In recent years, Asheville has emerged as a household name in real estate spheres. The fame is chiefly anchored on its rich arts scene and historic architecture, like the dome-topped Basilica of Saint Lawrence. Combine this with the breathtaking scenery of the Blue Ridge Mountains and its real estate offerings, and it’s easy to see why homebuyers and investors are flocking to Asheville.

The future of the Asheville housing market looks promising, with several key indicators backing this forecast.

Asheville Home Prices Forecast

For the year ending in October 2023, Asheville real estate sold for a median price of $484,990, trending up 6.5% year-over-year, according to Rocket Homes. The national median was $412,020 for the same period, as reported by Redfin, indicating an above-average market.

Additionally, the 6.5% growth is a few points shy of 7%, which is widely accepted as a good return on investment.

How Much Will Asheville Home Prices Go in the Next Year?

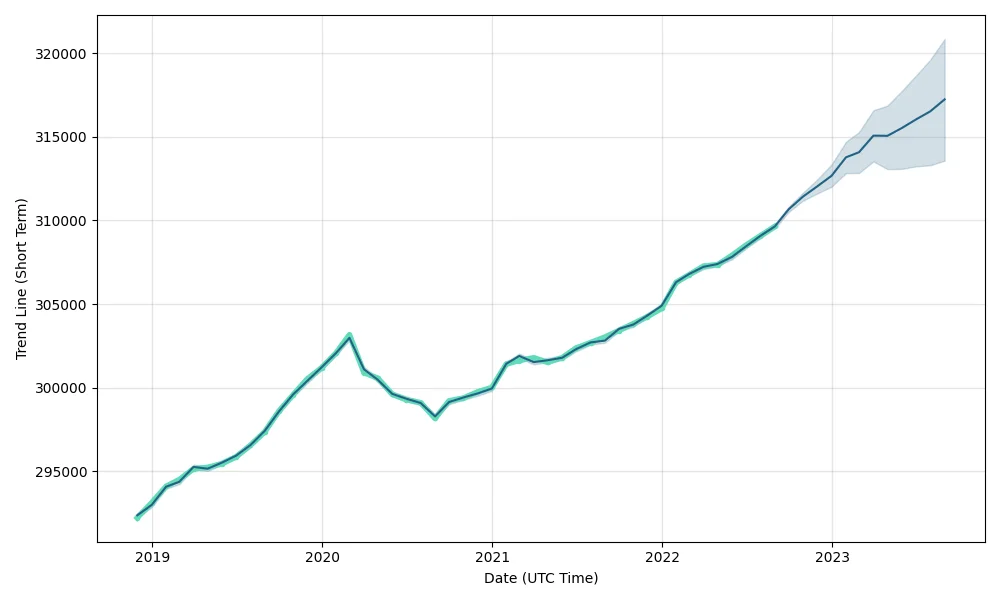

The most important question for prospective homebuyers and investors is whether the upward trend will continue. Market forecasts suggest median home prices in Asheville, NC, will increase.

Wallet Investor’s AI-based home value predictor projects an appreciation of 2.61% in one year and 12.25% over the next five years. Although considerably less than the ideal 7% and past year’s 6.5%, this is still good news for investors and aspiring homebuyers.

What Are the Most Expensive Neighborhoods in Asheville?

Asheville’s opulence and exclusivity are reflected in its upscale neighborhoods featuring elegant residences at a premium. Below are the top five most expensive neighborhoods in Asheville, according to Neighborhood Scout:

Downtown

The median real estate price in Downtown is a staggering $1,122,715, making it pricier than 99.3% of the neighborhoods in North Carolina and 95.5% of the neighborhoods nationwide. The real estate landscape here primarily comprises small (studio to two-bedroom) to medium-sized (three or four-bedroom) apartment complexes, high-rise apartments, and single-family homes.

Grace

Grace follows Downtown closely with a median price of $1,032,673. This places it above 97.4% of North Carolina neighborhoods and 90.6% of all U.S. neighborhoods. Like Downtown, the real estate scene is equally dominated by small to medium-sized single-family homes. Apartments are also common.

Oak Forest

Oak Forest offers a blend of affordability and comfort with a median real estate price of $820,483, which is more than 92.6% of neighborhoods statewide and 85.4% nationally. Unlike Downtown and Grace, where most homes are historic, here homes are relatively newer, built past 2000. Older homes are also available, most built from 1970 to 1999.

Hills of Beaverdam

Hills Of Beaverdam’s homes list at a median price of $780,968. The figure places it above 96.0% of the neighborhoods in North Carolina and 87.9% across the U.S. The architectural landscape primarily comprises medium-sized to small single-family homes and mobile homes.

Lake View Park

Lake View Park has a relatively lower median home price of $742,324. 95.1% of the neighborhoods in North Carolina and 86.0% of neighborhoods across the U.S. have lower median home prices.

What Are the Most Affordable Neighborhoods in Asheville?

For homebuyers on a budget, Asheville has some decent neighborhoods. Givens Estates is the most affordable, with a median real estate price of $582,563. But this is still higher than 95.1% and 86.2% of neighborhoods in North Carolina and the rest of the U.S., respectively.

Haw Creek falls second at $589,739. Other affordable options are Chestnut Hills and Hillcrest, with median home prices of $614,532 and $654,531 respectively. Montford closes the top five with a median real estate price of $690,598.

Factors Affecting the Asheville Real Estate Market

At the core of the Asheville, NC, real estate market’s growth is a strong economy, natural beauty, and favorable climate. Together, the factors grow the population and, therefore, the demand for housing.

Strong Economy

Asheville’s economy is robust, leading to a low (2.7%) unemployment rate. More jobs mean more people are looking to move into the area, hence positive population growth. A strong economy also means higher salaries and affordability, leading to high demand. Pricing re-calibrates to reflect the increased demand.

Natural Beauty and Recreation

Asheville boasts a strategic location at the foot of the Blue Ridge Mountains, commanding a stunning view of the range. Appalachian Mountain, with the lush covering of the Pisgah National Forest, can also be viewed within a 10-minute drive of Downton Asheville and is also easily accessible. These attractions provide outdoor activities galore, increasing the city’s desirability.

Thriving Arts Scene

Asheville is mainly famed for its art scene. The River Arts District is a perfect destination for microbreweries, music halls, restaurants, and art galleries. The Asheville Art Museum and the Black Mountain College Museum + Arts Center also offer a glimpse of the city’s creatives.

Mild Year-round Weather

Like the rest of North Carolina, Asheville is known for its humid climate characterized by warm summers and moderately cold winters. Fall and spring days are usually crisp, while the warm summers facilitate recreation.

A Friendly Sense of Community

Asheville has a population of around 93,000 residents and an area of about 45 square miles. That’s about 2,000 people for every square mile. Suburban areas and small towns usually have 1,000 to 3,000 people per square mile, meaning Asheville is moderately dense. This creates a sense of community that is invaluable to many homebuyers.

Population Growth

The culmination of all these factors is positive population migration. According to the U.S. Census Bureau, Asheville had a 13.4% population surge over the past decade, from 83,393 in 2010 to 94,589 in 2020. A slowdown was experienced from 2020 to 2022 but has since picked up. According to Redfin, 66% of Asheville’s residents are content to remain here, with more people looking to move here; 0.53% of all homebuyers across the country are searching for homes in Asheville.

Demand for Asheville Real Estate

The demand for homes in Asheville, NC, has been on an upward trajectory in recent years. The result is a seller’s market where home prices appreciate rapidly, and many homes are sold at and above the asking price. In October, 20% of homes sold at asking and 20% over asking.

Asheville home prices are slowly pushing the housing market into a luxury market. This shift has significantly impacted the buyer profile. About a third of homebuyers are affluent investors, mostly in their early thirties. The median household income is $90,300, 36% higher than five years ago.

How Much Housing Inventory Is Available in Asheville?

In October 2023, the number of Asheville homes for sale stood at 773 units, an increase from September’s 753. Of the 773 Asheville homes for sale, only 157 were sold, which was also lower than September’s 169. Given the current demand, it would take less than five months for all the homes in Asheville to be bought. This is indicative of a seller’s market. A balanced market should have around six months’ supply of inventory.

How Long Do Homes Stay on the Asheville Market?

Asheville homes for sale stay on the market for an average of 28 days. Although lower than the 2022 average of 25 days, it is still lower than the national average of 33 days. This underlines the buoyancy of Asheville’s real estate market and its seller’s market status.

In October 2023, 70% of homes were sold in less than 30 days after being listed. 19% of homes sold had been listed for 30 to 90 days. Only 11% of sold homes had been listed for over 90 days.

What Types of Homes Are in Highest Demand in Asheville?

One of the most straightforward and accurate ways to quantify demand for housing is through sales. In Asheville, single-family homes are the highest performers, according to October 2023 market reports. Three-bedroom homes are in the highest demand, with 369 units changing ownership in October. This was an increase of 6.6% from September despite the overall decline in home sales.

Four-bedroom came second with 176 units changing hands, a 2.9% increase from September. Two-bedroom, five-bedroom, and one-bedroom homes changed hands 150, 52, and 26 times, respectively, after 3.2%, 1.9%, and 7.1% drops from September.

Factors Impacting the Housing Inventory in Asheville?

The following are the main factors affecting the housing inventory in Asheville:

Steady Population Growth

As the city continues to gain popularity for its lifestyle perks, more people take interest in settling here. The influx exerts pressure on the housing inventory while the supply fails to keep up with the high demand for Asheville housing.

Mountainous Terrain

In Asheville, land available for large-scale real estate developments is limited due to the hilly terrain. Development projects are also challenging and expensive, which is another explanation for the Asheville housing bubble. The landscape also acts as an allure, increasing demand for Asheville housing. This exacerbates the supply-demand imbalance, hence the tight inventory.

Regulatory Constraints

The housing market in Asheville, NC, struggles with strict zoning regulations. The types of properties that can be built in certain areas and the density of development projects become affected as a result. Obtaining building permits is also cumbersome and expensive, discouraging developers.

Increased Demand for Second Homes and Short-term Rentals

Asheville is a popular destination for tourists. Many real estate investors aim to capitalize on this by purchasing homes to utilize as short-term rentals. This squeezes the inventory available for sale, especially in popular neighborhoods. The city’s appeal as a retirement destination also spurs demand for second homes, further constraining housing inventory.

High Mortgage Rates

Given its appeal and the rising population, Asheville’s housing market would have grown faster had it not been for the current mortgage rate environment. Although they have slightly declined from the 23-year high recorded in October, the rates are still high at 7.48% as of November 6, 2023.

Mortgages are expensive as a result, discouraging first-time homebuyers. Existing homeowners wishing to upgrade are also holding off as they currently have a significantly lower rate.

Asheville Real Estate Investment Outlook

Despite the current challenges with mortgage rates, inventory, and sales volume, the outlook for the Asheville market looks promising.

Is Asheville a Good Place to Invest in Real Estate?

Asheville is a highly attractive real estate investment location. Its high quality of life generates buyer demand that promises price appreciation. Families seeking to buy a home as a means of wealth preservation can choose this city.

Its tourist appeal is also ideal for investors as they can target short-term rentals. Rental income is high due to high demand and low vacancy rates. Property laws in Asheville and the rest of North Carolina are majorly landlord-friendly, unlike its neighboring states like South Carolina, Virginia, and Tennessee. Landlords will have an easy time dealing with non-compliant residents. They can evict tenants on many grounds, including non-payment of rent, breaching the lease agreement, and engaging in criminal activity.

What Are the Best Types of Properties to Invest in Asheville?

The best property investment type in Asheville would be affordable single-family homes, particularly three-bedroom houses. These are the highest performers in the Asheville market, meaning high rental income potential and demand should you wish to sell.

Given its tourist appeal, the Asheville, NC, real estate market has seen a surge in luxury real estate. This is pricing out homebuyers with low to median income. Investors seeking to buy and hold properties for passive income should target affordable homes. Moreover, they should target neighborhoods with many middle-income earners and affordable home prices discussed above.

A good transportation infrastructure has also made the suburbs attractive to families. They can live away from the city and enjoy more living space with a better ambiance while still having access to downtown Asheville.

Asheville is also home to multiple higher education institutions, such as Shaw University, Brevard College, Lenoir-Rhyne University, Mars Hill University, and the renowned Black Mountain College. Each institution has a high student population ranging from several hundred to several thousand. Real estate investors can tap into this market by owning properties near the universities.

What Are the Risks and Rewards of Investing in Real Estate in Asheville?

The rewards of investing in the Asheville, NC, housing market are the potential for rental income and capital appreciation. But a lot is at stake as buyers must pay high property prices. This means a risk of significant losses should market dynamics shift considerably, causing drastic price drops.

Even though North Carolina’s property laws are conducive for landlords, property taxes are on par with the national average. This means high holding costs that reduce investors’ returns.

Asheville Housing Market Comparison with Other Markets

Compared to its neighboring cities, Asheville has a more attractive market with higher stability and potential for growth. Below is a comparison of average home prices in Asheville, NC, with other cities for the last six months, according to Rocket Homes:

Asheville, North Carolina Vs. Boone, North Carolina Real Estate Market

As of October 2023, Boone, NC, had a median home price of $430,000. This was a staggering 17% decline month over month, while Asheville experienced a 1% increase. The previous month-over-month change for Boone was a 35% decline, while Asheville’s was zero. As such, Boone’s real estate market is highly volatile, while Asheville’s is stable.

Asheville, North Carolina Vs. Hendersonville, North Carolina Real Estate Market

Hendersonville’s real estate market is as stable as Asheville’s but with lower home prices. October 2023 saw it record a median home value of $420,000 after a 0% month-over-month increase. The previous month, it had seen a 2% increase.

Asheville, North Carolina Vs. Knoxville, Tennessee Real Estate Market

Knoxville, TN, has exhibited a steady but slow increase in home prices over the last six months. Its median home value in October 2023 was $349,900 after a 1% increase month over month. Previous months’ changes were also marginal, ranging between 1-3%.

Asheville, North Carolina Vs. Chattanooga, Tennessee Real Estate Market

Chattanooga has only had one month-over-month increase in home prices over the last six months. Its median home value was $320,200 in October 2023, while May 2023’s figure was $315,400.

Invest in the Asheville Housing Market Today to Reap Rewards

The Asheville housing market mirrors a promising future for homebuyers and investors. Its stability and potential for growth outperform many neighboring cities. Its diverse appeal, ranging from a high quality of life for families to its bustling tourism industry, creates a high demand for housing.