow and attract more residents, Naples homes stand to have a significant capital appreciation in the future. And so, despite the rising home prices versus 2022, the trend may be a continuous increase in property values.

Desirable Naples Neighborhoods for Investors

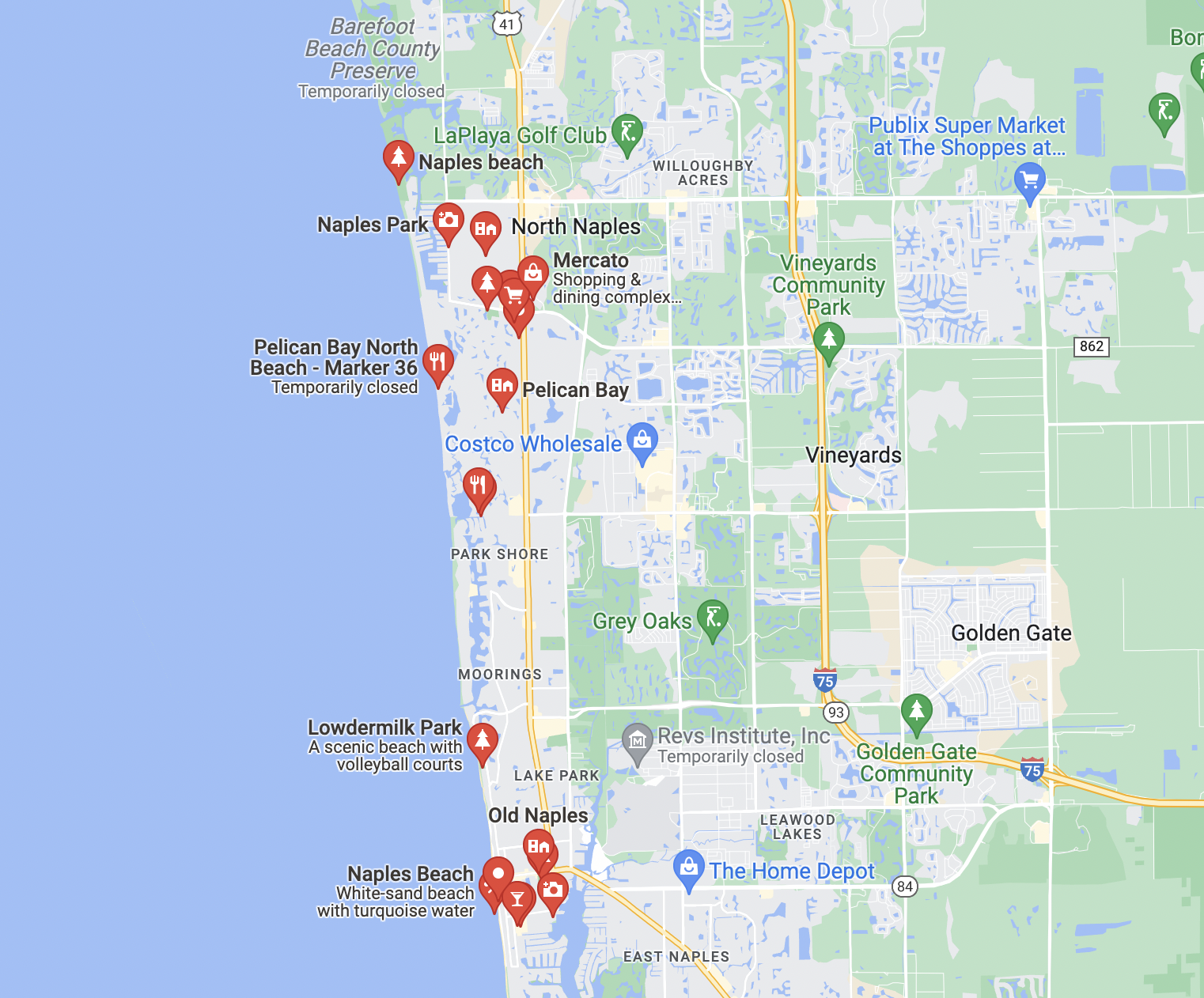

Naples city is composed of numerous neighborhoods, each with its unique character and own set of attractive features for residents. When it comes to finding the best investment property, these five areas are worth exploring. Here’s why.

Old Naples

Also known as “Olde Naples,” this southern part of the city is known for its historic charm and quaint atmosphere. It has sprawling lush gardens, old mansions, and a vibrant downtown district, all within easy reach of the white sandy beaches characteristic of Naples, Florida.

Real estate in this area offers a plethora of homes – from upscale houses to beach cottages to luxurious condominiums. As such, buying a home in this central location will prove to be a good choice for investors and long-term homeowners alike.

- Naples Beach

As evident in its name, homes along Naples Beach boast beachfront views and luxuries for miles on end. At the heart of it is Naples Pier, a favorite among tourists for its crystal-clear water, seaside activities, and vibrant stretch of restaurants, shops, and picturesque houses.

- Mercato

Mercato is a high-end cultural hub of office, retail, and residential spaces in a half-a-million-square-foot area. The commercial complex was developed to cater to all interests – from leisure and entertainment to dining and nightlife to luxury homes.

Compared to other residential neighborhoods in Naples, Mercato offers a convenient mix of suburban living and the vibrance of city life.

- Pelican Bay

Nestled to the north of Naples, Pelican Bay is another beachfront neighborhood known for its luxurious homes and peaceful lifestyle.

According to Realtor.com, the median home price in this area is $1.5 million, making it one of the most expensive areas in Naples. As such, interested homebuyers can expect large, beautiful homes and a fully functioning community with grocery stores, cafes, restaurants, parks, gyms, and schools, further adding to its appeal.

- Naples Park

An up-and-coming residential area in the city, Naples Park offers a suburban paradise with sprawling greenery and a quiet day-to-day life.

Unlike other neighborhoods in the area, it is not as busy with commercial establishments and foot traffic. However, residents can still enjoy nearby beaches, parks, shops, and restaurants.

These five neighborhoods represent different environments one can expect in Naples, although all offer the same residential charm and laidback lifestyle that clearly defines the city.

Tips on Finding a Good Deal on a Naples Home

- Buyers may need to stay active in researching potential homes.

- Consider homes that have been on the market for a while or those in need of some repairs. They may have a lower listing price versus new and more modern homes.

- Once set on a home, buyers may need to act quickly and make competitive offers, not deviating too far from the asking price.

Naples Real Estate: A Worthy Investment

The Naples housing market is a good option for those who are looking for capital appreciation and a high quality of life. While buyers may need to prepare for the high cost of living and the competitive market, the promising future of Naples real estate suggests a worthwhile investment for the long term.