Moving to Colorado Springs takes a period of adjustment. The city is 6,000 feet above sea level, which makes its air thin. Once you get used to that fresh mountain air, you’ll embrace all Colorado Springs offers.

Whether you’re into skiing, hiking, fine dining, craft breweries, or want a tranquil place to call home, the Colorado Springs real estate market is an ideal destination.

Median Home Price Forecast

Every prospective homeowner asks how much of a financial commitment it will be to move to Colorado Springs. That answer can be found in a deep dive into the current price trends.

Colorado Springs Home Prices: What to Expect in 2023

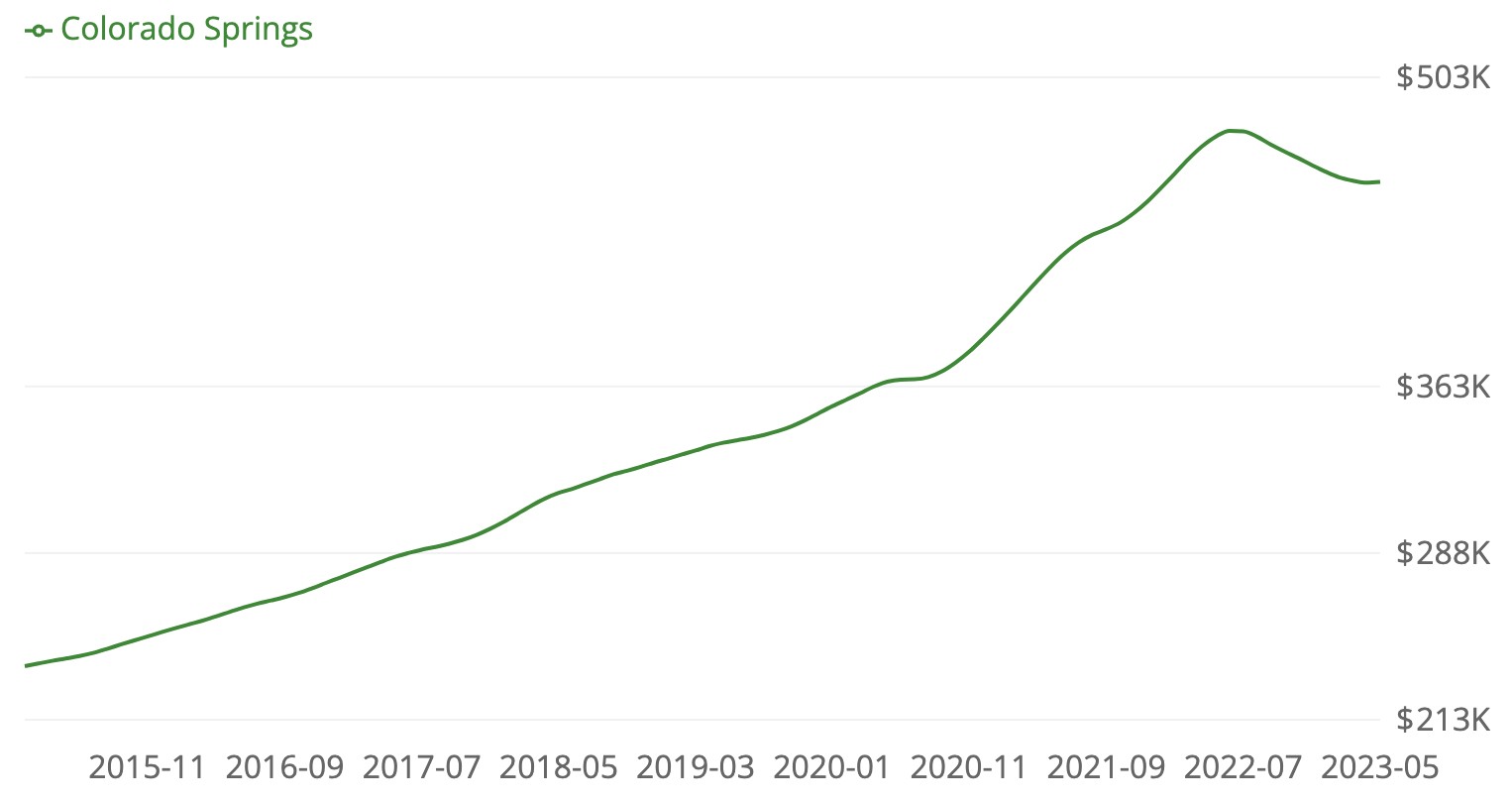

Understanding the prices begins with a look at the homes that have recently been sold in the area. According to the online real estate search site Rocket Homes, the median sold price for a home in Colorado Springs for August 2023 was $463,8981. A year ago, that price was 2.3% higher.

Factors Affecting the Colorado Springs Real Estate Market

What factors affect the current state of the Colorado Springs real estate market? The answer is supply. According to Rocket Homes, there were 994 homes up for sale in July. In August, that number jumped 14% to 1,134 homes for sale.

Market Dynamics in Colorado Springs Real Estate

The Colorado Springs real estate market has experienced a significant surge in housing inventory due to increased home construction. This influx of new listings has tilted the balance of power toward buyers. This offers them more choices and negotiating leverage.

The Impact of Mortgage Rate Fluctuations

The Colorado Springs housing market, like the broader U.S. real estate landscape, has been impacted by fluctuations in mortgage rates in recent years. As interest rates rise, prospective homebuyers may encounter affordability challenges. Meanwhile, sellers must adapt to avoid their homes staying on the market for longer than they want.

How Colorado Springs Home Prices Compare to Other Cities

How does that number compare to the median sold prices from nearby cities? Rocket Homes has the breakdown:

- Manitou Springs $637.4K +7.7% change from 2022

- Pikes Peak $645.4K +5.0% change from 2022

- Elsmere $470K 0% change from 2022

- Cheyenne Mountains $774K -2.9% change from 2022

What Buyers and Sellers Need to Know

A shift in home inventory could push Colorado Springs towards a buyer’s market. A buyer’s market happens when the supply of available homes surpasses the demand from potential buyers.

In simpler terms, when there are more homes for sale than buyers for those properties, you get a buyer’s market. In a buyer’s market, real estate prices tend to decrease as sellers find themselves in a situation where they must compete with one another to attract prospective buyers.

To gain an edge in this competitive market, sellers often adjust their asking prices downward. Additionally, sellers become more open to negotiating offers to prevent potential buyers from abandoning the transaction.

Tips for Buying a Home in Colorado Springs in 2023

One of the fundamental steps in your home-buying journey is obtaining mortgage pre-approval. This vital process, which can be as swift as 15 minutes through online applications, lays the foundation for your home purchase.

To get pre-approved, you must furnish various financial details. This includes tax returns, pay stubs, and bank account information. In return, a lender will provide an estimated loan amount, offering valuable insights into your budgeting capabilities.

Selecting the Right Lender

While obtaining a pre-approval letter is essential, it’s equally important not to rush into choosing a lender. Engaging in comparison shopping is critical to saving money throughout your home-buying venture, which extends to your choice of lender.

To make an informed decision, evaluate offers from at least three Colorado mortgage lenders. You should assess their rates and loan terms to identify the most favorable option.

Partnering With a Local Real Estate Agent

Navigating the intricacies of the Colorado housing market, particularly in areas like Colorado Springs, requires expert guidance. A local real estate agent can be your trusted ally in this journey.

With an average of just two offers and a swift 27-day selling period (according to real estate search site RedFin) for typical homes in Colorado Springs, you must act swiftly and effectively.

A knowledgeable agent possesses an in-depth understanding of the local market dynamics. Thus, the agent can help you avoid obstacles and make your home-buying experience smoother.

Start House Hunting and Making Offers

Equipped with a pre-approval letter and guided by an experienced agent, you’re now positioned as a serious homebuyer. Approach the house-hunting phase with an open mind, understanding that finding a property that perfectly aligns with your every desire may be a rarity.

Distinguish between absolute necessities, such as a backyard for your children, and aspects you can address later, like finishing a basement or upgrading a kitchen in the future.

When you identify a home that captures your heart, your agent will assist you in crafting an offer that captures the seller’s attention.

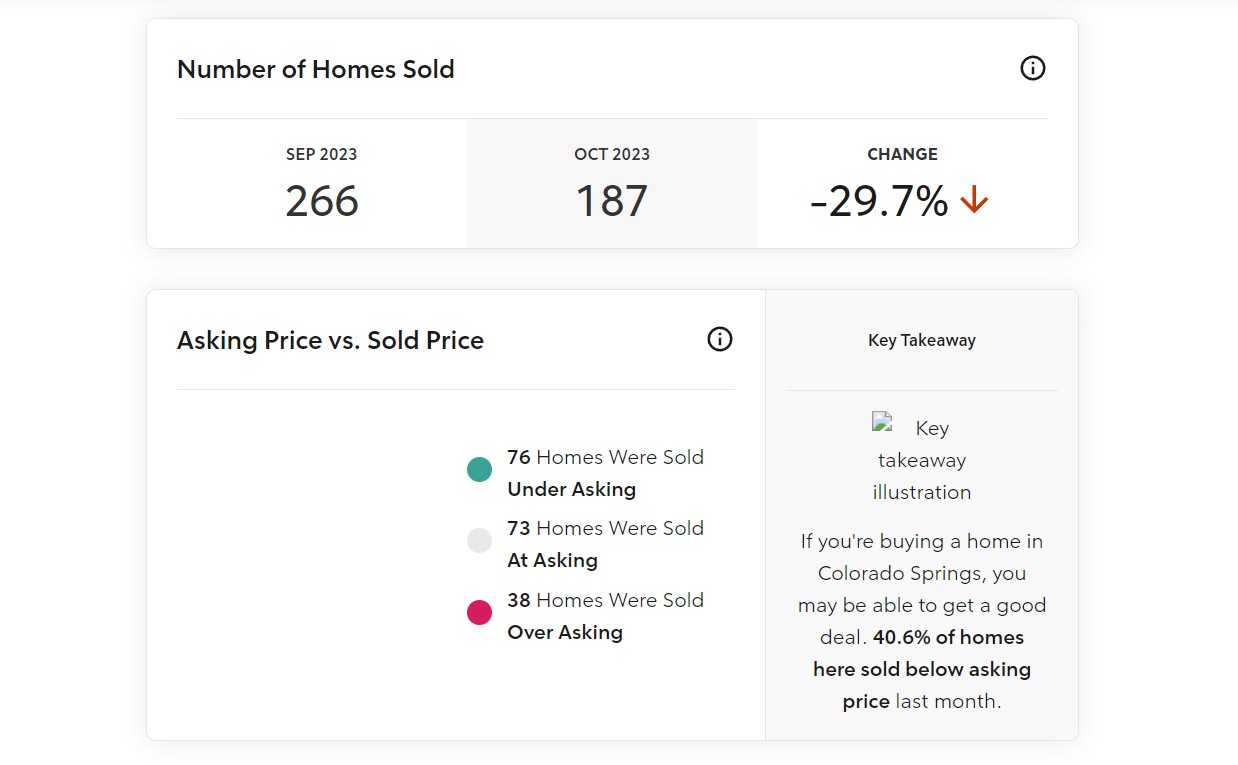

When considering your offer, it helps to know how many homes in Colorado Springs sold for the asking price versus the sold price. According to Rocket Homes, 100 homes were sold under asking in August.

Eighty-four homes were sold at asking, and just 45 sold over asking. That further proves the shift towards a buyer’s market in Colorado Springs.

Conducting Home Inspection and Appraisal

Upon accepting your offer, it’s prudent to schedule a home inspection. It helps identify any potential issues that might pose significant problems in the future. While this may incur additional costs, it safeguards against unpleasant surprises, particularly in the harsh Colorado winter.

A comprehensive inspection can reveal any necessary repairs or improvements. It offers peace of mind as you move closer to homeownership. Additionally, an appraisal is often conducted to determine the property’s value, aligning it with your purchase price and securing your investment’s worth.

Tips for Selling a Home in Colorado Springs

When preparing to sell your home in Colorado Springs, making informed decisions that maximize your returns is essential. Taking the time to assess these critical questions before listing your property can be financially rewarding.

Upgrading Your Home

While investing in significant home upgrades might seem appealing, it’s often not the most cost-effective approach when selling. Lavish renovations, like a fully remodeled kitchen with high-end finishes, may not yield a full return on investment.

Those big renovation projects can also be time-consuming and potentially delay the sale of your house. To enhance your home’s value, focus on smaller, budget-friendly improvements that offer a better return on investment.

Pre-listing Inspection

A pre-listing inspection isn’t mandatory but can help address potential issues before they become obstacles during a buyer’s inspection. A good roof inspection report or electrical system certification can help build confidence with a prospective buyer. Collaborate with your realtor to identify crucial repairs that warrant attention, avoiding unnecessary expenditures.

Home Staging

Consult with your real estate agent to determine if investing in professional home staging services is advisable. Although staging incurs costs, it can substantially enhance your home’s appeal to potential buyers. Thoughtful design details can transform your property into an inviting and desirable space. It could lead to a quicker sale and higher offers.

Smart Listing Price

Determining the right price for your home is a nuanced process influenced by various factors, including its age, square footage, location, and school district. Keep in mind that housing market dynamics are continually evolving.

Collaborate with your agent to review recent sales data (comps) of nearby properties, gaining insight into current buyer expectations. Realistic pricing is vital, as statistics show that homes in Colorado Springs are selling close to their list price.

Disclosures to Buyers

Colorado requires sellers to complete the state’s residential property disclosure form, a 10-page document outlining your knowledge of any property defects.

Additionally, you should provide the green disclosure form detailing energy-efficient features in your home.

If your property is part of a homeowner’s association, ensure you have all relevant documents, including bylaws and financial reserves, readily available for prospective buyers.

By carefully considering these essential aspects of selling your home in Colorado Springs, you can streamline the process and position yourself for a successful and profitable transaction.

Key Trends to Watch

What can prospective homebuyers and real estate investors expect for the Colorado Springs real estate market in the coming months? Here are some things to consider

Key Trends to Watch in the Colorado Springs Real Estate Market in 2023

Anticipated changes in the average sales prices of homes in Colorado Springs suggest a slight shift. Most experts predict a minor decrease. However, there is optimism that prices may rebound somewhat as the year progresses and inventory supply stabilizes.

Persistence of a Buyer-friendly Environment

While much of the United States currently leans towards a seller’s market, Colorado Springs paints a different picture. Recent times have witnessed buyers gaining increased control owing to a substantial rise in supply stemming from new home construction and listings.

Sellers have been required to entertain slightly lower offers to secure transactions. As the year progresses, experts foresee a gradual moderation in these changes, with early signs of stabilization evident in year-over-year comparisons.

That suggests that the market is unlikely to tilt entirely in favor of buyers, maintaining a balanced and neutral environment.

The Impact of the COVID-19 Pandemic on the Colorado Springs Real Estate Market

The Colorado Springs housing market experienced an initial setback during the early months of the COVID-19 pandemic, particularly between March and April 2020. Yet, it rebounded swiftly. Although housing prices in the Colorado Springs market reached record highs, the available inventory decreased somewhat.

The allure of Colorado Springs continues to attract buyers, intensifying competition. Traditionally marked by seasonal fluctuations, the Colorado Springs real estate market has undergone a significant transformation due to the pandemic and the surge in remote work.

The city’s exceptional quality of life, diverse seasons, and picturesque landscapes have enticed many remote workers to move to this scenic destination. This shift has been further driven by rising home prices in Denver. It makes Colorado Springs an increasingly attractive and affordable alternative for prospective buyers.

The trend isn’t confined solely to housing prices. It extends to rental listings as well. According to online renter sites RentCafe, the average rent in Colorado Springs is $1,576; in Denver, the rent is $2,000, and in Boulder, it is $2,439. That presents an excellent opportunity for investors who are interested in rental properties.

The Impact of Rising Interest Rates on the Colorado Springs Real Estate Market

The Colorado Springs market is not immune from the rise in mortgage rates. That rise was triggered by the Federal Reserve’s decision to raise interest rates. The Reserve’s move was an effort to curb rising inflation, but it has a ripple effect on mortgage rates. In other words, mortgage rates follow when the interest rates go up.

This trend of elevated interest rates persisted throughout the initial months of this year. In August, a 30-year fixed-rate mortgage stood at 7.18%. That is according to data from the National Association of Realtors.

These higher interest rates have become a major factor in squeezing many prospective homebuyers out of the market. That is one of the key factors to the recent decline in home sales.

- Related Article: Boulder real estate forecast 2023

The Impact of the Millennial Generation on the Colorado Springs Real Estate Market

The current population of Colorado Springs is 491,430. According to the census data website World Population Review, that number is 2.36% higher than the last census count in 2020. A large portion of those new residents fall into the millennial demographic.

Millennials bring distinctive preferences to the Colorado Springs real estate landscape. They prioritize homes in walkable neighborhoods with access to public transit, yet their focus leans towards practical, functional living spaces rather than sheer size.

That means that well-designed condominiums and duplexes in strategic locations hold as much appeal as larger suburban homes. Those are even more opportunities for investors looking to expand their property portfolios.

Calling Colorado Springs Homes

The Colorado Springs housing market has exhibited resilience and growth. It recovered swiftly from initial setbacks caused by the COVID-19 pandemic. Housing prices reached record highs while the available inventory decreased.

The dominant influence of Millennials in the market has shifted preferences toward practical, well-designed living spaces in walkable neighborhoods with access to public transit.

Colorado Springs remains a highly attractive and affordable alternative for buyers. This is particularly true for those looking for quality of life, scenic landscapes, and a more favorable price than Denver.

The absence of homes with negative equity in the Colorado Springs housing market has been a noteworthy factor contributing to rapid price appreciation. Overall, the market remains stable and promising for couples and families to call home.