Renowned for its sunny weather, world-famous attractions, and vibrant culture, Los Angeles is a highly desirable place to call home. This appeal has made the Los Angeles real estate market a hot commodity, showcasing upscale neighborhoods and elegant residential offerings.

Over the last five years, though, it was a rollercoaster ride for the market, moving from boom to bust and back again. This uncertainty has forced buyers and sellers to pay close attention and adapt to the shifting tides.

The future of the Los Angeles property market is a subject of speculation. While the market may have seen tremendous growth in the past, 2023 does not look like a banner year.

Several factors are driving the current state of the Los Angeles real estate market. These include rising interest rates, inflation, and supply chain disruptions. A couple of key trends are also shaping the Los Angeles real estate market landscape. These include the growth of remote work and increasing demand for single-family homes.

Los Angeles Median Home Price Forecast

The Los Angeles median home price has increased over recent years. As of July 2023, the median home price was $1.0 million, a jump of 4.3% from the same period in 2022. The median price per square foot was $628, marking an increase of 2.1% from 2022.

Despite showing an upward trajectory in recent years, home prices in Los Angeles are expected to decline slightly for the remaining part of 2023. This is primarily due to economic factors such as rising interest rates and inflation, resulting in decreased home affordability.

Experts predict a drop of about 9% in house prices in the coming months. Therefore, buying a home in Los Angeles is a bad short-term investment. However, property values are expected to remain stable in the long run. A five-year investment plan is expected to yield a 0.39% profit.

This means now is a good time for buyers to purchase properties at relatively lower prices before the market rebounds.

Factors Affecting the Los Angeles Real Estate Market

The Los Angeles real estate market is subject to various factors. These include the following:

COVID-19 Pandemic

The COVID-19 pandemic affected real estate markets across the U.S., including Los Angeles. Lockdowns nearly froze the housing market.

Economic uncertainty also made people afraid of buying or listing homes. But this pause was short-lived. Within months, the market bounced back. Low interest rates boosted the market by about 14.3%. However, there was limited inventory, so prices went up.

The pandemic ultimately ignited a buying frenzy that continues to push home prices to new heights. It led to a shift towards remote work. Today, many companies are embracing flexible work policies. The shift has led to increased demand for properties that offer dedicated workspaces.

The rise of remote work also means people are not tied to living near employment hubs. The result is a surge in buyers looking for properties outside the city center.

Economic Growth

Before the pandemic, the city’s economy was strong, supported by entertainment, tech, and tourism industries. This made real estate highly desirable.

The economy slowed down during the pandemic, so fewer houses were sold. But now the market situation is better. There are more jobs, and businesses are bouncing back, making the economy strong. These factors are shoring up the Los Angeles real estate market.

Rising Interest Rates

After a period of historic lows in the aftermath of the pandemic, interest rates started to rise. This trend continued through 2022 and into 2023, bringing the rates to the highest since 2001.

Higher interest rates mean higher monthly payments for homeowners. This has affected the affordability of Los Angeles real estate, cooling the market slightly. However, the rate of economic growth is offsetting the impact of the higher mortgage rates, restoring the market’s momentum.

Inflation

Inflation is rising, driving the cost of construction materials and labor upward. The additional expense is usually passed on to the home buyers, resulting in higher home prices. The Federal Reserve is also likely to continue raising interest rates in response to inflation.

Supply Chain Disruptions

Supply chain disruptions during the pandemic also significantly impacted the housing market. These disruptions created a shortage of building materials, slowing down the construction of new homes. Demand for existing properties increased, driving up prices.

How do Los Angeles home prices compare to major US cities

The median home price in Los Angeles is significantly higher than the national and California averages of $421,714 and $783,300, respectively. However, it is essential to consider the city’s long-term growth prospects and appeal. In light of these factors, the high median home price emerges as an indication of the area’s intrinsic value rather than a stumbling block.

Compared to other major California cities, Los Angeles home prices are fair. San Francisco’s median home price is $1.3 million, San Jose’s is $1.4 million, and San Diego’s is $901,000.

What Buyers and Sellers Need to Know

The following are some of the most critical points that buyers and sellers need to keep in mind when venturing into the Los Angeles real estate market:

Low Inventory

Los Angeles has been experiencing tight market conditions. Currently, Los Angeles County has a 2.5-month supply of inventory. The Los Angeles Metro Area, on the other hand, has 2.7 months of supply.

A balanced real estate market should have a four- to six-month inventory. Therefore, the Los Angeles property market is a seller’s market. This tight supply situation has led to an increase in selling prices and multiple offer scenarios. However, the situation is similar in the rest of Southern California, where the inventory is equally low.

This scarcity is advantageous for sellers as their properties will attract more attention and potentially higher offers. For buyers, this means they will have to strategize to achieve success.

Days on the Market

Properties in Los Angeles are staying on the market for an average of 37 days. This speedy turnover indicates urgency amongst buyers and indicates that the market is highly active and competitive. Buyers should be assertive during negotiations to avoid being outpaced by competition.

High Buyer Demand

The Los Angeles real estate sector is witnessing a surge in demand. Multiple factors, including a stable job market and economy, are driving up demand. The city’s cultural and lifestyle offerings have also intensified buyer demand. Buyers should be ready to face competition. On the other hand, sellers can capitalize on the increased demand to get a favorable deal.

Bidding Wars

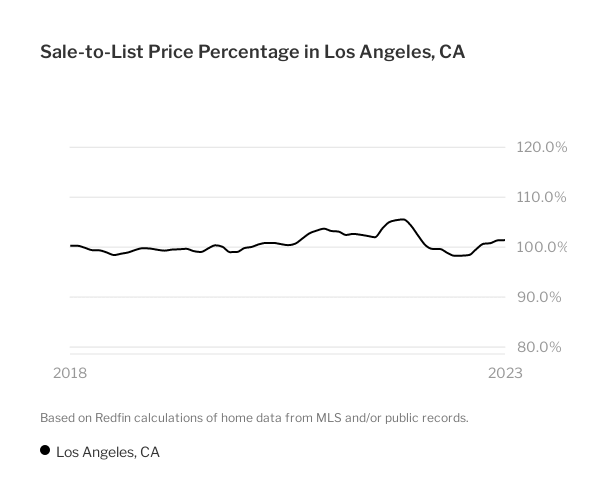

A typical house in the Los Angeles housing sector attracts four bids. This trend is driving up home prices above the initial listing price.

Prospective buyers must be agile and ready to make competitive offers. They should also be financially prepared to pay above the asking price.

For sellers, bidding wars present a favorable market situation. It can be an excellent opportunity for higher returns on their investments or a quick sale.

Los Angeles Real Estate Market in 2024: Predictions for Home Sales

A competitive market requires buyers to have a clear plan. These tips can help streamline the homebuying process in Los Angeles:

Finding a Good Real Estate Agent in Los Angeles

Finding a reliable real estate agent is vital to navigating the Los Angeles housing market. A good agent will have a deep understanding of the market dynamics. They will also be able to provide expert advice tailored to your needs.

They should have a proven track record of negotiating favorable deals for their clients and have a robust network of contacts in the industry.

Getting Pre-Approved for a Mortgage

Get pre-approved for a mortgage before you start house hunting. This sets a clear budget. It also positions you as a serious buyer in the eyes of sellers, giving you a competitive edge over other buyers.

Consult with a mortgage lender to understand the pre-approval process and the loan amount you qualify for. This will be based on your income and credit history, among other factors.

Making a Competitive Offer

In a competitive market like Los Angeles, making your offer as competitive as possible is crucial. A competitive bid isn’t just about the price but could also include terms that appeal to the seller. These include a speedy closing timeline and waiving certain contingencies.

Los Angeles Real Estate Sales Volume Forecast for 2023

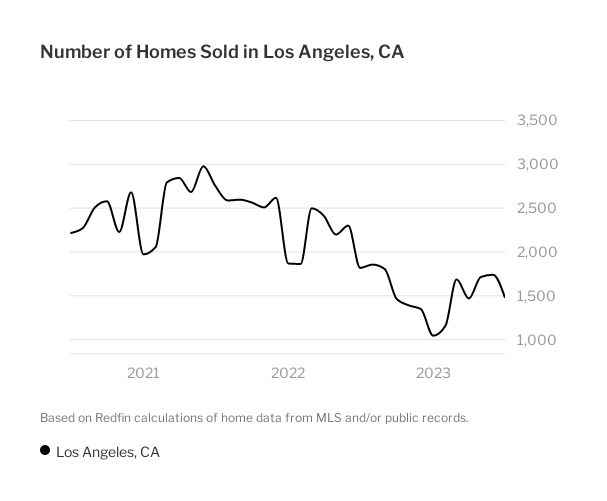

In July 2023, the Los Angeles real estate market saw a drop in sales. It recorded 1,475 sales compared to 1,818 sales in July 2022.

The downturn in property transactions was due to a variety of factors. These include inflation and rising mortgage rates, which increased home prices. The trend is expected to continue in the short term.

How sales volume in the Los Angeles real estate market compares to other cities

The current sales volume of the Los Angeles real estate market aligns with other major cities across California. In July 2023, many of California’s metropolises saw a decrease in home sales.

San Francisco, for instance, recorded 354 sales compared to 434 sales in July 2022. San Diego also experienced a setback, with 835 sales in July 2023, down from 876 the previous year. The same was true for San Jose, with 432 sales in July 2023 versus 464 the year prior.

This means Los Angeles is performing just as well as other major cities despite declining sales.

What Buyers and Sellers Need to Know

For buyers and sellers, understanding the dynamics surrounding sales in Los Angeles’ real estate market can be instrumental in making informed decisions.

Inventory Levels Will Remain Low

Expert opinion leans towards a modest increase or even stagnation in housing supply for 2023. Dropping home prices will incentivize buyers to purchase homes, reducing the available inventory.

On the other hand, sellers will be hesitant to put their homes on the market, waiting for an increase in prices. This could further reduce inventory levels, driving sales volume downwards.

Buyer Demand Will Remain Strong

The Los Angeles housing market is expected to sustain high demand thanks to its desirability and offerings. Economic growth, job market growth, and appeal to a younger demographic are expected to sustain buyer demand. However, limited inventory will limit the number of sales.

Tips for Buyers and Sellers in the Los Angeles Real Estate Market Housing Market

Buyers should be ready to act quickly. For sellers, competitive pricing and staging are crucial even in a seller’s market. They should also be prepared to handle multiple offers. An experienced realtor can help in this aspect.

Other Key Trends Shaping the Los Angeles Real Estate Market

Apart from the effects of the COVID-19 pandemic and rising inflation and interest rates, these trends are shaping the Los Angeles real estate market in 2023:

Millennial Generation

The millennials, the largest generation group in the United States, are entering their homebuying years. This demographic has a strong preference for urban living and proximity to amenities. This could reshape the city’s housing landscape.

Their demand for affordable and sustainable housing options could cause a shift towards smaller, more efficient homes and green building practices.

Growing Tech Industry

The burgeoning tech industry is expected to impact the Los Angeles real estate market. Startups and established tech giants will set up shop in the city. This will result in a wave of tech workers relocating to the city and, subsequently, a surge in demand for housing.

Climate Change

Los Angeles is located near the Pacific Ocean. Climate change poses a threat to rising sea levels through global warming. This could lead to flooding and property damage.

Los Angeles Real EstateHousing Market Snapshot

The Los Angeles Housing Market is teeming with opportunities and challenges. With low inventory levels and high buyer demand, the market is tilted in favor of sellers. The city’s long-term growth prospects, cultural appeal, and diversified economy also present buyers with value for money and potential for growth.